GBP/USD had another strong week, gaining close to 100 points. GBP/USD closed just above the 1.25 level. There are 8 events on the schedule this week. Here is an outlook on the major market-movers and an updated technical analysis for GBP/USD.

The BoE revised upwards its forecast for economic growth, essentially acknowledging that its earlier forecasts of Brexit were far too pessimistic. The BoE also held interest rates at 0.25%, helping fuel the pound’s surge. US Non-Farm Payrolls were upbeat and wage growth improving to 0.3%, above the estimate of 0.2%. The Fed refrained from raising rates last week, but the policy statement was slightly hawkish, as the Fed gave the economy a solid report card.

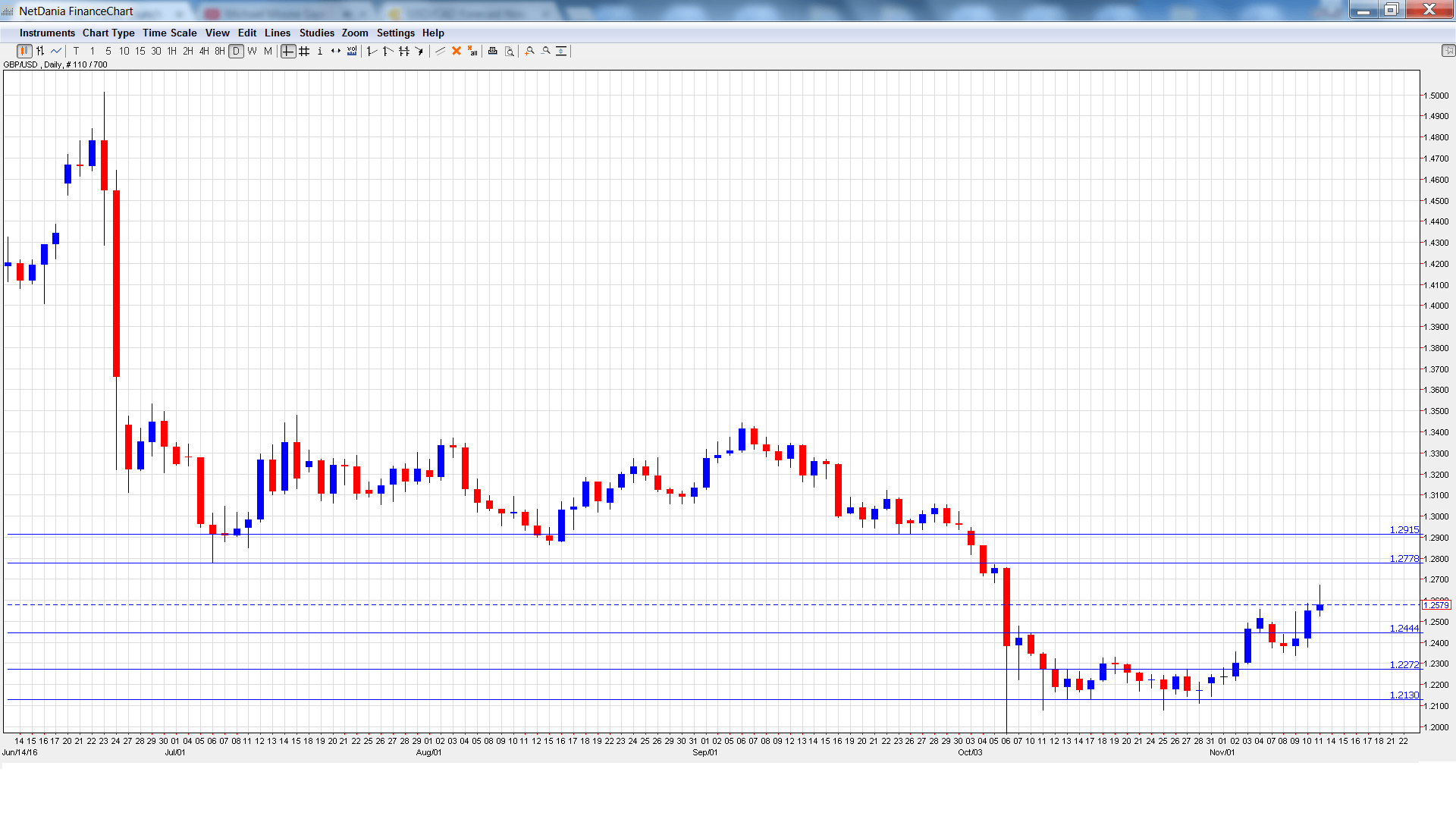

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- CPI: Tuesday, 9:30. CPI is the primary gauge of consumer inflation and should be treated as a market-mover. The index improved to 1.0% in September, its highest level since November 2014. Another strong reading is expected in October, with an estimate of 1.1%.

- PPI Input: Tuesday, 9:30. This inflation indicator dipped to 0.0% in September, but is expected to jump 1.1% in October. Will the index match or beat the rosy prediction?

- RPI: Tuesday, 9:30. RPI includes housing costs, which are excluded from CPI. The indicator improved to 2.0% in September, matching the forecast. The upward swing is expected to continue in October, with an estimate of 2.3%.

- Inflation Report Hearings: Tuesday, 10:00. This quarterly report is closely watched as it can provide clues about the BoE’s future monetary policy. With inflation running at higher levels, the report could make interesting reading.

- Average Earnings Index: Wednesday, 9:30. Wage growth is a key component of the labor market. The indicator has posted two straight readings of 2.3%, and an identical gain is expected in the September reading.

- Claimant Count Change: Wednesday, 9:30. The indicator posted a negligible gain of 0.7 thousand, short of the forecast. The estimate for October stands at 1.9 thousand. The unemployment rate is expected to remain at 4.9%.

- CB Leading Index: Wednesday, 14:30. This minor indicator has failed to post a gain since February. The index posted a flat reading of 0.0% in September.

- Retail Sales: Thursday, 9:30. Retail Sales is the primary gauge of consumer spending. The indicator came in at 0.0% in September, shy of the forecast of 0.3%. The forecast for the October report stands at 0.5%.

* All times are GMT

GBP/USD Technical Analysis

GBP/USD opened the week at 1.2485 and touched a low of 1.2336, as support held at 1.2272 (discussed last week). The pair then reversed directions and climbed sharply, touching a high of 1.2674. GBP/USD closed the week at 1.2579.

Live chart of GBP/USD:

Technical lines from top to bottom

With the pair posting sharp gains last week, we begin at higher levels:

1.2915 was a cushion in September but switched to a resistance line after sharp losses by GBP/USD.

1.2778 is next.

1.2620 was a cushion back in 1985.

1.2447 is next.

1.2272 marked the high point in October.

1.2130 is the final support level for now.

I am neutral on GBP/USD.

The US economy continues to move in the right direction, buoyed a very strong labor market. The Fed is expected to raise rates in December, which is bullish for the dollar. At the same time, the UK economy has managed post-Brexit better than expected, and the BoE may be able to avoid further rate cuts if the economy remains steady.

Our latest podcast is titled Trump-time – fiscal, monetary and market implications

Follow us on Sticher or iTunes

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the kiwi, see the NZD/USD forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For the Canadian dollar (loonie), check out the USD to CAD forecast.