GBP/USD reversed directions last week and gained 110 points. The pair closed at 1.3120, its highest level since September 2016. This are 10 events this week. Here is an outlook for the highlights of this week and an updated technical analysis for GBP/USD.

In the UK, Preliminary GDP remained unchanged at 0.3%, matching the estimate. Over in the US, Advance GDP posted a strong gain in 2.6% in the second quarter, above the estimate of 2.5%. However, political risk continues to rise, as Trump’s failure to pass a healthcare bill weighed on the US dollar.

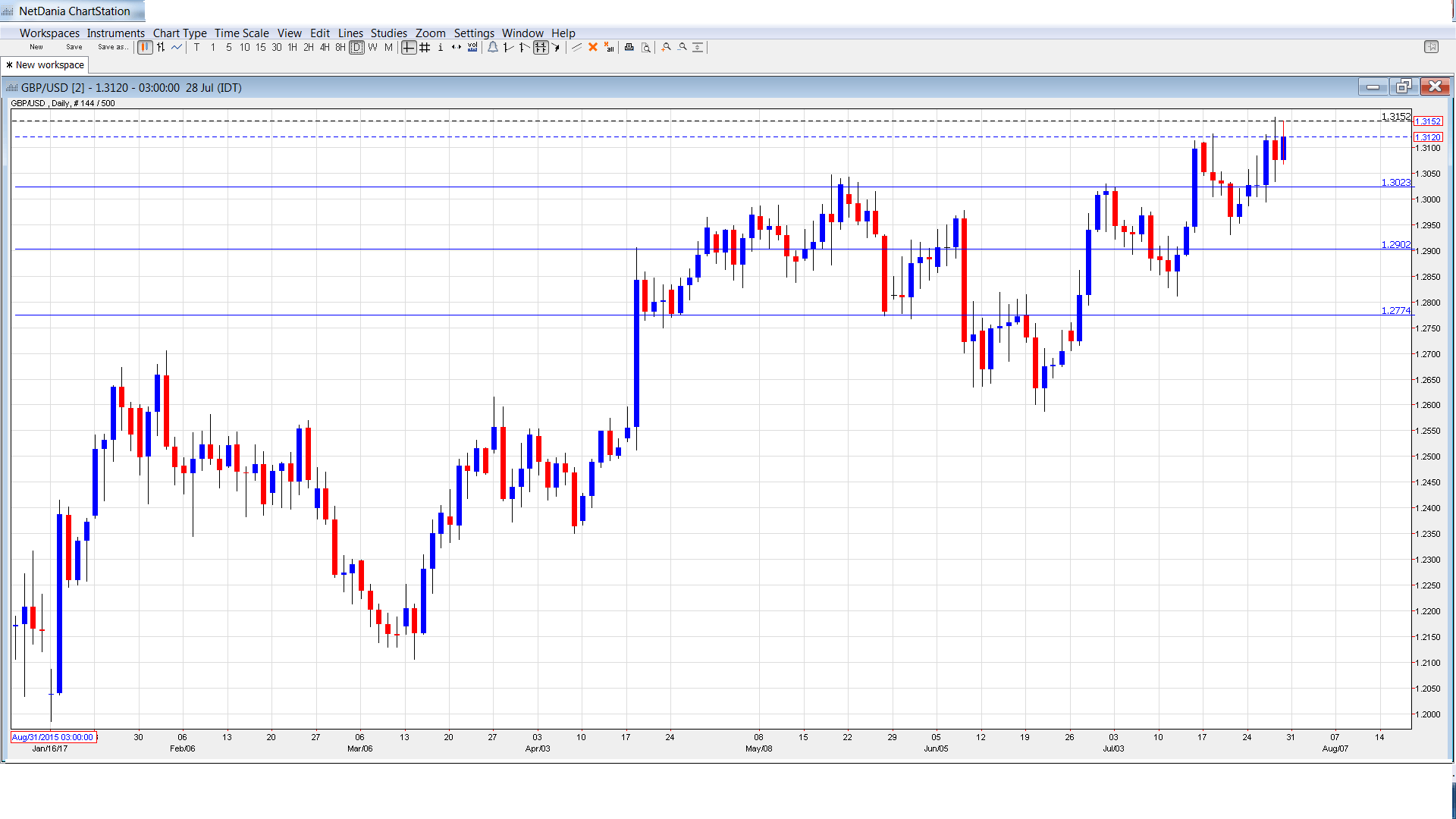

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Net Lending to Individuals: Monday, 8:30. Borrowing levels are closely monitored, as they often translate into stronger consumer spending, a key driver of economic growth. The indicator climbed to GBP 5.3 billion in May, well above the forecast of GBP 4.0 billion. However, the markets are expecting a weaker reading in June, with an estimate of GBP 4.9 billion.

- Nationwide HPI: Tuesday, 6:00. This indicator is a gauge of the strength of the housing sector. After three straight declines, the indicator posted a strong gain of 1.1% in June, easily beating the estimate of 0.1%. Will we see another gain in the July release?

- Manufacturing PMI: Tuesday, 8:30. The index has slowed over the past two readings, but continues to point to expansion. The June reading of 54.3 missed expectations, and little change is expected in July.

- 10-y Bond Auction: Tentative, Tuesday. In July, the yield on 10-y bonds climbed to 1.38%, above the yield of 1.14% in June.

- BRC Shop Price Index: Tuesday, 23:01. This indicator gauges consumer inflation in BRC shops. The index continues to post declines, although the declines have been moderating. The June release came in at -0.3%.

- Construction PMI: Wednesday, 8:30. The index dipped to 54.8 in June, just shy of the estimate of 55.0 points. The estimate for July stands at 54.2 points.

- BoE Inflation Report: Thursday, 11:00. This quarterly report provides the bank’s forecast for inflation over the next two years. A press conference with Governor Mark Carney follows.

- Monetary Policy Summary: Thursday, 11:00. This monthly report discusses the bank’s economic outlook and could provide clues of future monetary moves.

- Official Bank Rate: Thursday, 11:00. The BoE is expected to maintain the benchmark rate at 0.25%, where it has been pegged since July 2016. The estimate for the vote at the last meeting is 3-0-5 (three members in favor of a hike, five in favor of no change).

- Asset Purchase Facility: Thursday, 11:00. No change is expected in the asset-purchase scheme, which is currently at 435 billion pounds. The estimate for the vote at the last meeting is 0-0-8.

*All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.3004 and quickly dropped to a low of 1.2987, testing support at 1.3020 (discussed last week). Late in the week, the pair climbed to a high of 1.3159. GBP/USD closed the week at 1.3120.

Technical lines from top to bottom

We start with resistance at 1.3444.

1.3347 has held in resistance since September 2016.

1.3238 is next.

1.3112 has switched to support following strong gains by GBP/USD. It is a weak line.

1.3020 is protecting the symbolic 1.30 line.

1.2902 is the next support line.

1.2775 has been a cushion in July. It is the final line for now.

I am neutral on GBP/USD.

The US dollar is under pressure, with mixed numbers in Q2 and worries that the Fed might not raise rates in December. Brexit worries continue to darken the mood of investors, as the start of negotiations between the UK and the EU has revealed wide gaps between the two sides.

Our latest podcast is titled Draghi Dud and the Petrol Pendulum

Follow us on Sticher or iTunes

Safe trading!

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.