GBP/USD had a banner week, gaining over two cents. The pair closed the week at 1.5871. There are 10 events this week, including a host of inflation releases, highlighted by CPI. Here is an outlook of the events and an updated technical analysis for GBP/USD.

The pound received a strong boost from Claimant Count Change, which hit a multi-year low. As well, US manufacturing and consumer confidence releases were weak.

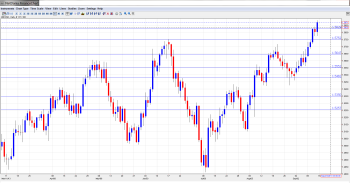

[do action=”autoupdate” tag=”GBPUSDUpdate”/]GBP/USD graph with support and resistance lines on it. Click to enlarge:

- Rightmove HPI: Sunday, 23:01. This housing inflation indicator dropped 1.8% in July, its first decline since November. The indicator provides a snapshot of activity in the UK housing sector.

- BOE Quarterly Bulletin: Monday, 23:01. The BOE Quarterly Bulletin is a minor event, as most of the commentary and analysis contained in the report as been released previously.

- CPI: Tuesday, 8:30. This is the first key event of the week. CPI is the most important UK inflation indicator and is often a market-mover. CPI has been quite steady in recent releases and little change is expected in the August reading, with an estimate of 2.7%.

- PPI Input: Tuesday, 8:30. PPI Input looks at inflation experienced by manufacturers. In July, the index jumped to 1.1% from 0.2% the previous month. This was the sharpest gain since March. The markets are expecting a much smaller gain for August, with the estimate standing at 0.3%.

- RPI: Tuesday, 8:30. RPI is similar to CPI, but also includes housing prices, which can distort the underlying trend. The readings have been steady and market estimates have been quite accurate. Little change is expected in the August release, with an estimate of 3.2%.

- MPC Asset Purchase Facility Votes: Wednesday, 8:30. The BOE’s asset purchase facility has remained pegged at 375 billion, but the breakdown of the previous vote drew eyebrows. The breakdown of the vote was 9-0, which was a change from the split vote we have become accustomed to in the past. This points to the ability of new Governor Mark Carney to keep other policymakers in line with his views. The breakdown for the previous vote is expected to remain unchanged.

- MPC Official Bank Rate Votes: Wednesday, 8:30. The BOE’s vote on interest rates, which has remained at 0.50% for over four years, is usually unanimous, and this is expected to be the case for the previous vote.

- Retail Sales: Thursday, 8:30.Retail Sales is one of the most important indicators, and provides an important gauge of the health of consumer spending in the UK. The key indicator jumped from 0.2% in June to a sharp 1.2% gain in July, beating the estimate of 0.7%. The markets are bracing for a much lower gain in August, with the estimate standing at 0.5%. Will the indicator beat the prediction?

- CBI Industrial Order Expectations: Thursday, 10:00. With the British economy showing improvement, confidence indicators have also pointed higher and we are seeing this with Industrial Order Expectations. The indicator has been mired in negative territory since August 2011, but managed to reach the zero level in July, easily beating the estimate of -8 points. The markets are expecting a stronger reading for August, with an estimate of 2 points.

- Public Sector Net Borrowing: Friday, 8:30. In July, Public Sector posted a surplus of 1.7 billion pounds, which was short of the estimate of -3.7 billion. However, this was the first surplus since January. The markets are braced for a huge deficit for August, with the estimate standing at 11.9 billion dollars.

Live chart of GBP/USD: [do action=”tradingviews” pair=”GBPUSD” interval=”60″/]

GBP/USD Technical Analysis

GBP/USD opened the week at 1.5633. The pair dropped to a low of 1.5628 but it was all uphill after that. The pound climbed to a high of 1.5885, breaking past resistance at 1.5832 (discussed last week). GBP/USD closed the week at 1.5871.

Technical lines from top to bottom:

With the pound posting sharp gains, we start at higher ground:

1.6475 has held firm since August 2011. Next is 1.6343. This line was last breached when the pound dropped sharply in August 2011.

We next encounter resistance at 1.6247. This was a key resistance line in October and November 2012. Next, 1.6125 has held firm since January, when the pound went on a sharp skid that saw it drop below the 1.50 level.

1.60, a key psychological barrier, is the next line of resistance. This line was last tested in mid-January, when the pound went on a sharp slide that saw it fall below the 1.49 line.

1.5944 saw a lot of activity in November 2012 and this past January.

1.5832 was busy in late January and until it fell last week, had provided resistance since February. It begins the week as a weak resistance line.

1.5752 was easily breached by the surging pound and has reverted to a support line. Prior to this, it was last breached in June, marking the peak of a rally by the pound which started in May. It has

1.5648 saw a lot of activity in June and continues to provide resistance. It has come under strong pressure in September, and was swept away early in the week buy the pair. It is providing strong support.

1.5550 is providing GBP/USD with support. This line saw action in mid-June, as GBP/USD pushed past this line and climbed as high as the mid-1.5750 range. It has more breathing room as the pair trades at higher levels.

1.5484 was quite busy in August and continues to provide support.

1.5350 saw some action in the first week in August, when the pound started a rally that saw it climb above the 1.57 line.

1.5258 is the final line of support. This line provided the pair with key support back in July.

I am bullish on GBP/USD.

The pound had an outstanding week as it climbed close to 1.59, a level not seen since January. The pound has garnered close to four cents since the start of September, so we could be due for a correction. With the US Federal Reserve meeting later in the week, QE tapering will be in the spotlight, and speculation about QE has been bullish for the US dollar. At the same time, US key releases have not looked sharp, and the dollar will have difficulty rebounding if US data does not improve.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.