GBP/JPY, aka “The Dragon” has kept its powder and fire dry, falling due to a toxic mix of events pushing this popular cross lower.

Here are the reasons for the fall and levels to watch:

GBP/JPY pulled by both sides

- GBP: For the Bremain campaigners, this is a bad week. The fact that manufacturing PMI beat expectations doesn’t really help when a race that seemed to lean in favor of the Remain is now shifting in the other direction. The Brexit campaign is gaining ground, leading in some polls and recovering lost ground in others. After the ORB and ICM polls, two more polls show a dead-heat tie. The FT’s Brexit tracker shows a narrow lead of 3% for the Bremain camp against 5% beforehand, before the latest updates.

- JPY: The Japanese yen dropped on reports about postponing the sales tax hike. When this became an official announcement the yen surged back. A classic “buy the rumor, sell the fact”. In addition, the slide in stocks pushed USD/JPY lower, a classic move and USD/JPY lost 110.

GBP/JPY Technical Levels

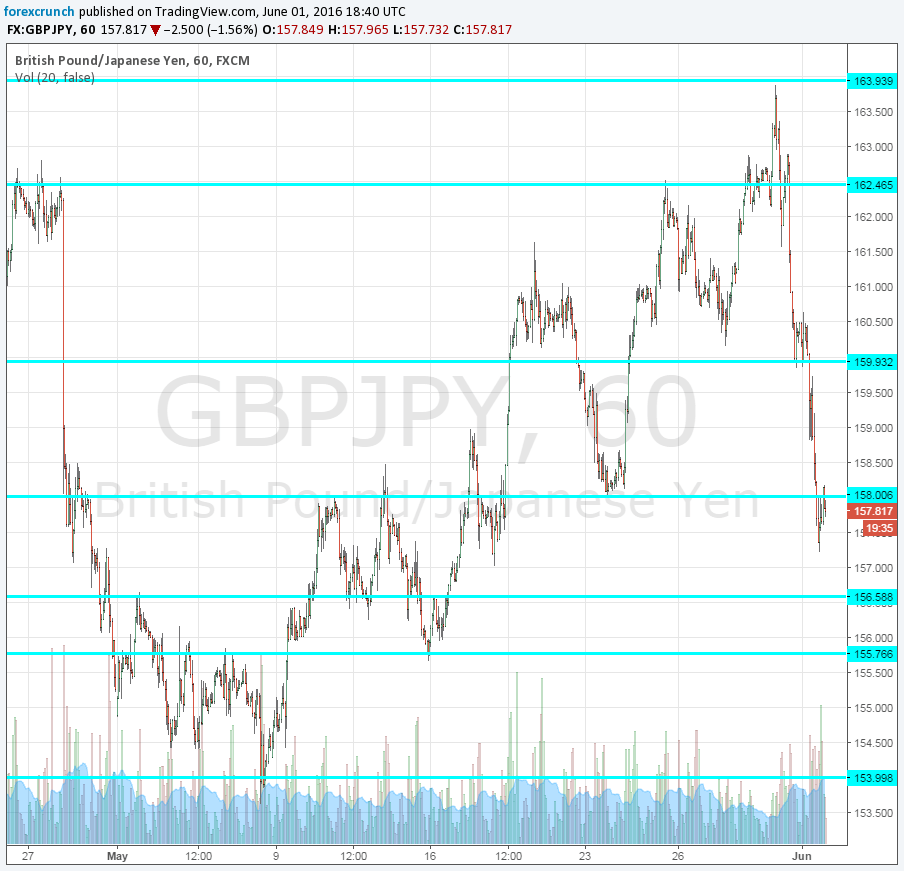

GBP/JPY had already tackled resistance at 163.80, a line which worked as both support and resistance in the past. But when the tables turned against the cross, it fell initially to battle 162.50 and then it clung onto 160.

However, this was short lived and we dropped below the previous support line of 158 to trade at the 157 handle. The next line of support is 156.60, followed by 155.80.

Further support, assuming the current downtrend continues, appears at 154.

More: GBP/JPY – a Brexit Play

Here is the chart: