We have seen EUR/USD fall from the highs on dovish comments by Nowotny, losing the 1.1460 level after it struggled to break above it.

Yet the euro is still strong. The team at Credit Agricole talks about how to trade this resilience:

Here is their view, courtesy of eFXnews:

We think that the Eurozone BoP flow backdrop could remain generally supportive for EUR going into year-end. We expect the issuance of EUR-denominated debt to subside further in the next few months.

In addition, we expect Eurozone supranationals to increase the issuance of FX debt while Eurozone corporates could start to catch up with their hedging programmes. Indeed, recent anecdotal evidence suggests that the latter remains severely underhedged given the persistent gap between current EUR/USD and their budget rate (which range between 1.20 and 1.25).

The closer FX spot moves to the budget rate, the more actively should the Eurozone exporters start hedging. These developments could suggest that selling pressure on EUR in the forward (and spot) market could continue to abate. What is more, a renewed risk sell-off on the back of lingering concerns about China and/ or the global economy could benefit EUR given its negative correlation with risk appetite.

The near-term outlook: long EUR/JPY

We think that tactical longs in EUR/JPY could be attractive at current levels. We do not expect any significant changes in the ECB’s policy on 22 October.

At the same time, Crédit Agricole CIB economists have frontloaded their call for BoJ QE to 30 October from January 2016. The combination of factors could lift EUR/JPY back towards 142.

The trade has the attractiveness that it needs to not underperform in the event of a further significant deterioration of market risk sentiment.

The longer-term: the ECB holds the key

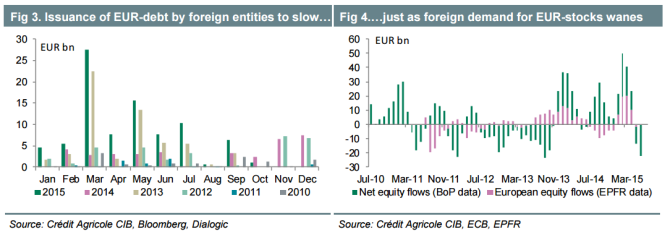

Looking over the next three to six months we think that the outlook for EUR could deteriorate yet again. Part of that is the renewed pick up in the EURissuance by non-Eurozone entities that could add to the downside pressure on EUR on the FX forward and spot market yet again in Q116 (figure 3). This could offset the impact from potential further unwinding of EUR-short hedges in response to the continuing underperformance of Eurozone stock markets. ECB policy will play a decisive role in spurring demand for EUR-funding in our view.

We expect the Governing council to expand QE in Q1. The measures could boost the attractiveness of EUR as a funding currency and encourage renewed selling by multinationals looking for cheaper funding. In addition, the measures could boost the attractiveness of longs in the Eurozone stock markets, backed-up by short-EUR hedges yet again. In short, more ECB easing could trigger a repeat of the BoP flow developments from late 2014 and early 2015 and see EUR losing ground broadly, yet again.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.