- The GBP/USD pair is bearish despite temporary rebounds.

- A new higher high could activate a larger upwards movement.

- More declines are expected if the pair stays under the UML.

The GBP/USD price moves somehow sideways today. The 1.3000 psychological level stopped the downside movement. The pair registered a strong rebound in the short term, but the price failed to stabilize above the 1.3100 level.

–Are you interested in learning more about CFD brokers? Check our detailed guide-

It has found support on the 1.3050 key level and is struggling to come back higher. Still, the downside pressure remains high. It could drop deeper anytime if the Dollar Index jumps towards new highs. Technically, the DXY found resistance around the 100.50 level. A new short-term drop could help the currency pair to rebound and recover.

In the short term, we cannot exclude USD’s minor depreciation after mixed US data reported yesterday. Retail Sales reported only a 0.5% growth in the last month versus the 0.6% expected, while the Core Retail Sales came in better than expected, registering a 1.1% growth exceeding the 1.0% growth expected.

In addition, the Prelim UoM Consumer Sentiment and the Import Prices came in better than expected. Unfortunately for the USD, the Unemployment Claims and the Business Inventories reported worse than expected data.

Today, Industrial Production is expected to register a 0.4% growth in March versus 0.5% in February, while the Capacity Utilization Rate could be reported higher at 77.8% compared to 77.6% in the previous reporting period. Therefore, the USD needs support from the US economy to resume its appreciation.

GBP/USD price technical analysis: Triangle pattern broken

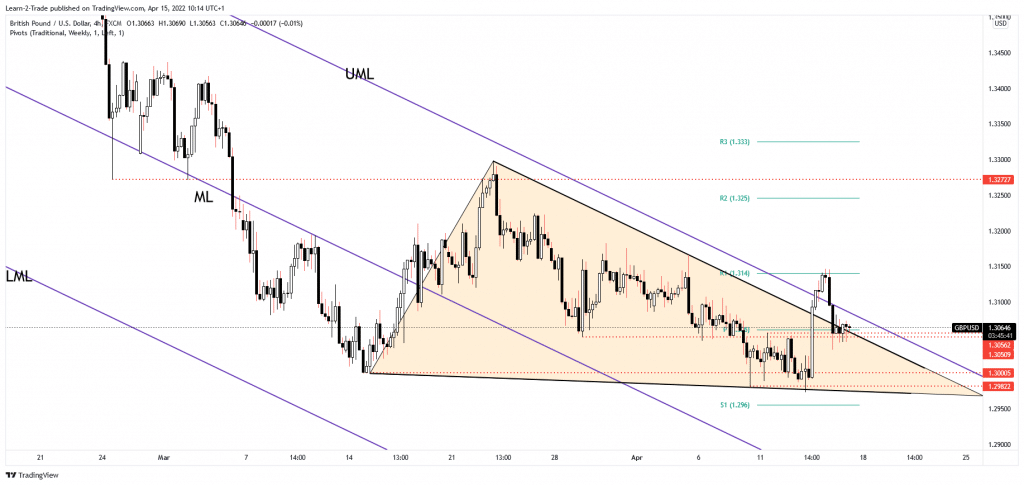

As you can see on the 4-hour chart, the pair is trapped between the weekly R1 (1.314) and the 1.3000 psychological level. In the short term, it may continue to move sideways. The price escaped from the triangle pattern and jumped above the descending pitchfork’s upper median line (UML), but it failed to stay above this dynamic resistance.

–Are you interested in learning more about MT5 brokers? Check our detailed guide-

The pair has retested 1.3050 static support and the triangle’s resistance. Jumping and stabilizing above the upper median line (UML) may signal a potential larger rebound. Actually, a new higher high, a bullish closure above 1.3146, could activate an upside continuation. On the other hand, staying within the descending pitchfork’s body below the UML may signal a potential deeper drop.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money