- XAU/USD maintains a bullish bias despite temporary drops.

- It could test and retest the near-term support levels before jumping higher.

- The USD’s depreciation helped the price of gold to approach and reach new highs.

Gold price gained as the USD dropped deeper against its rivals. The metal is trading at $1,919 at the time of writing.

The bias is bullish; that’s why the yellow metal could resume growth despite temporary drops. Fundamentally, the XAU/USD jumped higher after the US Consumer Price Index reported a 0.1% drop in December, while CPI y/y came in at 6.5%, as expected.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Tomorrow, the Canadian CPI is expected to report a 0.6% drop in the last month versus the 0.1% growth in the previous reporting period.

On Wednesday, the BOJ, US retail sales, and the United Kingdom inflation data are seen as high-impact events and could bring sharp movements. The US PPI and Core PPI data will also be released, so the fundamentals could drive the markets.

The Bank of Japan is expected to keep its monetary policy unchanged, while the United Kingdom could report lower inflation.

Today, the US banks will be closed in observance of Martin Luther King Jr. Day. Later, the BOE Gov Bailey Speaks could shake the markets. In my opinion, as long as the Dollar Index continues to drop, the XAU/USD could approach and reach new highs.

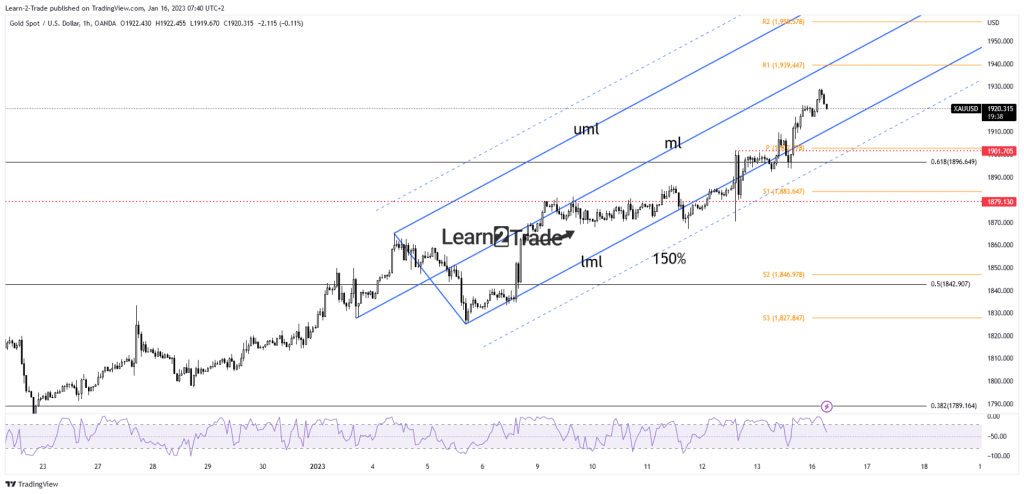

Gold price technical analysis: Retreat from top

Technically, the price of gold retreated a little. However, the outlook remains bullish despite temporary drops. After taking out the $1,879 resistance, the price action signaled an upside continuation.

–Are you interested to learn more about forex signals? Check our detailed guide-

After the US inflation data, the XAU/USD registered a false breakdown with a good trend below the $1,879 level. It has registered a valid breakout through 61.8%, so gold could extend its swing higher.

The ascending pitchfork’s lower median line (LML), 1,901, and the 150% Fibonacci line represent near-term support levels. As long as it stays above these levels, the rate could still approach and reach the median line (ml) and the weekly R1 (1,939).

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.