After the Eurogroup meeting broke up without a deal yesterday, it seems that the situation is boiling. Greek banks are suffering accelerated withdrawals. The ECB is convening at 10:00 GMT to decide on more Emergency Liquidity Assistance (ELA) in an emergency teleconference. Talks are still going on in Luxembourg and across the continent towards the Leaders’ meeting on Monday.

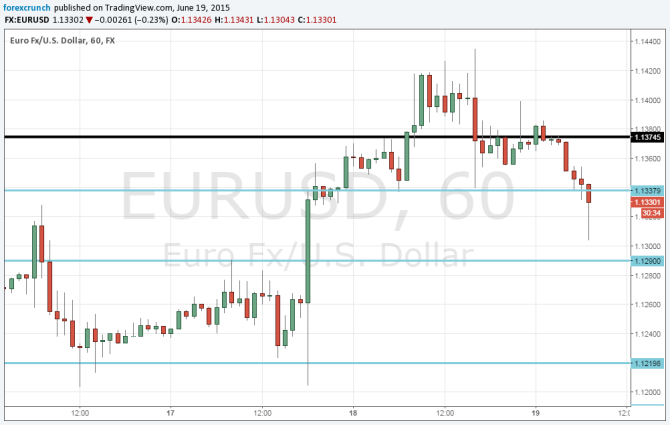

On this troubled background, it is no wonder that EUR/USD is reacting and falling to the next trading range, after having backtracked from the break of the double top.

There is not too much data on the agenda today: German PPI fell short of expectations by remaining flat instead of 0.2% in April. That doesn’t help, but after this is behind us, the stage is left for the Greek crisis.

The low so far is 1.1304, above 1.1290 that is minor support. Further support awaits at 1.1220. On the topside, the 1.1340 that was just lost is minor resistance and 1.1375, which was the strong double top, still plays a role.

More: Why Greece currently has leverage over all troika members