- The GBP/USD pair rebounded, but the throwback could be only a temporary one.

- The BOE could be decisive later, so the currency pair could register sharp movements.

- A new higher high could activate a larger growth.

The GBP/USD price rallied at the time of writing as the DXY’s drop punished the USD. In the short term, the Dollar Index moves sideways.

-Are you interested in learning about forex tips? Click here for details-

Technically, the index seems slightly overbought, and a potential sell-off could force the greenback to depreciate. Still, don’t forget that the DXY maintains a bullish bias despite temporary retreats.

As you already know, the Federal Reserve increased the Federal Funds Rate from 1.00% to 1.75% even if the traders expected only a 50-bps hike. Despite the 75-bps rate hike, the USD depreciates right now. It seems that the interest rate increase was already priced in. Fundamentally, the USD was weakened by poor US retail sales data.

Technically, the GBP/USD pair is in a rebound, but it remains to see how it will react after the BOE. The Bank of England is expected to increase the Official Bank Rate by 25-bps from 1.00% to 1.25%. After FED and SNB decisions, we cannot exclude a 50-bps hike.

Also, the US is to release the Unemployment Claims, expected at 215K in the previous week. In addition, the Building Permits, Housing Starts, and Philly Fed Manufacturing Index will also be released. Today, the fundamentals will drive the price.

GBP/USD price technical analysis: Bullish momentum

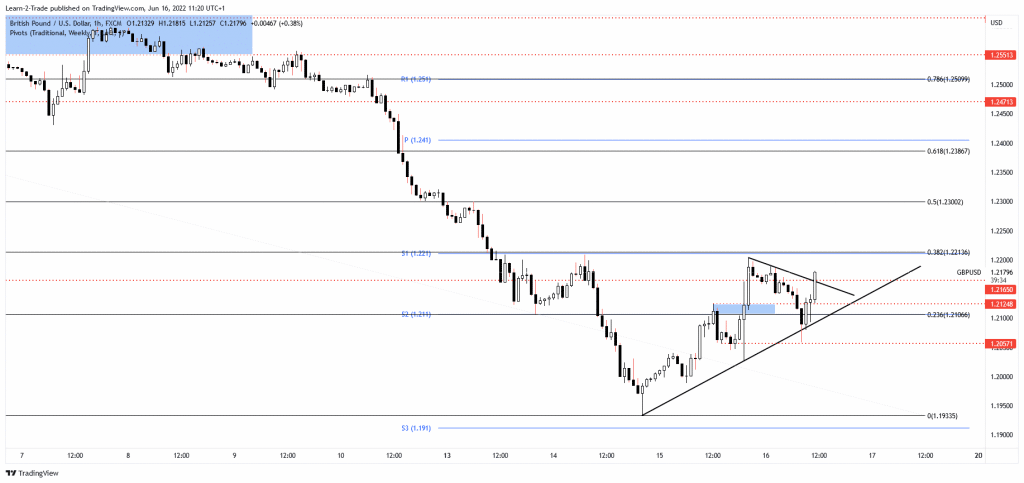

The GBP/USD pair developed a leg higher after its massive drop. As long as it stays above the uptrend line, the rate could approach new highs. The 1.2165 historical low represents a static resistance. Also, the minor downtrend line stands as a dynamic resistance. The volatility could be huge around the BOE, and the GBP/USD pair could register sharp movements.

-Are you interested in learning about the forex basics? Click here for details-

From the technical point of view, the current swing higher could be only a temporary one. As you can see on the 1-hour chart, the price failed to reach the 38.2% (1.2213) retracement level, signaling exhausted buyers. Only a new higher high, making a valid breakout above this level, could activate a larger growth. A valid breakdown below the uptrend line indicates that the rebound ended and that the GBP/USD pair could come back down.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money