The higher level of political uncertainty continues supporting the British pound. The end of the contest in the UK Conservative Party with Andrea Leadsom’s withdrawal sent cable to 1.30 but it struggled to extend its gains immediately.

One of the reasons halting the advance was the fact that PM-elect Theresa May reiterated that “Brexit means Brexit” – as leader, she will respect the will of the British people. She also vowed “to make a success” out of it.

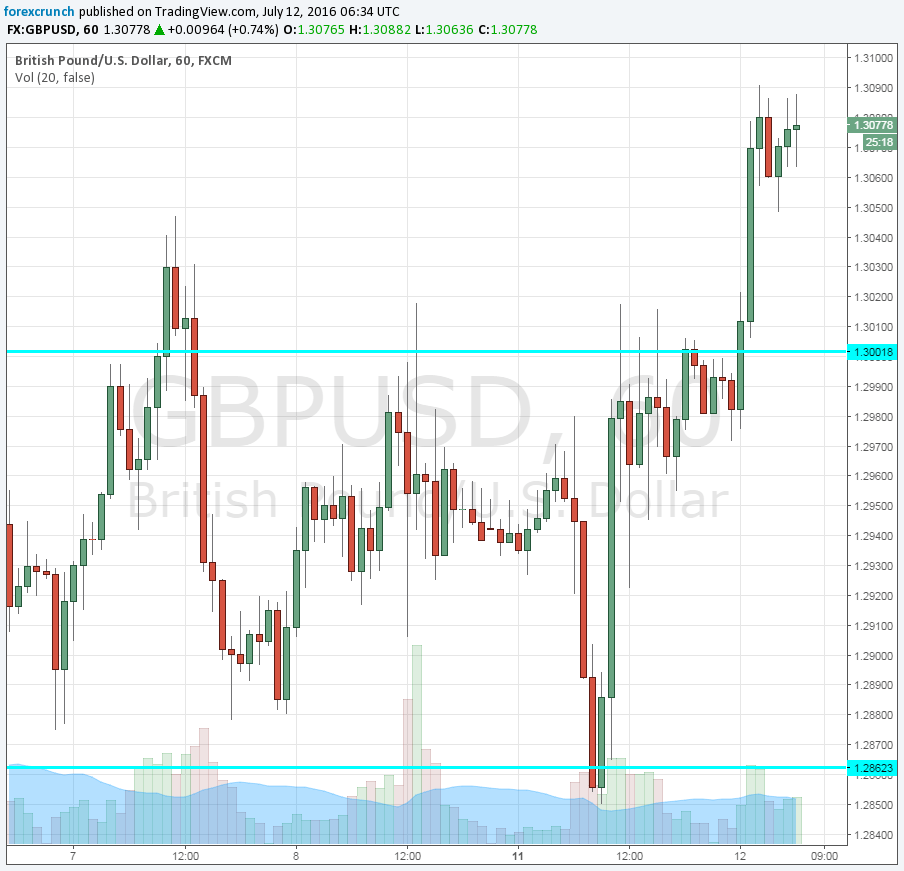

With some time to consolidate and fresh traders in play in Asia, we had a further rise. The high for today is 1.3091, still under the 1.3110 level that supported the pound days after Brexit became reality.

Still lots of Brexit uncertainty

The removal of political uncertainty regarding the top spot in the UK does not mean the end of uncertainty regarding Britain’s economic future. May, like her peers, is not keen on triggering Article 50 and exiting the EU immediately. Nobody knows when it will actually happen and what new trade agreements will take shape.

And nobody knows the impact Brexit is already having on business. Construction PMI collapsed and the construction sector is under pressure due to accelerated withdrawals from property funds. Further PMIs will come only in early August and hard data will be available only later on.

BOE ready to ease

The Bank of England convenes on Thursday in its first scheduled post-Brexit decision. Carney has already hinted about further stimulus now and more in August. It is unclear what exactly they will do, but markets expect a cut of 0.25% to 0.25%.

In addition, the BOE has its regional offices and collects data from the UK. This may be anecdotal evidence and not hard and full data, but Carney could sound worried once again.

All in all, Brexit poses significant challenges and the trouble is far from over. Is there a sell opportunity?

What do you think?

More: BoE to cut rates by 0.25%, more stimulus in August; EURUSD parity not likely

Here is the recovery on the charts: