GBP/USD continued its winning ways last week, gaining 160 points. The pair closed at 1.2542, its highest weekly close since early December. This week’s key events are PMI reports and the Official Bank Rate. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

As expected, US GDP softened in Q4 compared to the previous quarter. The economy expanded 1.9%, close to the estimate of 2.1%. Unemployment Claims and Existing Home Sales missed expectations, but consumer confidence moved slightly higher, beating the forecast. In the UK, Preliminary GDP edged up to 0.6%, above the forecast of 0.5%.

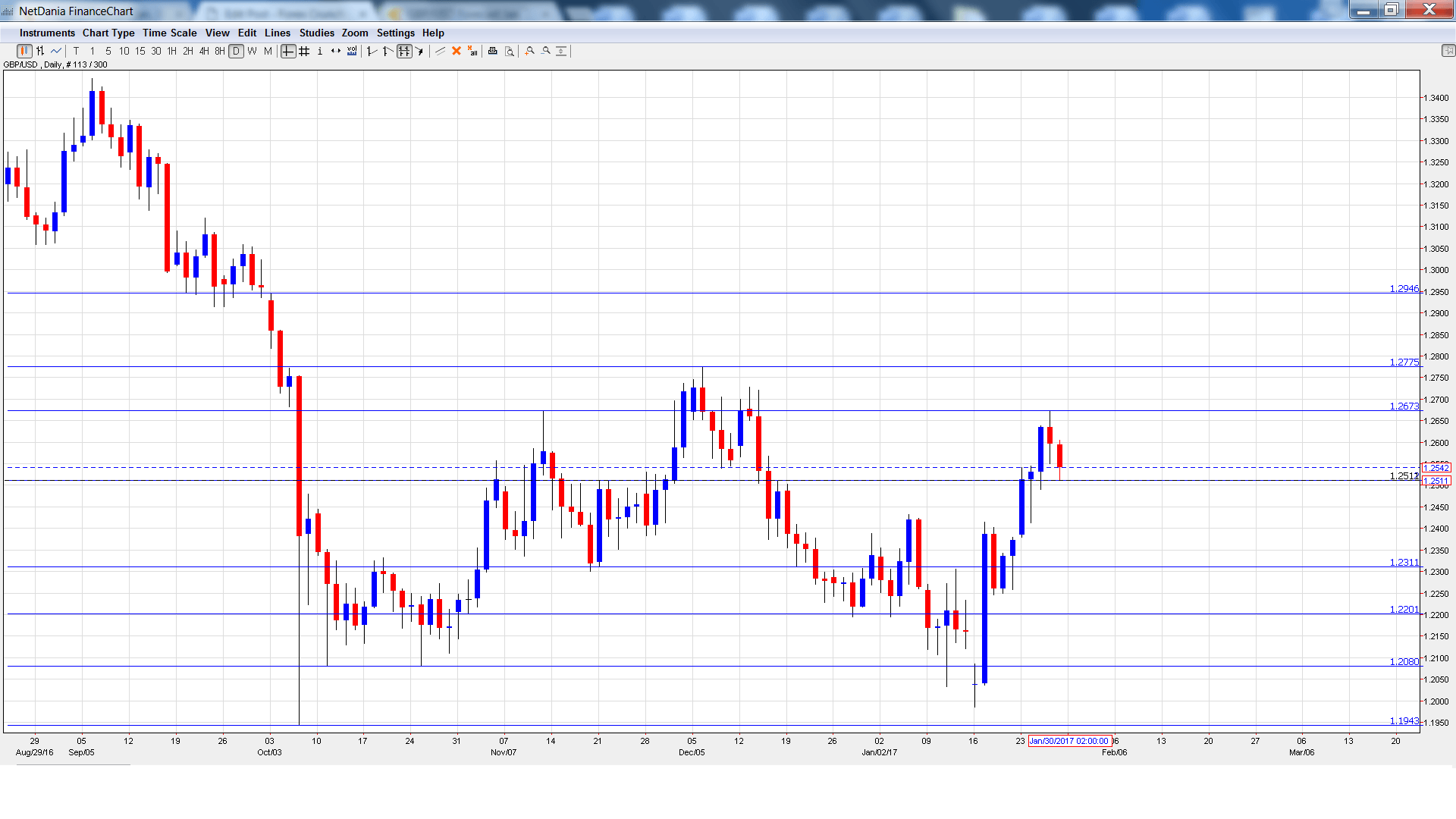

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- GfK Consumer Confidence: Tuesday, 00:01. The indicator continues to post to pessimism, posting a decline of -7 points in December, close to the forecast of -8 points. The estimate for January is -8 points.

