German business is bullish: the manufacturing PMI beat expectations with a score of 58.3 points, significantly better than 56.5 predicted. The services PMI lags a bit behind but is also above projections: 55.6 against 54.6 that was on the cards.

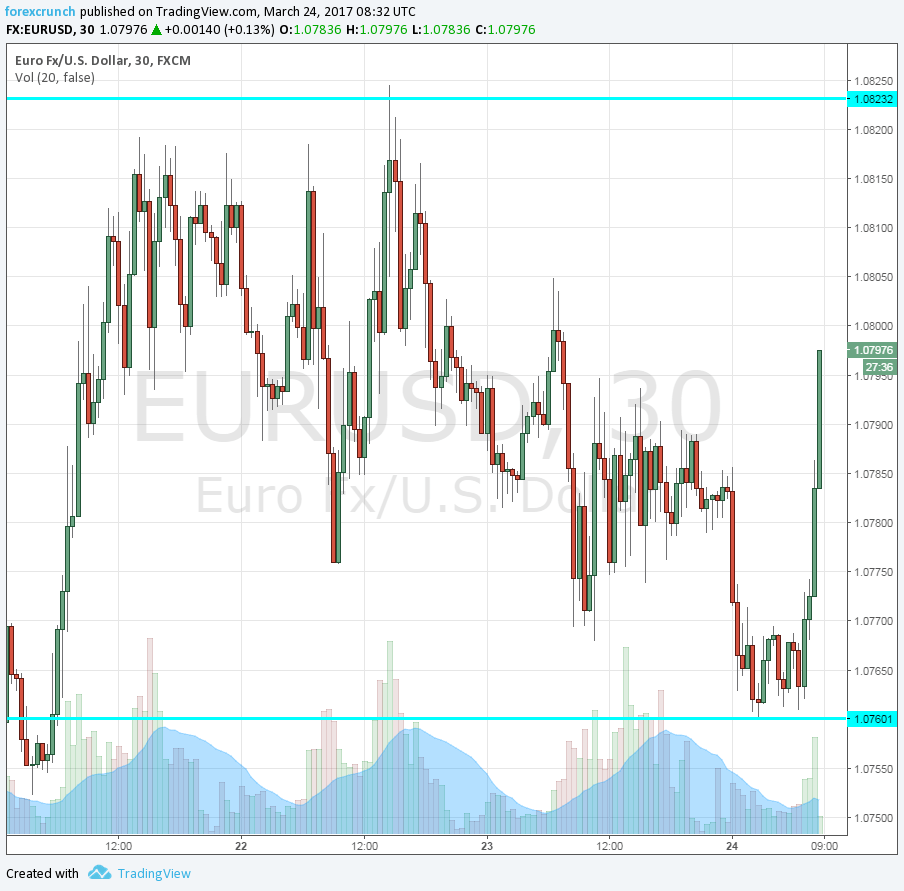

EUR/USD extends its recovery and eyes the 1.08 level. Resistance awaits at 1.0830, followed by 1.0870. Support is back at 1.0750.

Here is how this move looks on the euro/dollar chart.

Markit’s purchasing managers’ indices were expected to remain mostly unchanged: manufacturing to stand at 56.5 and services at 54.6 points. Any score above 50 represents economic expansion. Germany is the largest economy in the euro-zone.

EUR/USD was on a recovery path ahead of the publication, trading around 1.0780. Beforehand, the pair dropped on due to a greenback comeback. President Trump laid down an ultimatum to lawmakers: vote on Friday on Trump-care. He vowed to move on to tax reform regardless of the outcome. Markets want to see tax cuts and infrastructure spending from the new administration.

Earlier, French PMIs beat expectations: the manufacturing PMI came out at 53.4 points against 52.4 expected. The services PMI came out at a steaming hot level of 58.5 instead of 56.2 points. Does this reflect optimism about the outcome of the elections?

More: France: Mainstream Macron seen as debate winner – EUR/USD rising