GBP/USD dropped 150 points last week. The pair closed at 1.2965. This week’s highlight is Preliminary GDP. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

The pound dropped sharply after British CPI slowed down to 2.6%, short of the estimate of 2.9%. In the US, political risk continues to rise, as Trump’s failure to pass a healthcare bill triggered a fresh wave of US dollar selling. The revelation that Special Counsel Mueller is expanding his investigation into Trump’s business dealings also contributed to the greenback’s losses.

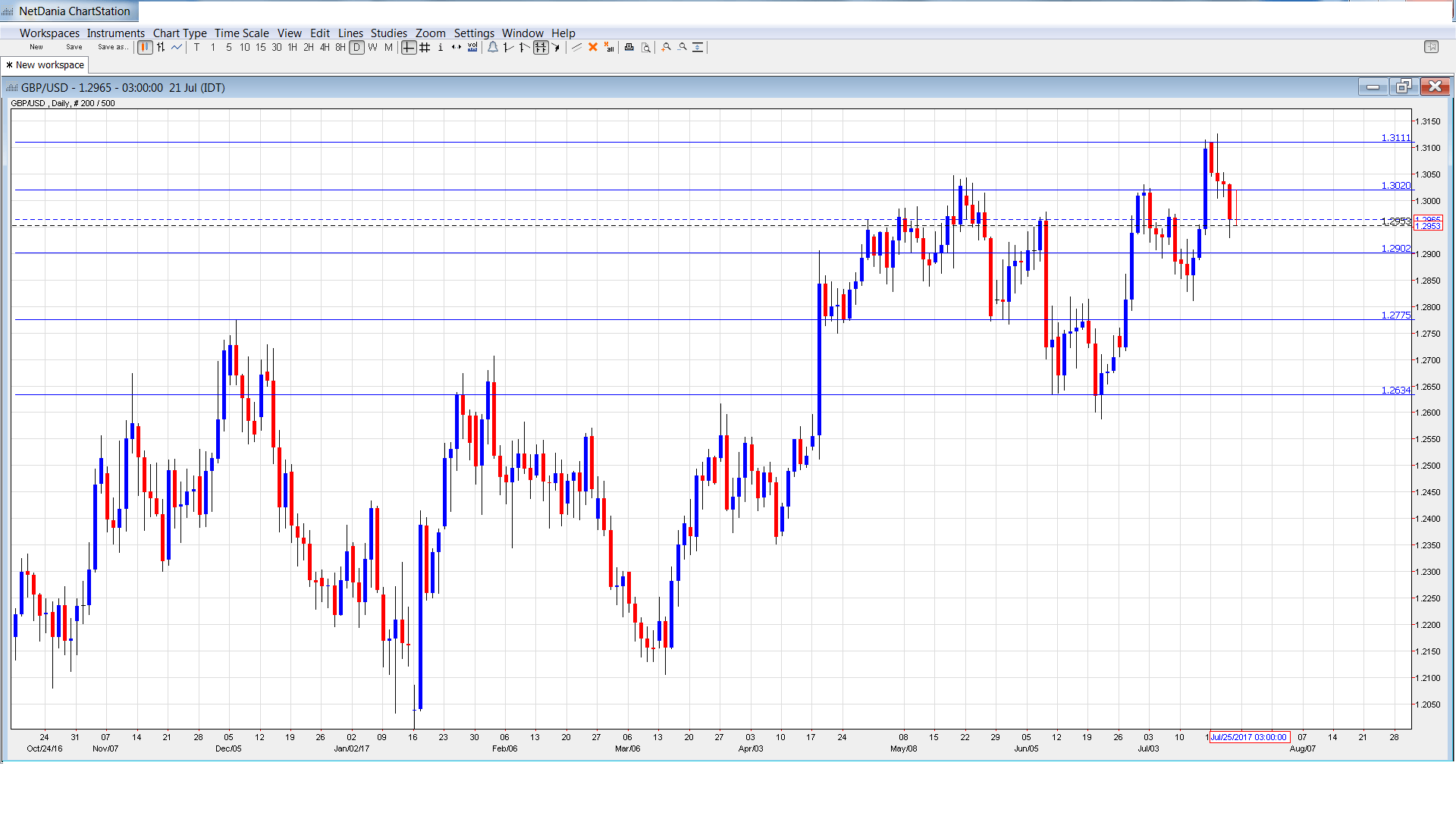

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CBI Industrial Order Expectations: Tuesday, 10:00. The manufacturing sector has been improving, as the indicator surged to 16 in June, crushing the estimate of 7 points. The estimate for July stands at 12 points.

- MPC Member Andy Haldane Speaks: Tuesday, 17:00. Haldane will deliver a lecture at the Finance Foundation in London. Remarks which are more hawkish than expected is bullish for the British pound.

- Nationwide HPI: Wednesday, 26th-31st. This indicator is a gauge of the strength of the housing sector. After three straight declines, the indicator posted a strong gain of 1.1% in June, easily beating the estimate of 0.1%. Will we see another gain in the July release?

- Preliminary GDP: Wednesday, 8:30. This is the key event of the week. The economy slowed down in the first quarter, with a gain of 0.3%. This missed the estimate of 0.4%. The markets are expecting another gain of 0.3%, and if the reading is softer than expected, the pound could react with losses.

- CBI Realized Sales: Thursday, 10:00. Retail and wholesale sales jumped to 12 in June, crushing the estimate of 4 points. Little change is expected in July, with an estimate of 11 points.

- GfK Consumer Confidence: Thursday, 23:01. The British consumer remains pessimistic, and the indicator dropped to -10 points in June, its lowest reading since July 2016. The estimate for July is -11 points.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3109 and climbed to a high of 1.3126. It was all downhill from there, as the pair dropped to a low of 1.2930, as support held at 1.2902 (discussed last week). GBP/USD closed the week at 1.2965.

Technical lines from top to bottom

1.3347 has held in resistance since September 2016.

1.3238 is next.

1.3112 was tested in resistance for a second straight week.

1.3020 is an immediate support line. It is protecting the symbolic 1.30 line.

1.2902 is the next support line.

1.2775 has been a cushion in July.

1.2634 is the final support line for now.

I am neutral on GBP/USD.

The British economy is showing some signs of fatigue and the Brexit cloud is making investors nervous. The Fed is on record that it will raise interest rates a third time in 2017, but the markets have their doubts, as inflation remains weak and second quarter numbers in the US have not impressed.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.