Some good economic news coming in from the US: the ISM Manufacturing PMI beat with 53.2 points, better than 51.3 expected. The manufacturing sector, which usually lags behind services, is bouncing back. Also the employment component is on the rise, topping the 50 point level that separates contraction and expansion. This is good news for next week’s Non-Farm Payrolls report.

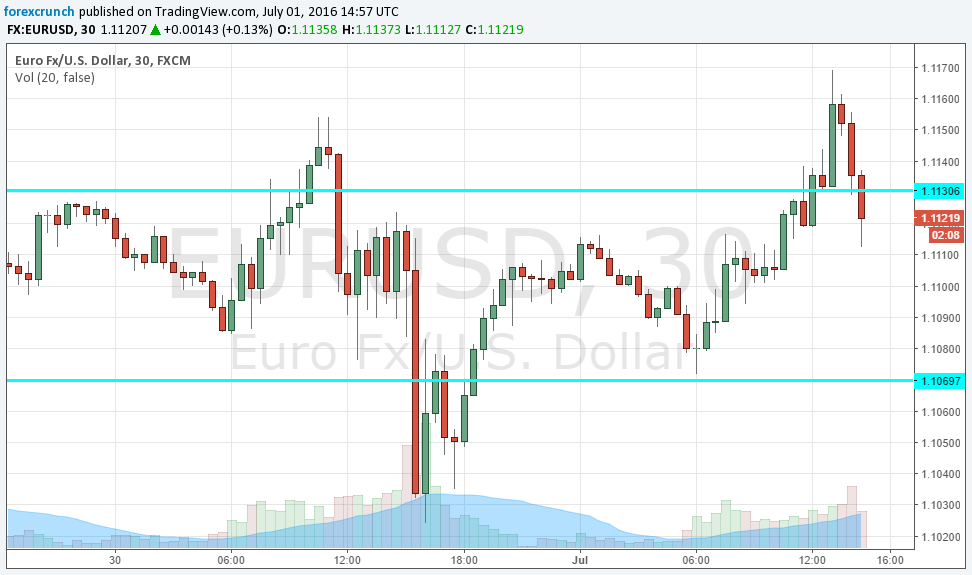

Markets are beginning to move away from the Brexit aftershocks and reacting: the US dollar gained some ground on the news and EUR/USD slips from the highs to trade back at 1.1120. Support awaits at 1.1070 and 1.0960. Resistance is at 1.180 and 1.1250.

All in all, EUR/USD is returning to its frustrating manner, trading within a narrow range. The pair fell sharply on the Brexit news but not as much as expected.

For the US economy, the good news is not enough to change the Fed’s mind. Without a blockbuster jobs report and even with such an outcome, a rate hike is not on the cards. The UK’s exit of the EU as well as China’s devaluation and other signs of lackluster growth in the US are enough for the already-dovish Fed to refrain from action.

Here is the EUR/USD chart. It’s refreshing to see markets react to indicators.