GBP/USD showed some strong movement during the week, but closed the week unchanged, at 1.4240. This week’s highlights are the PMI reports. Here is an outlook on the major events moving the pound and an updated technical analysis for GBP/USD.

As expected, the Federal Reserve opted not to raise rates and was cautious in its policy statement. US numbers did not impress last week, as durables were short of expectations. In the UK, Preliminary GDP posted a gain of 0.5%, matching the forecast.

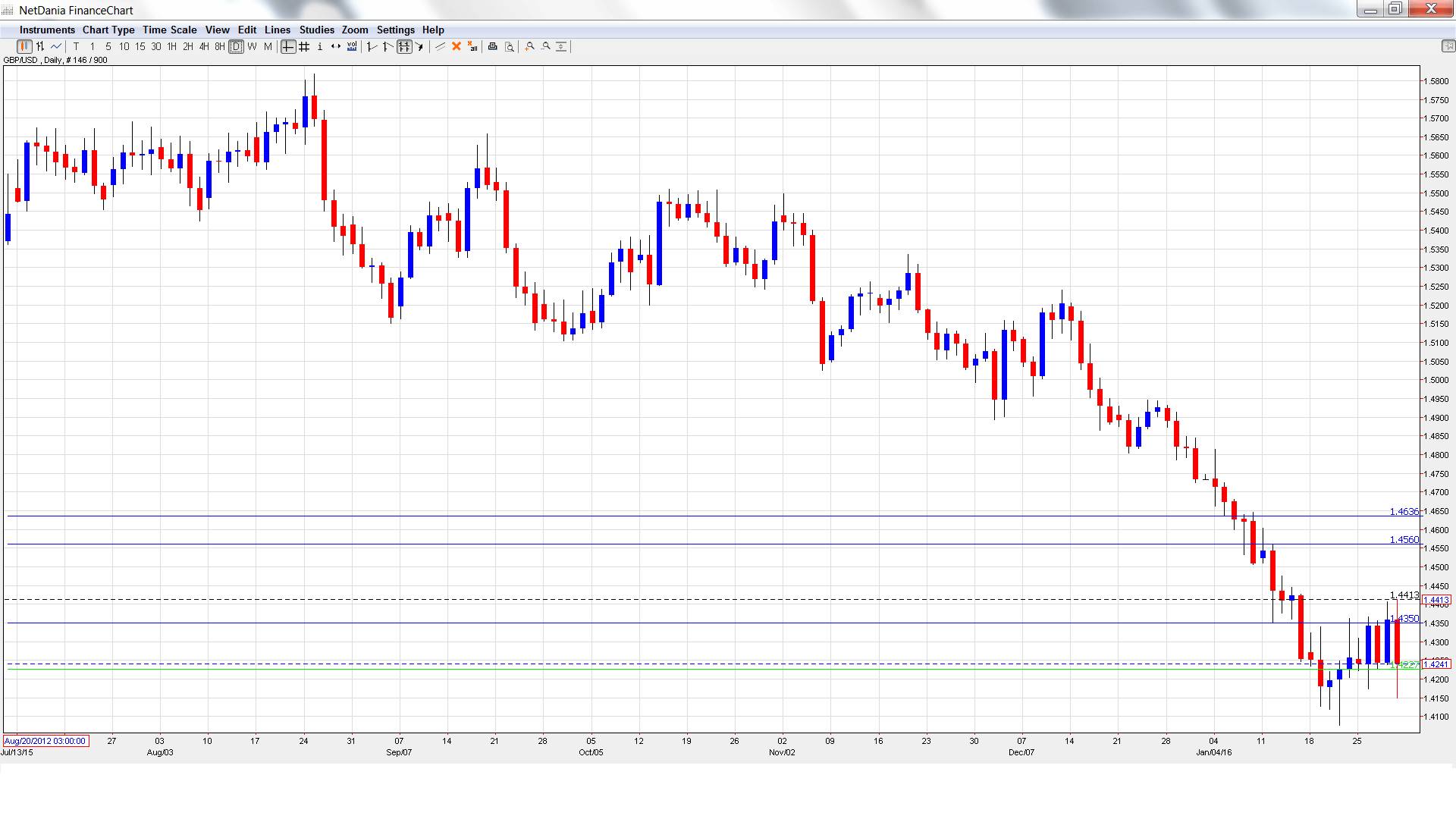

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Manufacturing PMI: Monday, 9:30. The week kicks off with the key manufacturing report. The index has been losing ground, and dipped to 51.9 points in December, shy of the forecast of 52.8 points. More of the same is predicted in January, with an estimate of 51.8 points.

- Net Lending to Individuals: Monday, 9:30. Higher credit levels usually translate into increased spending, a key driver of economic growth. The indicator jumped to 5.3 billion pounds in December, ahead of the forecast of 4.9 billion pounds. This marked the highest gain since May 2008. The estimate for January remains at 4.9 billion pounds.

- Construction PMI: Tuesday, 9:30. This index continues to post numbers well above the 50-level, indicative of expansion in the construction sector. In December, the indicator improved to 57.8 points, beating the estimate of 56.1 points. Little change is expected in January, with the estimate standing at 57.6 points.

- BRC Shop Price Index: Wednesday, 00:01. The index provides a look at inflation in BRC shops. The indicator continues to post declines, coming in at -2.0% in December. This was little-changed from the previous reading of -2.1%.

- Services PMI: Wednesday, 9:30. Services PMI continues to hover in the mid-50 range, indicating expansion in the services sector. The December release came in at 55.5 points, almost matching the forecast. The estimate for January stands at 55.4 points.

- Halifax HPI: Thursday, 4th-9th. This indicator provides a snapshot of the level of activity in the UK housing sector. The index bounced back in December with a strong gain of 1.7%, compared to the forecast of 0.5%.

- BOE Inflation Report: Thursday, 12:00. This report should be treated as a market-mover. Inflation remains at weak levels, and the markets will be looking for hints about the BOE’s monetary plans, and whether a rate cut is a possibility.

- Official Bank Rate: Thursday, 12:00. The BOE is expected to hold the benchmark interest rate at 0.50%. The central bank will also release the vote of the December rate decision, which is expected to remain at 8 members in favor of holding the current rate level, and one member in favor of raising rates.

- Asset Purchase Facility: Thursday, 12:00. QE levels are expected to remain at 375 billion pounds. The BOE will also release the December vote which maintained the current levels. The vote breakdown is expected to be unanimous (9-0).

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.4253 and touched a high of 1.4413 late in the week. The pair then retracted and gave up these gains, dropping to a low of 1.4148, as support held firm at 1.4135 (discussed last week). GBP/USD closed the week at 1.4241.

Technical lines from top to bottom

We start with resistance at 1.4635.

1.4562 remains a strong resistance line.

1.4346 is the next resistance line. It was tested as the pair posted strong gains before retracting.

1.4227 was tested in support. It is a weak line and could see further action early in the week.

1.4135 is the next support level. This line marked a low point in December 2001.

The symbolic level of 1.40 is next. It was last breached in March 2009.

1.3809 was a cushion in February 2009. It is the final support line for now.

I am bearish on GBP/USD.

The Fed sounded dovish in the January statement, but the markets will be looking for hints as to a March hike, so any positive US data could bolster the US dollar. Inflation levels remain weak in the UK, and a pessimistic inflation report from the BoE could weaken the pound.

In our latest podcast we make sense of turbulent markets

Follow us on Sticher or on iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.