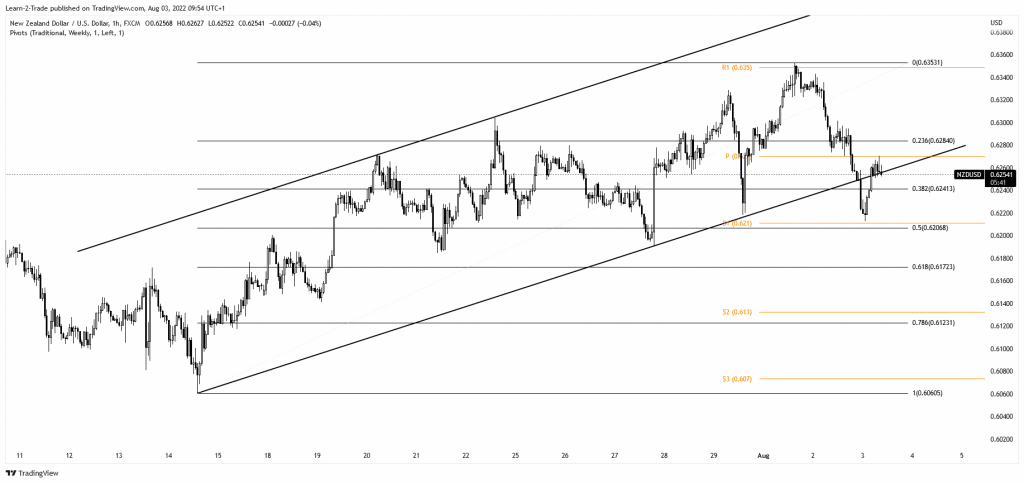

- The NZD/USD pair signaled exhausted buyers after failing to retest the channel’s upside line.

- A new lower low activates more declines.

- The US economic data could be decisive today.

The NZD/USD price rebounded as the Dollar Index dropped after a strong gain. The pair was trading at the 0.6258 level at the time of writing.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

Technically, the currency pair seems choppy as the Dollar Index reached strong upside obstacles. As you already know from my analyses, the DXY was in a corrective phase, and now it has tried to develop a new leg higher.

But the bearish pressure is still strong. DXY’s deeper drop will restrict the USD from taking the lead and dominate the currency market. The NZD/USD pair dropped, but the bias remains bullish on lower time frames. We need strong confirmation before considering going short.

Fundamentally, the USD depreciated as the JOLTS Job Openings came in at 10.70M yesterday, below the 10.99M expected. Today, the New Zealand economic data came in mixed. Employment Change registered a 0.0% growth versus 0.4% growth expected, the Unemployment Rate came in at 3.3% above 3.1% forecasted, and Labor Cost Index surged by 1.3%, beating the 1.1% growth estimate. In comparison, the ANZ Commodity Prices dropped by 2.2%.

Later, the US ISM Services PMI is seen as a high-impact event. The indicator is expected to drop from 55.3 to 53.5 points. Final Services PMI could remain steady at 47.0 points, while the Factory orders may report a 1.3% growth.

NZD/USD price technical analysis: Swing higher

From the technical point of view, the NZD/USD pair registered a strong swing higher within the uptrend channel pattern. Its failure to reach the upside line signaled buyers’ exhaustion. Now, it has dropped below the lower band of the channel, indicating that the leg higher ended.

–Are you interested to learn more about forex bonuses? Check our detailed guide-

Still, it’s premature to talk about a larger drop as the price rebounds. It may only test the near-term resistance levels before dropping again. Validating its breakdown below the channel support may signal more declines. Only a new lower low, dropping and closing below today’s low of 0.6212, could activate a larger downside movement.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.