GBP/USD was making attempts to recover but did not go anywhere fast and found itself grinding lower. The upcoming week feature the manufacturing PMI as well as other figures. Here are the key events and an updated technical analysis for GBP/USD.

The British government has stepped up its efforts in the Brexit negotiations, presenting a bulk of proposals. However, it seems that the EU negotiators are not going anywhere fast. House prices dropped by 0.9% according to Rightmove, a worrying sign. GDP growth was confirmed at 0.3%, a slow pace. In the US, data was OK but Trump’s issues weighed and the dollar slipped against many currencies. The greenback got another blow from Yellen’s Jackson Hole speech. The Fed Chair was not hawkish, sending the dollar down. And a late development helped the pound: the UK Labour Party now supprts a softer Brexit, putting pressure on the government. This gives a boost to the pound.

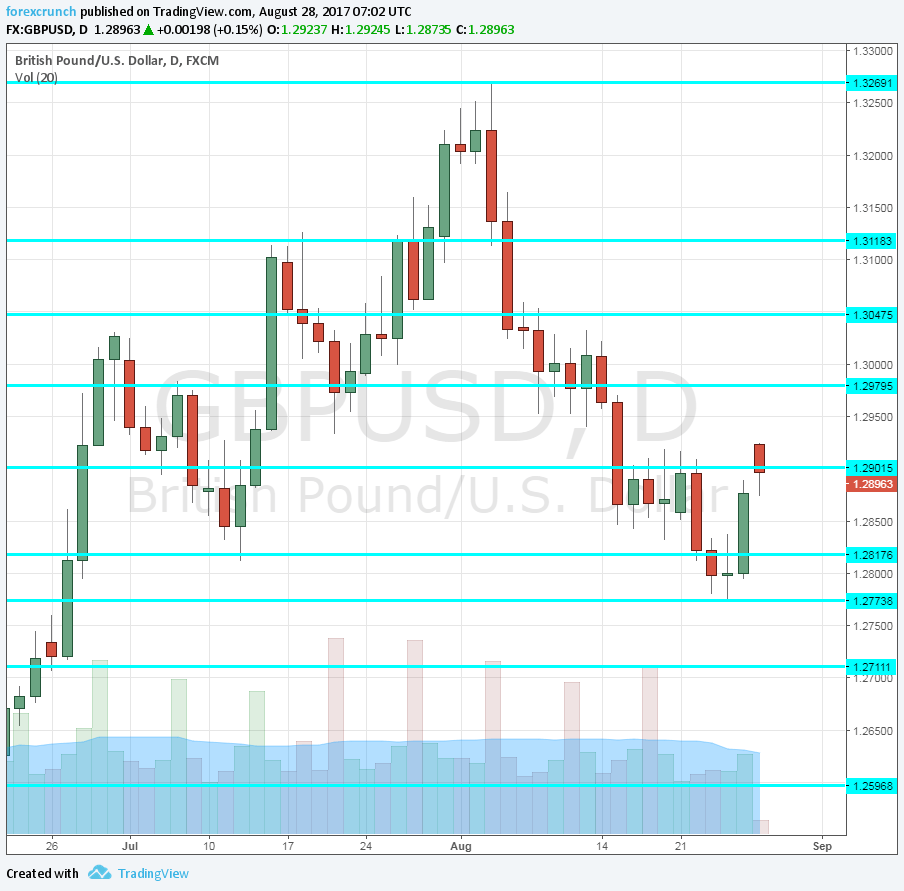

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily chart with resistance and support lines on it. Click to enlarge:

- Nationwide HPI: Tuesday, 6:00. Various housing price indices have been pointing downwards, but Nationwide’s figure has shown a rise of 0.3% in July. Will we see a drop in August? A minor rise of 0.1% is predicted.

- BRC Shop Price Index: Tuesday, 23:01. The British Retail Consortium’s measure provides another gauge on consumer activity. It dropped by 0.4% y/y in June.

- Net Lending to Individuals: Wednesday, 8:30. The level of lending indicates economic activity but also a credit binge that the BOE fears. A rise of 5.6 billion was reported in June, higher than expected. A smaller rise of 5.3 billion is predicted.

- Mortgage Approvals: Wednesday, 8:30. This official figure by the BOE has shown stability in the number of approvals at 65K, for the third consecutive month in June. We now get the figure for July. A tick up to 66K is predicted.

- GfK Consumer Confidence: Wednesday, 23:01. This 2000-strong survey by GfK has been leaning lower in the past few months. A disappointing drop to -12 was reported in July, worse than projected. A slide to -13 is expected.

- Manufacturing PMI: Friday, 8:30. Markit’s purchasing managers’ indicator for the manufacturing sector beat expectations and reached 55.1 points in July. A very similar level of 55 is forecast.

GBP/USD Technical Analysis

Pound/dollar broke above 1.2890, mentioned last week. However, it had a hard time holding above this level and eventually slipped to lower ground.

Technical lines from top to bottom:

1.35 was the post-Brexit high and remains the top level. It is followed by 1.3370 which capped the pair several times in 2016.

The 2017 high (so far) of 1.3270 is the next barrier. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I remain bearish on GBP/USD

The slow pace of Brexit negotiations joins the slow pace of the economy. While the US economy has its own troubles, the pound remains under immense pressure.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!