The GBP/USD price followed the European currency and gained significant weight against the US Dollar on Wednesday. However, the pair pared off gains later in the New York session. Today, the pair has been able to find significant support from the 1.3800 support.

Powell has been roughly saying the same thing lately during press conferences after the Fed’s meetings. His position, as you can see, remains unchanged. The inflationary pressure is because of household spending growth. It is understandable since people spend the money, they accumulated during the coronavirus pandemic and tough isolation measures.

-If you are interested in forex day trading then have a read of our guide to getting started-

But as optimistic as Powell is about inflation, the US PPI report was released yesterday, which also rose stronger than economists’ forecasts in June. According to the data, in June this year, the producer price index jumped by 1.0% against the forecast of 0.6%. The index rose 0.8% in May. On an annualized basis, the index rose by 7.3%, while economists had expected an increase of 6.8%. About core inflation, which excludes energy and food, the annual growth was 5.6%.

UK inflation data provided substantial support and improved bullish sentiment in the market. The report indicated that the UK consumer price index in June this year rose much more than expectations, a certain wake-up call for the Bank of England and its policymakers. According to the data, the index rose 0.5% in June, after rising 0.6%. There was an immediate increase in the Pound, as analysts expected growth to slow down to 0.2%. On an annualized basis, the CPI jumped to 2.5% at all, which is not as bad as it might seem.

Immediately after that, several statements were made by a representative of the Bank of England, noting that it is currently difficult to assess the prospects for inflation. The Deputy Governor of the Bank of England, John Cunliffe, said that one should not pay much attention to the inflationary pressures that are now observed. The key question related to inflation is whether supply chain problems will continue and the balance of supply and demand at the end of this summer. In this unprecedented growth situation, “it is very difficult to assess the prospects for further economic growth”, said Cunliffe.

-Are you looking for automated trading? Check our detailed guide-

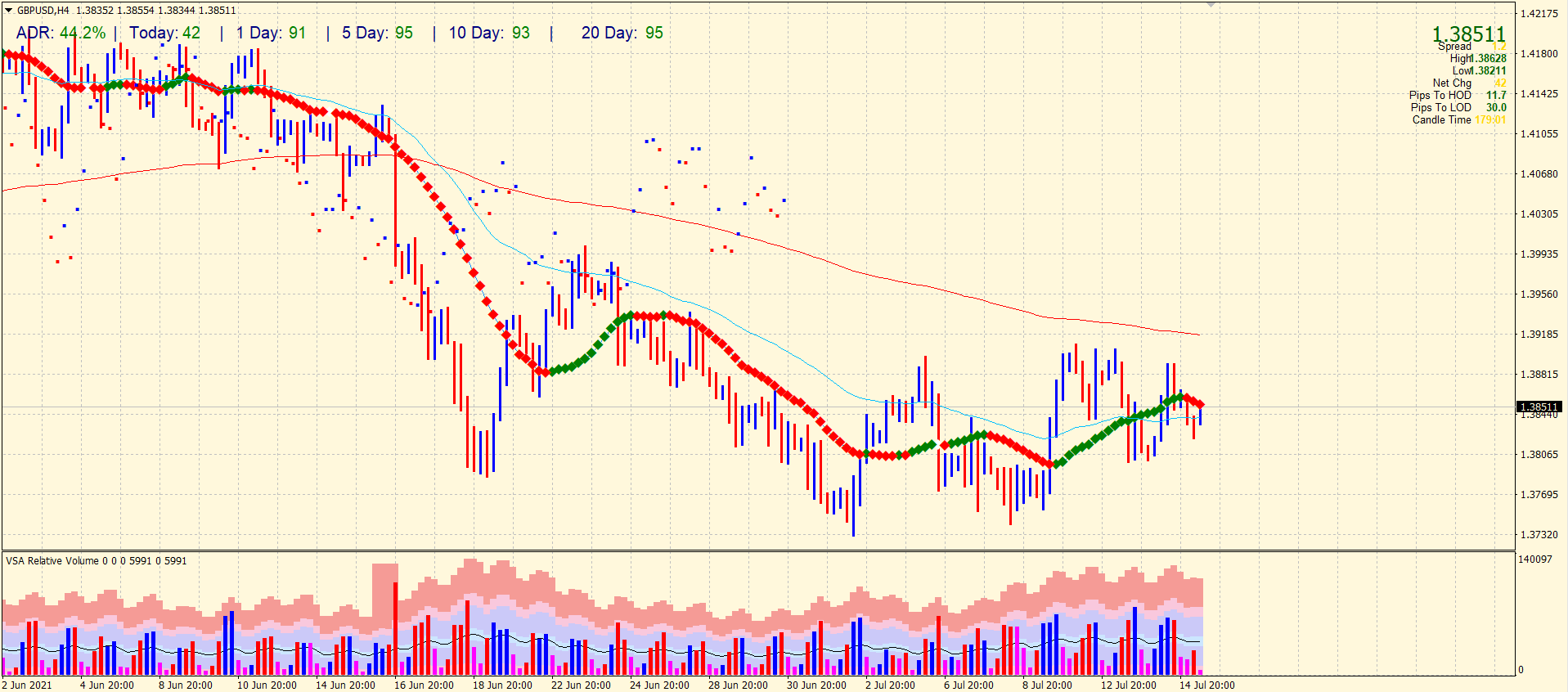

GBP/USD price technical forecast: Ranging or trending?

The technical picture of the GBPUSD pair shows that after a major Asian fall, the bulls will quickly try to compensate for the losses, hoping for a breakdown and consolidation above the resistance of 1.3860. Only then can we talk about the Pound’s return to the 1.3890 highs. Suppose the pressure on the Pound nevertheless returns during the European session. In that case, the breakdown of support at 1.3829 will likely increase pressure on the trading instrument. It can push towards the base of the 1.3800 figure and then to the larger support at 1.3770.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.