The Japanese economy grew by 0.5% in Q3 2016, significantly better than 0.2% that was expected. In addition, this came on top of an upwards revision for Q2: a rise of 0.2% instead of 0% originally reported. This strong real growth rate came on top of a drop in prices: the GDP Price Index slipped by 0.1% instead of an expected rise of 0.3%. So, nominal growth was not that exciting. Nevertheless, the economy is growing in real terms. Also in annualized terms, the economy grew at a solid 2.2% rate, much better than predicted.

Normal currencies would rally on good news, but the yen is no normal currency, it is a safe haven one. In addition, these are not normal times: the shock victory of Donald Trump is stirring financial markets and recently helping the US dollar rally.

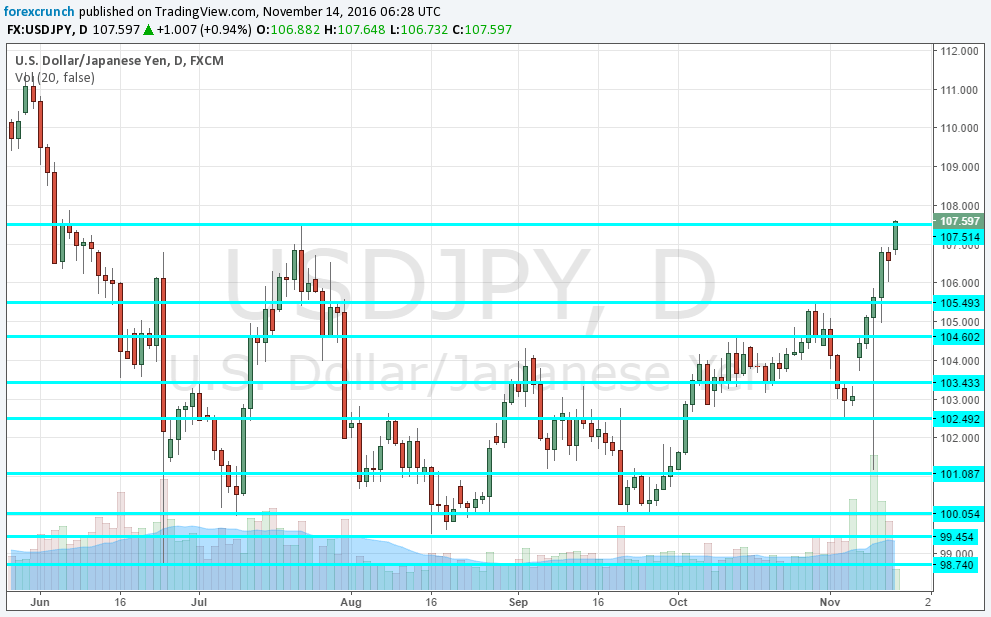

Dollar/yen hit a high of 107.64. On the way, it broke above the 107.50 resistance line, a swing high set back in July. It is now trading at the highest levels since June, a 5-month high. Can the pair continue higher? The Japanese authorities must be cheering for that.

BOJ Governor Kuroda said that rates can go either way, mimicking Carney’s approach. It seems that he doesn’t want to say anything significant to stop the rally. He did say that he prefers foreign exchange to move in a more stable manner, but if it is going in the right direction for him (a weaker yen), he will probably not complain too much.

There were fears of BOJ intervention upon a Trump victory but there seems to be absolutely no need. The prospects of excessive fiscal spending by a Trump administration have sent US bond yields and the dollar much higher.

Here is the daily chart of USD/JPY. The next line of resistance is only at 110.