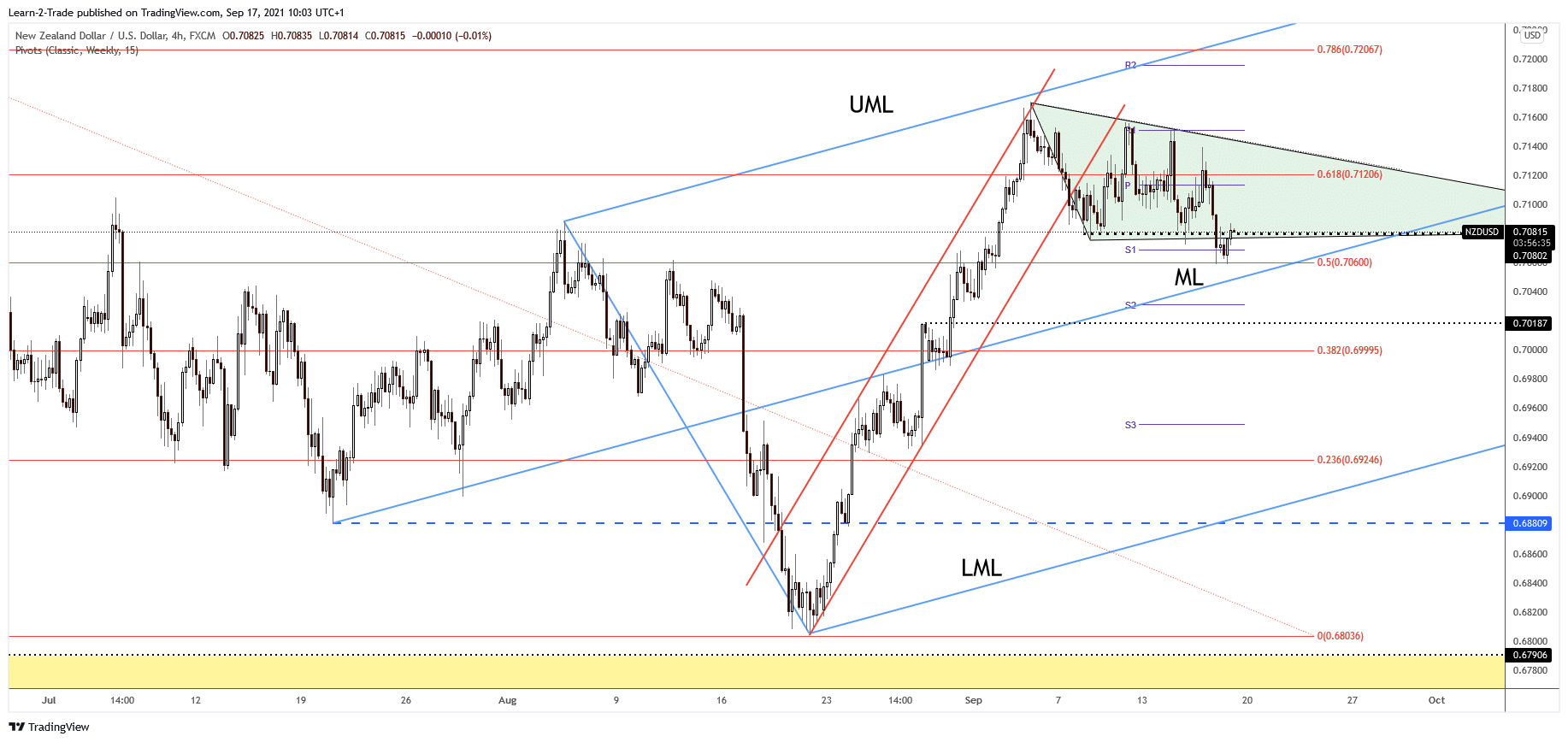

- The NZD/USD pair escaped from a triangle pattern. A valid breakdown below the ML may activate further declines.

- Technically, a strong bullish pattern here above the immediate support levels could signal a bullish momentum.

- The US Prelim UoM Consumer Sentiment could bring sharp moves in the NZD/USD pair later.

The NZD/USD price has recovered a little after the most recent sell-off. It has rebounded amid the Dollar Index correction lower after reaching a dynamic resistance. From the technical point of view, the price is still bullish as long as it stays above strong downside obstacles.

-Are you looking for the best CFD broker? Check our detailed guide-

The USD is still very strong in the short term after the United States retail sales data came better than expected in August. The Retail Sales rose by 0.7% versus 0.7% drop expected, while the Core Retail Sales registered a 1.8% growth compared to 0.1% decline expected. The NZD/USD dropped yesterday even though the New Zealand GDP registered a 2.8% growth versus 1.1% expected compared to 1.4% growth registered in the last reported period. Today, the Business NZ Manufacturing Index was reported at 40.1 below 62.2 in the last reporting period.

The NZD/USD pair hovers above support. The US Prelim UoM Consumer Sentiment could be decided later today. The indicator is expected to rise from 70.3 to 71.9 points which could be good for the USD.

NZD/USD price technical analysis: Bullish view remains intact

The NZD/USD price failed to stabilize above the 61.8% retracement level. Now it has dropped and retested the 50% retracement level. As a result, it has escaped from the triangle pattern, but it’s still located above strong downside obstacles.

-Are you looking for forex robots? Check our detailed guide-

From the technical viewpoint, the price could increase as long as it stays above-ascending pitchfork’s median line (ML). Dropping and stabilizing below it may signal further drop. Personally, I’ll stay away and wait for a fresh opportunity around the 50% level and after the pair reaches the median line (ML). Its current decline, retreat, was somehow expected after failing to reach the ascending pitchfork’s upper median line (UML).

A false breakdown with great a doji candle or a major bullish engulfing could bring new upside movements. On the other hand, DXY’s rise may boost the USD, so a valid breakdown through the median line (ML) may announce a strong drop.

Looking to trade forex now? Invest at eToro!

75% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.