GBP/USD surged to higher ground as everything went in its favor. Is the BOE really about to raise rates? Can it extend its gains? Retail sales stand out now. Here are the key events and an updated technical analysis for GBP/USD.

Inflation is rising in the UK: at 2.9% y/y, it beat expectations and triggered a more hawkish tone from the Bank of England. Carney and his colleagues may raise interest rates “in the coming months”. This hawkishness sent the pound surging despite no change in the voting pattern. MPC member Gertjan Vlieghe provided a confirmation of the BOE’s intentions to raise rates soon.The slow pace of wage rises, 2.1% y/y and the comeback of the dollar did not halt cable’s rise.

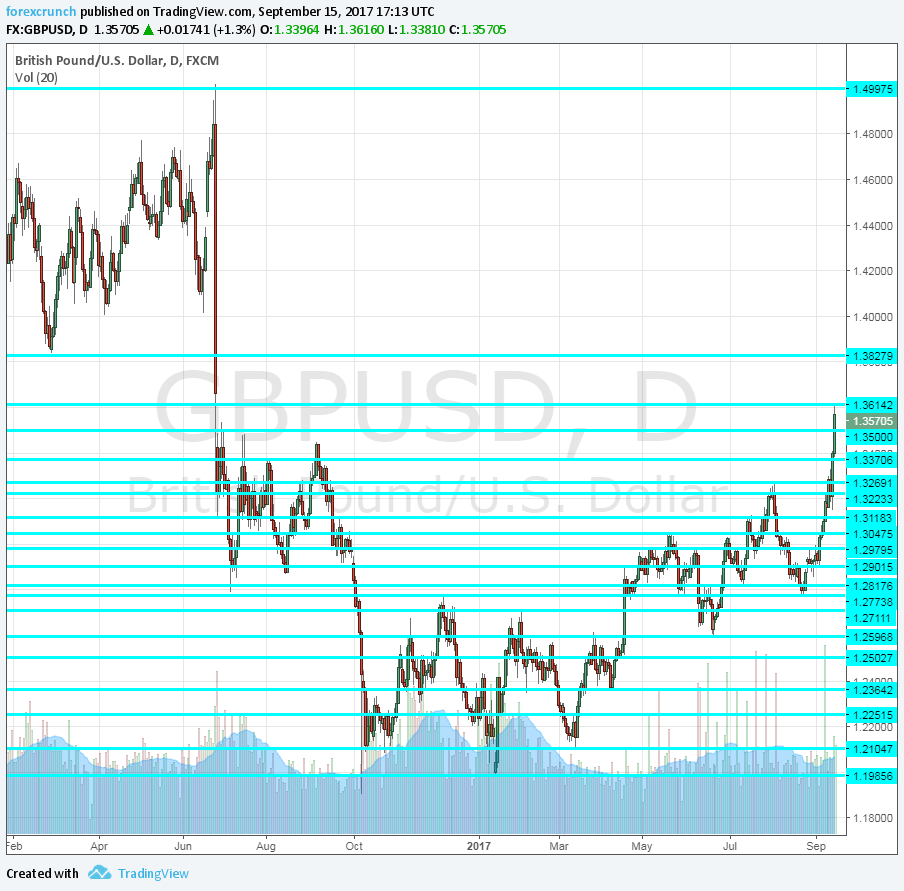

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD daily chart with resistance and support lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. Rightmove provides an early estimate of house prices. The House Price Index fell by 0.9% in August. It could rise in September.

- Retail Sales: Wednesday, 8:30. The volume of sales surprised to the upside in the past two months but remains volatile. After a rise of 0.3% in July, we could see a slide now. A small rise of 0.2% is expected.

- Public Sector Net Borrowing: Thursday, 8:30. The government was in a surprising surplus in July: 0.8 billion pounds. The figure is usually negative, representing a deficit. A return to a deficit is likely now: 6.5 billion.

- CBI Industrial Order Expectations: Friday, 10:00. Expectations of businesses are somewhat volatile, but they are certainly positive. In July, the figure advanced from 10 to 13 points. A repeat of the same score is forecast.

GBP/USD Technical Analysis

Pound/dollar was on the rise, storming above the 1.3370 level (mentioned last week) and felt comfortable above it.

Technical lines from top to bottom:

We start from higher ground this time. 1.3830 was a trough that the pair experienced back in February 2016, before the Brexit vote. The very first low that the pair experienced after the vote was 1.3620.

1.35 was the post-Brexit high and remains the top level. It is followed by 1.3370 which capped the pair several times in 2016.

The 2017 high (so far) of 1.3270 is the next barrier. 1.3225 was the high point of September.

It is followed by 1.3180, which capped the pair in July. 1.3120 served as resistance twice in the summer of 2017 and remains important.

Below, 1.3050 is a double top as seen during the spring of 2017. 1.2975 awaits on the lower side of 1.30.

Further below, 1.2890 separated ranges on the way down. It is followed by 1.2820 and 1.2775.

I am bearish on GBP/USD

Markets got too excited about the BOE’s hawkishness. We’ve seen this movie before. Carney prefers talking up the pound than raising rates. Some of the hot air could come out of this bubble.

Follow us on Sticher or iTunes

Further reading:

- EUR/USD forecast – for everything related to the euro.

- USD/JPY forecast – projections for dollar/yen

- AUD/USD forecast – predictions for the Aussie dollar.

- USD/CAD forecast – Canadian dollar analysis

- Forex weekly forecast – Outlook for the major events of the week.

Safe trading!