- GBP/USD continues to decline despite better-than-expected UK GDP.

- Corona cases in the K are rising again, giving more room to the bears.

- Brexit woes are worrying and renewed tension may weigh on the Pound.

Even though the US dollar is weaker, the GBP/USD price is hesitant to climb above 1.3812 ahead of Friday’s London opening. The reason could be related to spills due to Covid issues and concerns about Brexit.

According to the latest virus data, UK deaths and infections are more than eight times higher than in early May. Thursday was the country’s highest daily number of cases since July 23, with 33,074.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

On the other hand, research commissioned by the Consumer Choice Group said they believed the government was “not open at all” about the impact of new trade deals (post-Brexit).

Furthermore, Reuters describes Brexit jitter and round-robin traffic (RoRo) between Irish and UK ports. The news reports: “Imposing controls on some goods after neighboring UK left the EU’s trade orbit on December 31, UK imports fell 35% in the first five months of 2021, while shipping routes to mainland Europe more than doubled.

The European Union (EU) has also missed the residency deadline by about 60,000 citizens, igniting a new Brexit reaction from old allies.

Although the GDP was positive in the second quarter, the GBP/USD pair fell to a multi-day low of the previous day, slightly below 1.3800. The producer price index (PPI) indicates that the US dollar may be at risk due to its strength. Furthermore, Fed officials recently expressed concerns about restrictive monetary policy, evidenced by a recent Reuters poll. In addition, a new report from the Independent revealed that the UK economy is recovering strongly from the pandemic despite the GDP now being just 4.4% below pre-crisis levels.

The US dollar index (DXY) fell 0.06% to the time of printing despite US President Joe Biden’s push to lower vaccine prices. Additionally, Moderna’s six-month antibodies study appears to be challenging the GBP/USD bears.

Traders of GBP/USD will focus on macros in the absence of key dates/events. Nevertheless, August’s Michigan Consumer Sentiment Index, a stay-the-course indicator at 81.2, cannot be ignored.

–Are you interested to learn more about day trading brokers? Check our detailed guide-

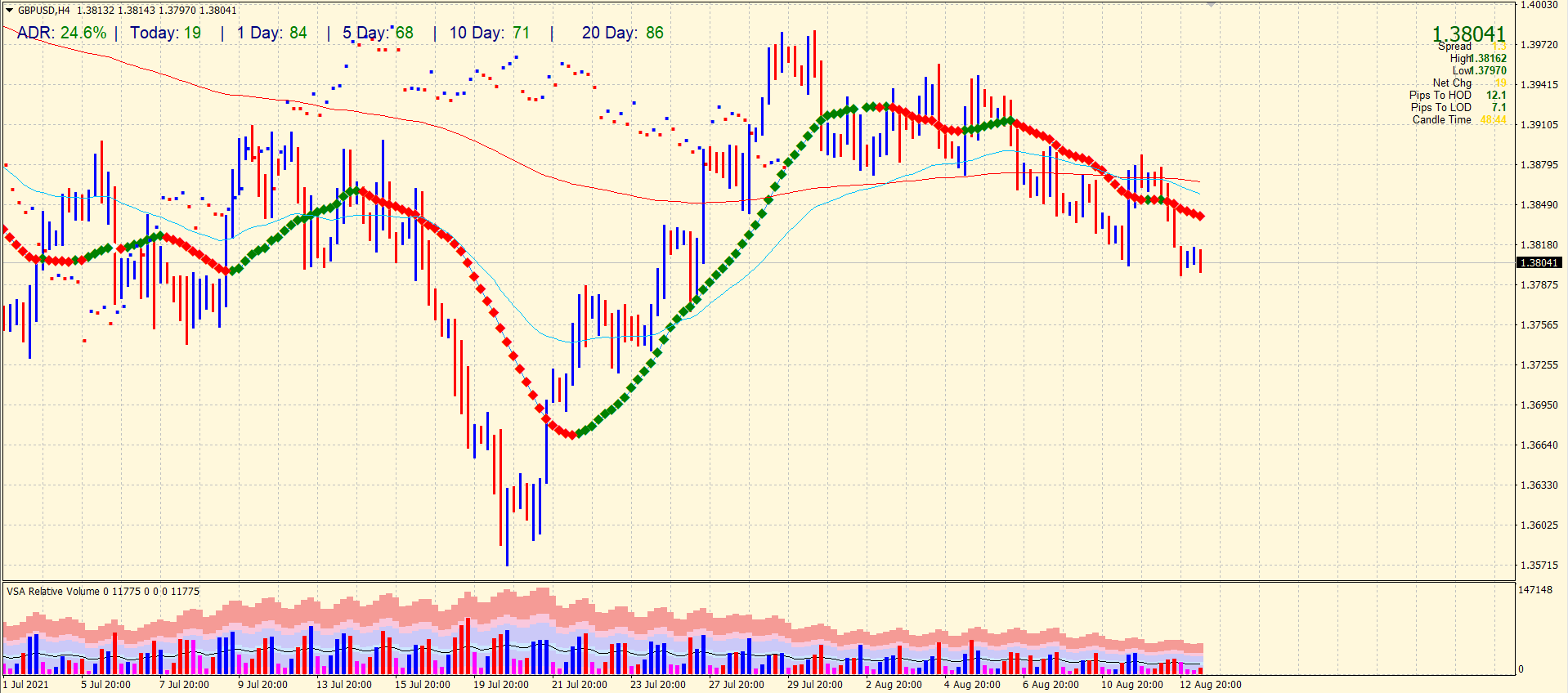

GBP/USD price technical analysis: Bears gathering strength

The GBP/USD pair is struggling to find support near the 1.3800 handle. The volume is constantly supporting the bearish move. It looks poised for the pair to break the 1.3800 level and test previous support of 1.3770 ahead of 1.3730. On the upside, 1.3825 is the immediate resistance ahead of 1.3850. However, the broader picture shows that the pair is making a pennant pattern on the 4-hour chart. Hence a probability of breakout on the upside also exists.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.