- Net Lending to Individuals: Tuesday, 9:30. Consumer credit levels are closely linked to spending levels by consumers, a key engine of economic growth. In December, the indicator improved to GBP 51. billion, above the forecast of GBP 4.9 billion. The upswing is expected to continue, with an estimate of GBP 5.3 billion.

- 10-year Bond Auction: Tuesday, Tentative. The 10-year bond dipped to 1.16% in January, marking a 3-month low.

- BRC Shop Price Index: Wednesday, 00:01. This index looks at consumer inflation in BRC shops. In December, the indicator came in at -1.4% and has not posted a gain since 2013.

- Nationwide HPI: Wednesday, 7:00. This indicator provides a snapshot of the strength of the housing sector. The indicator surged in December with a gain of 0.8%, well above the forecast of 0.2%. The estimate for the January report stands at 0.0%.

- Manufacturing PMI: Wednesday, 9:30. The PMI jumped to 56.1 in December, easily beating the estimate of 53.3. Another strong release is expected in January, with an estimate of 55.9.

- Construction PMI: Thursday, 9:30. The index improved to 54.2 in December, pointing to expansion. This beat the estimate of 52.6. The January estimate stands at 53.9.

- BoE Inflation Report: Thursday, 12:00. This report is released every quarter, and details the bank’s forecast for inflation and economic growth over the next two years. If the forecast calls for higher inflation levels, the pound could climb higher. BoE Governor Mark Carney will follow up with a press conference and discuss the report.

- Monetary Policy Summary: Thursday, 12:00. This summary is released on a monthly basis. The report contains discusses economic conditions and could provide clues about the BoE’s future monetary policy.

- Official Bank Rate: Thursday, 12:00. The BoE is expected to maintain rates at 0.25%. The MPC will release the vote breakdown for the November rate decision, when the bank held rates. The markets are predicting that the vote for that decision was a unanimous 9-0 vote.

- Asset Purchase Facility: Thursday, 12:00. The BoE’s asset-purchase program is expected to remain at 435 billion pounds. The voting breakdown for the November decision (which remained at 435 billion pounds) is expected to be a unanimous 9-0 vote.

- Services PMI: Friday, 9:30. The indicator strengthened for a third straight month, climbing to 56.2 in December. The indicator is expected at 55.8 in the January report.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2384 and quickly dropped to a low of 1.2380. The pair then reversed directions and climbed to a high of 1.2673, as resistance held at 1.2674 (discussed last week). GBP/USD retracted late in the week and closed at 1.2542.

Live chart of GBP/USD:

Technical lines from top to bottom

With GBP/USD posting sharp gains, we start at higher levels:

1.2946 has provided resistance since early October.

1.2849 is next.

1.2775 was a high point in December 2016.

1.2674 was a cap in November.

1.2512 has switched to a resistance role. It is a weak line.

1.2311 is an immediate support line.

1.2201 switched to support after GBP/USD made sharp gains early in the week.

1.2080 is protecting the symbolic 1.20 level.

1.1943 has provided support since October 2016. It is the final support line for now.

I am neutral on GBP/USD.

Just a week into his new job, Donald Trump has not shied away from controversial moves, leading to some nervousness in the markets. The new president withdrew the US from the Trans-Pacific Partnership and has escalated tensions with Mexico. However, the economy is strong and if inflation levels move higher, we could see the Fed step in with additional rate hikes which is bullish for the US dollar. In the UK, higher inflation levels have boosted the pound, and the markets will be monitoring the BoE Inflation report.

Our latest podcast is titled Trumping Trade and the Donald Dollar

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.