Ahead of Theresa May’s key Brexit speech, there are reports that she will lean heavily towards a “Hard Brexit”, more control on borders and accepting to lose single market access. The pound is clearly the main victim, with a dip under 1.20 on GBP/USD but it is also important to remember the other side of the divorce: the EU. The continent is being left by the UK.

Risk aversion is taking over, with the dollar and the yen gaining ground against all the rest. So while EUR/GBP is on the rise, EUR/USD and EUR/JPY are falling.

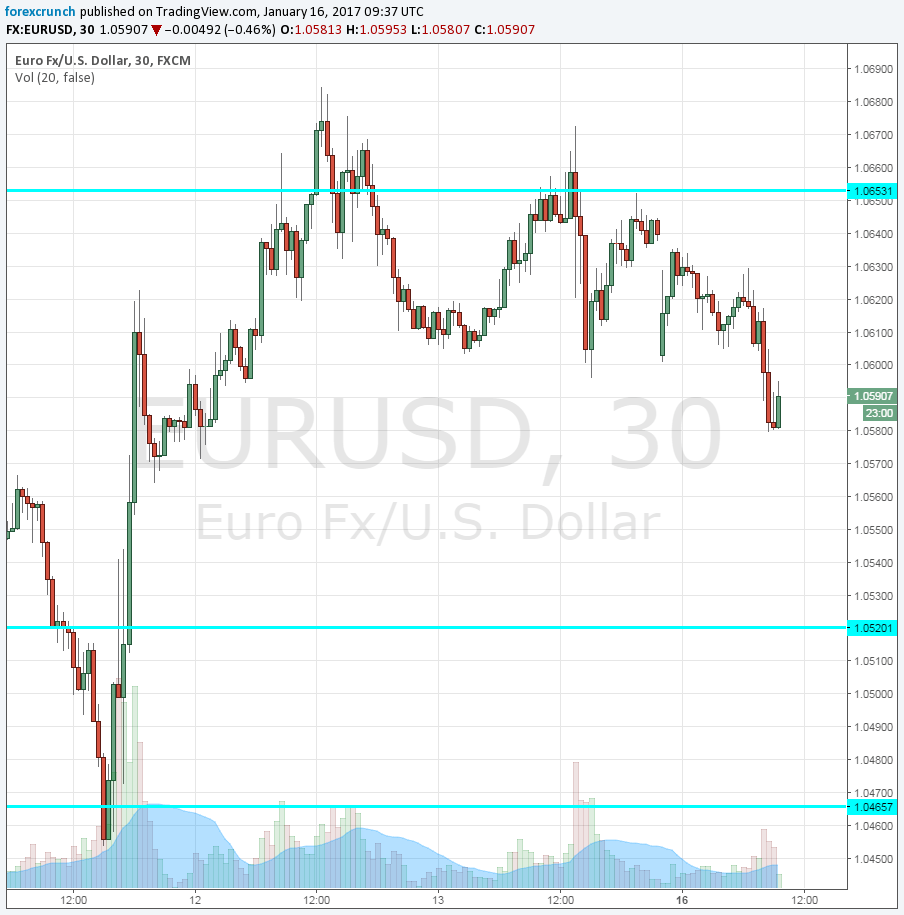

Euro/dollar is trading under 1.06, but maintaining a safe distance from support at 1.0520. Further support awaits at 1.0460 and 1.0350. Resistance is at 1.0680.

Last week, EUR/USD dropped to the 1.04 handle on worries that Trump will reinvigorate the Donald Dollar rally. However, we received a Donald Disappointment, with no mention of fiscal stimulus alongside some trade war rhetoric. The dollar fell down and EUR/USD made a 200 pip bounce.

These Hard Brexit fears are currently no match for the Dark Donald move, but EUR/USD is on the back foot.

And what about the euro side of this equation? We have the ECB later this week and Draghi could drag the euro down.