The NZD/USD price has rebounded in the short term. But it seems that the upside is limited as the DXY is still bullish. The pair could drop again if the Dollar Index resumes its growth. It’s trapped within a broad sideways movement range. A valid breakout could bring us a great trading opportunity.

-If you are interested in forex day trading then have a read of our guide to getting started-

It remains to see what will really happen as the DXY has slipped lower after some poor US data. The Unemployment Claims indicator was reported at 360K, above 350K estimate. Unfortunately for the USD, the Industrial Production has increased only by 0.4%, versus 0.6% expected while the Capacity Utilization Rate from 75.1% to 75.4%, coming below 75.7% expected.

NZD/USD price technical analysis: Awaiting breakout or reversal

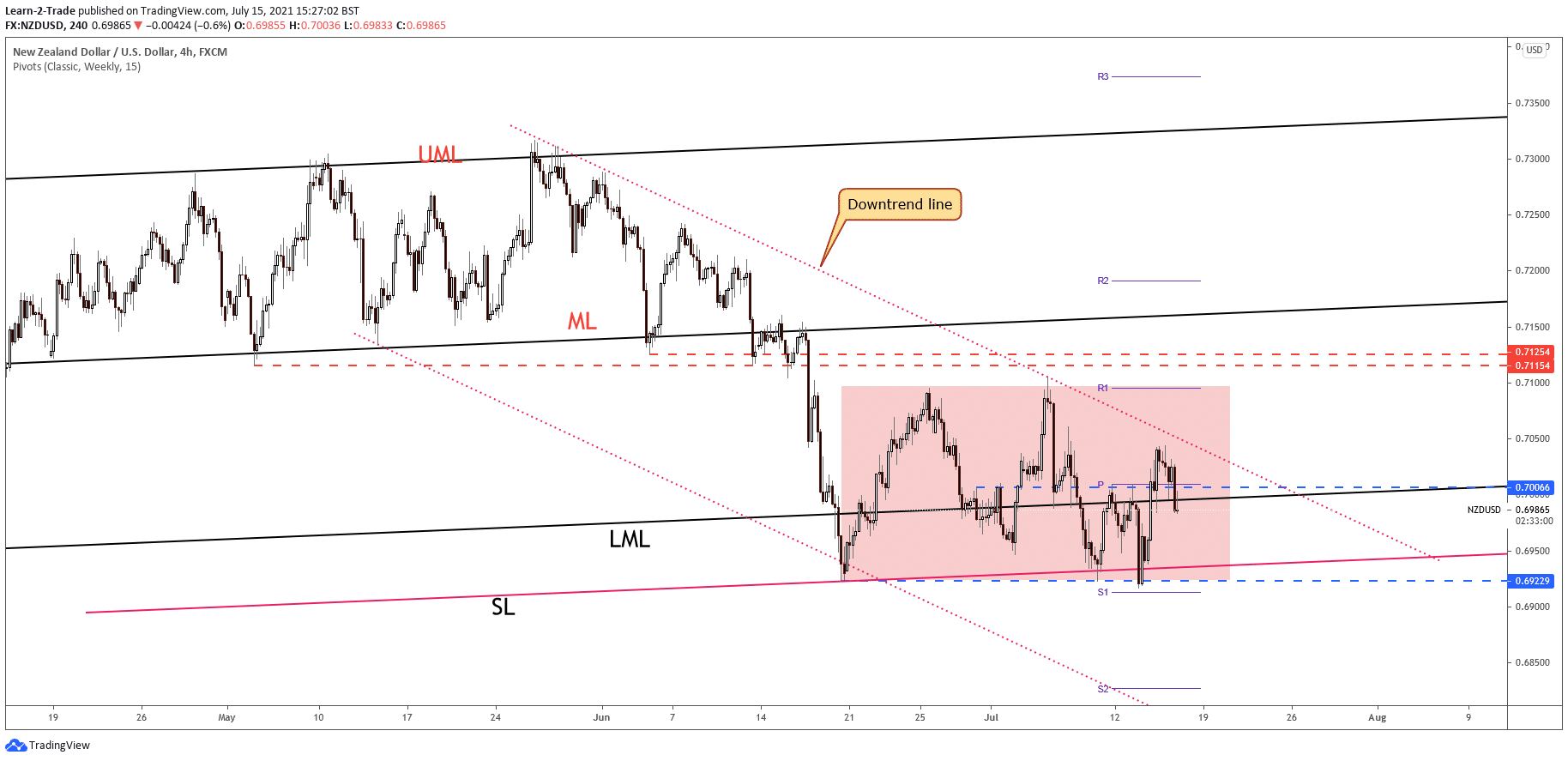

As you can see on the 4-hour chart, the NZD/USD pair dropped without reaching the downtrend line. It continues to move sideways between the weekly R1 (0.7095) and S1 (0.6913). Escaping from this pattern could bring high probability trades. We’ll have to wait for a valid breakout.

-Are you looking for automated trading? Check our detailed guide-

The selling pressure remains high as long as it stays within the down channel’s body. So technically, you should know that an upside breakout through the downtrend line could announce a potential upside reversal.

The NZD/USD price is in a neutral zone right now, so we don’t have a reading opportunity. We’ll have to wait for a fresh one. The price action has shown an oversold situation here on the H4 after failing to stay under 0.6922 static support.

Also, it has failed to stay under the ascending pitchfork’s sliding parallel line indicating that the sellers are exhausted. Thus, a buying opportunity could appear before the price escapes from the extended range.

Personally, I believe that an upside movement is favored. The current drop could be only temporary. Jumping and stabilizing above the downtrend line is seen as a buying signal.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.