- GBP/USD trades above intraday high and posts largest one-day gain in three days.

- On stable yields, the weak session in Asia triggered a market consolidation.

- The UK and US PMIs were mixed, while Ukraine’s earlier risk appetite favored the bears.

- The UK retail sales for February, Fedspeak, and Eurogroup meetings will be important for tracking intraday trends.

A two-day pause has allowed bulls to regain control of the GBP/USD price, up 0.26% intraday around 1.3220 in Europe early Friday.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Recent gains in the cable pair could reflect the market’s recovery from recent losses during the dollar pullback and concerns about the upcoming data release. However, despite these concerns, cautious sentiment prevails over concerns over Ukraine and Russia and the recent mixed data out of the UK, which may challenge the pair’s buyers.

As the market struggles to extend weekly gains on dormant yields, the US Dollar Index (DXY) fell 0.38% to 98.41 on the day. The 10-year Treasury yield was still 2.36%, while S&P 500 futures had not followed Wall Street’s gains and showed no sign of risk aversion, hitting 4510-15.

On the previous day, the ‘bears’ in the GBP/USD pair generally appreciated mixed UK data and the US dollar’s strength.

The manufacturing PMI for the UK fell from 58.0 in February to 55.5 in March. The market was expecting 56.7. Also, the service companies’ activity index rose to 61.0 from 60.5 in the previous month and 58.0 in market expectations. According to Reuters, the consumer confidence index dropped for the fourth consecutive month from -26 in February to -31 in March, the lowest level since November 2020, at the height of the Coronavirus outbreak.

Likewise, the US Markit manufacturing PMI increased to 58.5 in March, compared to 57.3 earlier and 56.3 market expectations. Accordingly, the service sector’s business activity index increased to 58.9 from 56.5, which was a weaker forecast. Meanwhile, the composite PMI rose from 55.7 to 58.5. On the other hand, US Durable Goods orders declined 2.2% m/m in February against -0.5% forecast and 1.6% growth in January.

Market sentiment is affected by the West’s desire to take joint action to stop Russia’s invasion of Ukraine, supporting safe-haven demand for the dollar. However, risk aversion seems unlikely as members of the eurozone are divided. Similarly, one might hope that a further push against Russia could lead to positive results in the peace talks.

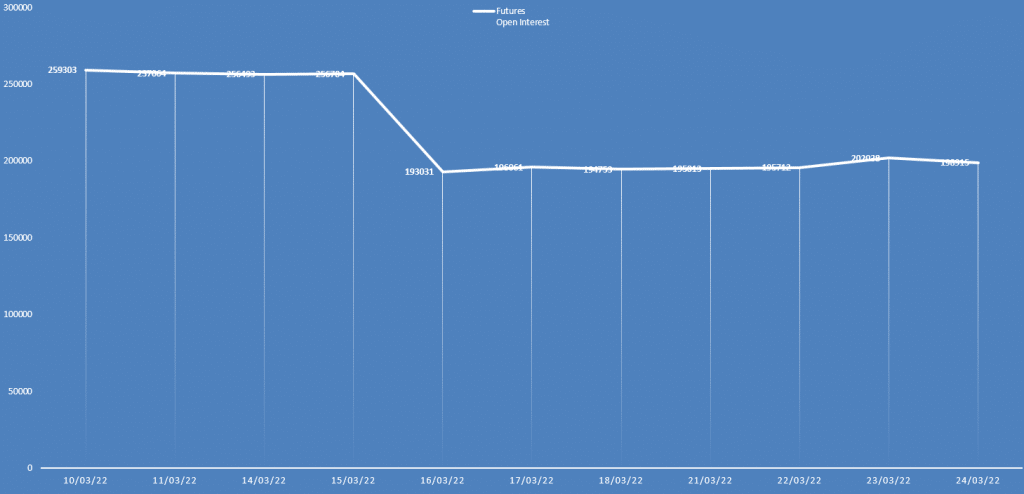

GBP/USD price analysis via daily open interest

The GBP/USD price closed in red yesterday while the daily open interest briefly fell. It shows reducing sellers in the market. Hence, the trend could be bullish.

–Are you interested in learning more about forex bonuses? Check our detailed guide-

What’s next for the GBP/USD analysis?

UK retail sales for February, which are expected to fall to 7.8% y/y from 9.1%, will also be a significant risk factor since gloomy numbers coupled with a likely resurgence in abandonment sentiment could pressure GBP/USD exchange rates.

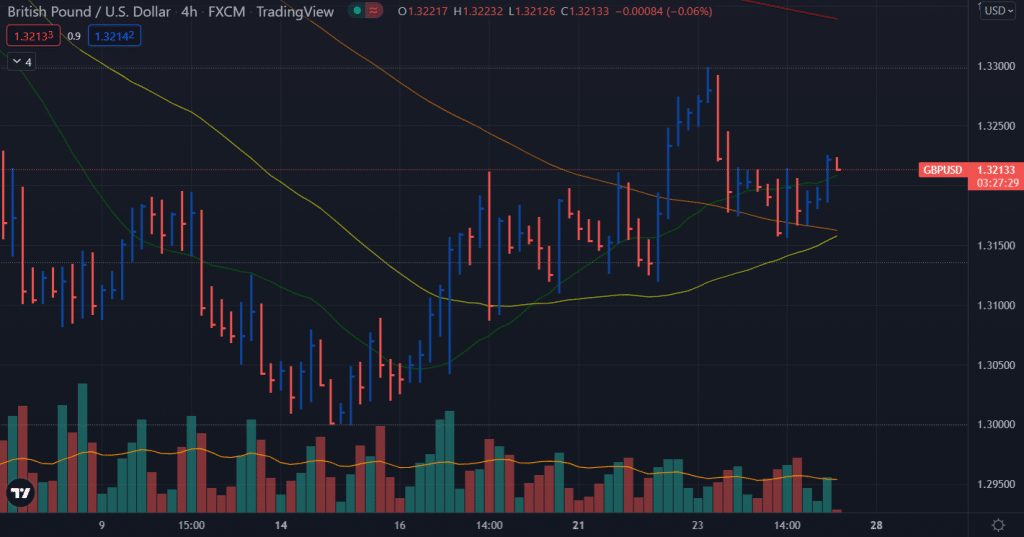

GBP/USD price technical analysis: Bulls to rally

The GBP/USD price managed to post gains above the 1.3200 level and the 20-period SMA on the 40hour chart. The 50 and 100 SMAs on the same chart will make a bullish crossover which will further ignite the buying. The bulls will be aiming at the 1.3300 level if it finds acceptance above 1.3200.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money