The New Zealand dollar was looking for a new direction. The upcoming week features key data for the RBNZ before its important decision. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

Trade balance remained positive in New Zealand, albeit did not beat expectations with hitting 127 million. In the US, data was initially OK, but the terrible GDP report weighed heavily on the greenback.

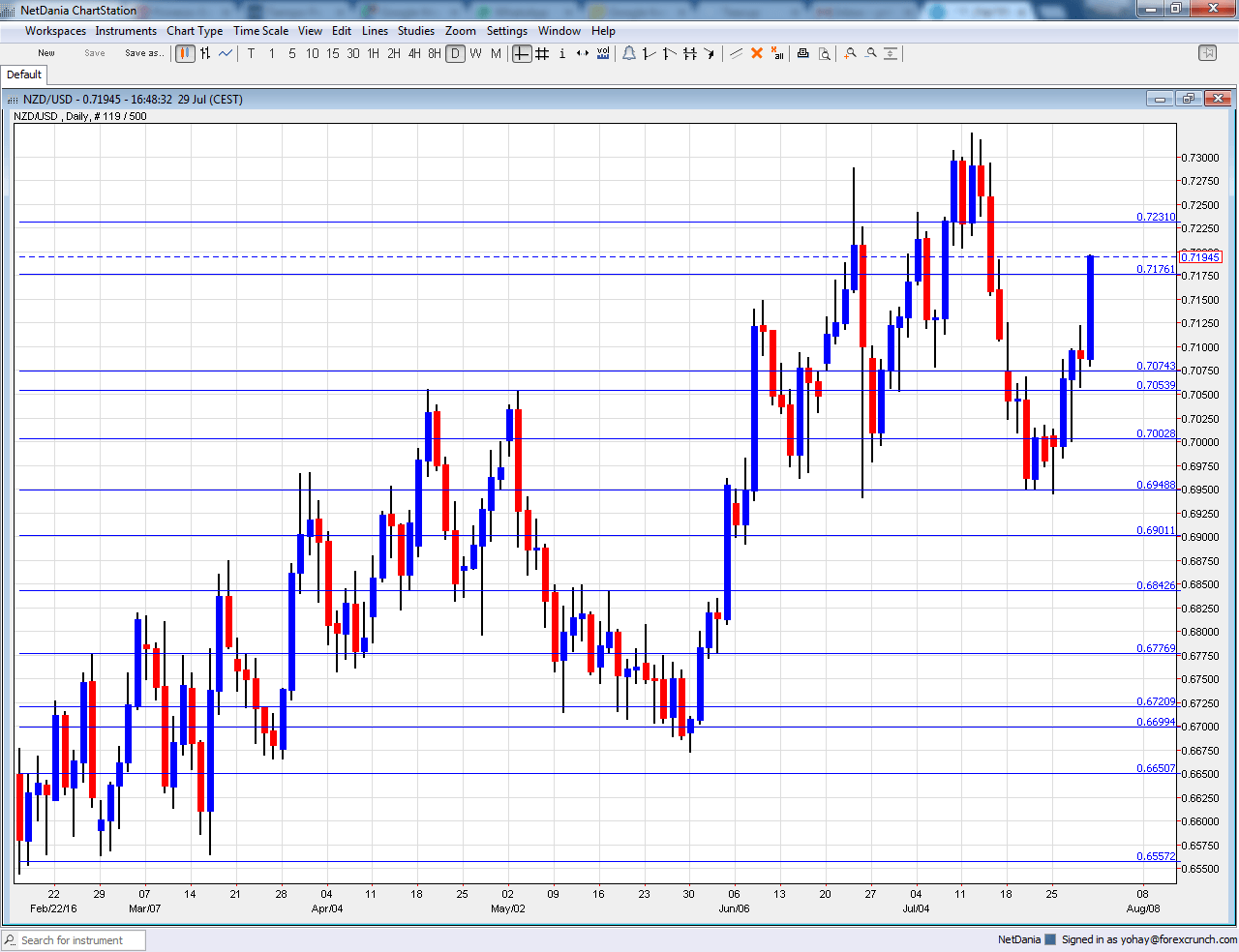

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Inflation Expectations: Tuesday, 3:00. With inflation figures released only once per quarter, this publication provides another view on the state of prices. In the last two quarters, inflation expectations stood on 1.6%, lower than numbers previously seen. The figure could further fall.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade Price Index provides a bi-weekly update on milk prices, New Zealand’s primary export. Prices remained flat last time.

- ANZ Commodity Prices: Wednesday, 1:00. Commodities are important for New Zealand. Prices jumped 3.7%, a leap in comparison to previous data.

NZD/USD Technical Analysis

Kiwi/dollar found support at 0.6940 (mentioned last week). It then went up and up, hitting much higher levels.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7305 is the high of 2016 so far.

0.7290 was the pre-Brexit peak and serves as high resistance. The next line is 0.7240 which capped the pair in July 2016.

0.7160 worked as support when the kiwi was trading on the much higher ground in 2014. 0.7050 was the peak in April 2015.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6840 capped the pair during May 2016 and tops the range. 0.6720 is the low seen in May 2016 more than once providing the lower bound.

The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

I am bearish on NZD/USD

It seems that the RBNZ is determined to cut rates and the Fed is still on course for further rate hikes.

Our latest podcast is titled A grounded chopper, slow-mo growth, and an unreliable BOE boyfriend?