- GBP/USD price hit 9-month lows last week before finding some recovery at the back of hawkish comments from the Bank of England.

- The energy crisis in the UK may not let the bulls for an easy run.

- UK services PMI may trigger fresh impetus in the market ahead of US NFP data.

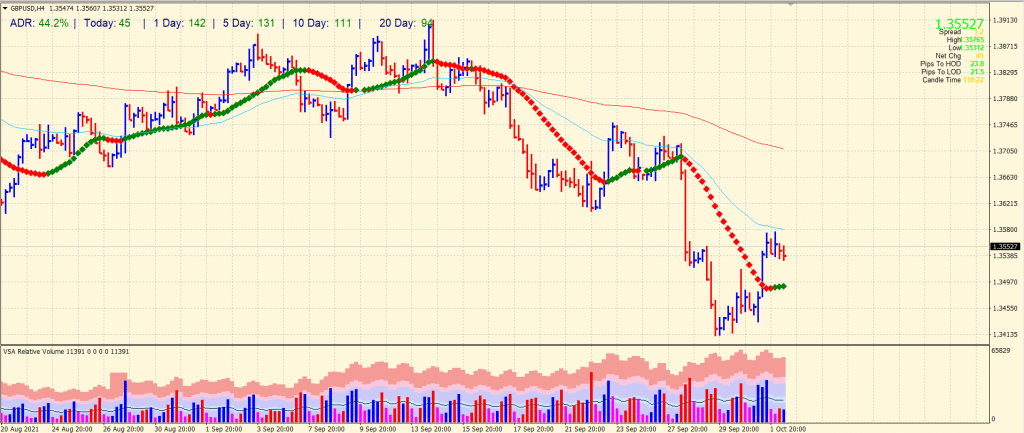

The GBP/USD price plunged last week to a 9-month low. The pound fell 3 cents against the dollar as concerns about a recovery in the UK economy led to a decline before it recovered some losses on Friday.

-Are you looking for the best CFD broker? Check our detailed guide-

The GBP/USD rate fell from 1.37 to 1.34 in a week before rising above $ 1.35 on Friday as the pound rose to trade at around 1.3541 by the end of the European session.

The pound sterling has fallen sharply as fuel shortages were felt in the UK last week. The gasoline crisis has heightened concerns about the UK’s economic recovery, fueled by rising inflationary pressures, supply chain concerns, and energy crises.

A moderate monetary policy tightening signal from the Bank of England (BoE) and speculation of a rate hike as early as 2022 gave the pound an edge at the start of the week.

As the gasoline crisis in the UK worsened, the GBP/USD pair dropped sharply from 1.37 to 1.34 in midweek trading.

A fear of stagflation has increased as consumers and businesses worry about the impact of supply chain problems and inflationary pressures.

Three more energy companies failed last week amid rising energy costs and a worsening energy crisis in the UK.

PMI data for UK services could spark a little movement in pound sterling. However, sterling could benefit from further improvement in growth performance amid supply chain issues following an unexpected upward revision in the manufacturing PMI.

Meanwhile, risk appetite, US Treasury bond yields, and the debt ceiling debate will affect the US dollar.

In September, US economic data, including the ISM manufacturing purchasing managers’ index, could also drive the US dollar. In addition, activity in the service sector is expected to expand and may strengthen the US dollar.

Employment data is the most important release on Friday. Whether the Federal Reserve will start tapering in November if non-farm payrolls grow as projected in September might depend on NFP figures.

-Are you looking for forex robots? Check our detailed guide-

GBP/USD price technical analysis: Consolidating under 50-SMA

Around the mid-1.3500, the GBP/USD pair is well above the 20-period SMA on the 4-hour chart, which is a positive sign for the pair. However, the pair consolidates just below the 50-period SMA and might need a catalyst to break above the key level. On the flip side, the 20-period SMA around 1.3500 may support the pair ahead of 1.3470.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.