The Reserve Bank of New Zealand cut rates and the market reaction was a bounce in NZD/USD. The cut was priced in and markets have become ever hungry for more. The “buy the rumor, sell the fact” response seemed somewhat exaggerated, especially given the fact that the Bank also hinted about further cuts down the road and also expressed worries about the exchange rate.

Well, perhaps we are now seeing a belated reaction to the decision. New Zealand had another major release this week: retail sales. This is an important data point in every country and even more so in New Zealand, where official data is released only once per quarter and not on a monthly basis like in most countries.

And this data was excellent: sales rose 2.3% q/q, far better than 1% expected, more than double. Core sales also surprised to the upside with a leap of 2.6% against 1.1% expected. In addition, this advance came on top of upwards revisions for Q1.

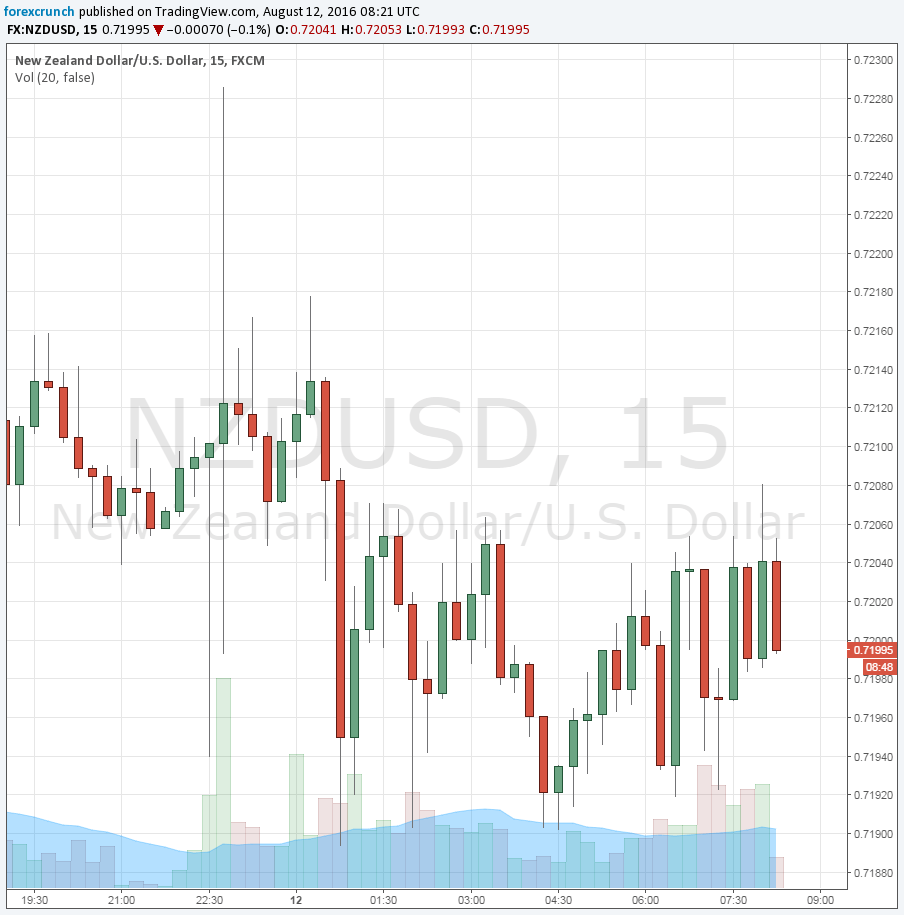

Positive surprise, positive reaction? Only for less than a minute. NZD/USD made a swing up to 0.7228 from 0.7205, hardly a proportionate reaction. And this didn’t last either. The pair fell down and basically returned to hugging the 0.72 level.

When something doesn’t rise on good news, it is a sign of weakness.

So, is the rate cut (and subsequent future ones) sinking in? This is part of the story. Another factor is the renewed strength of the US dollar. The greenback suffered some mood swings this week. Is it the miss in Chinese data? No, that came afterward and it wasn’t a disaster.

So, the poor reaction in NZD/USD is quite telling.

What do you think?