The New Zealand dollar had an interesting week, rising on USD weakness. The upcoming week is already packed with events. The milk auction stands out. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The US dollar resumed its rise following the NFP, but the kiwi held its ground. The greenback then tumbled down on the Donald Disappointment. The President-Elect failed to mention fiscal stimulus in his press conference while he did talk down pharma companies and demanded that companies stay in the US.

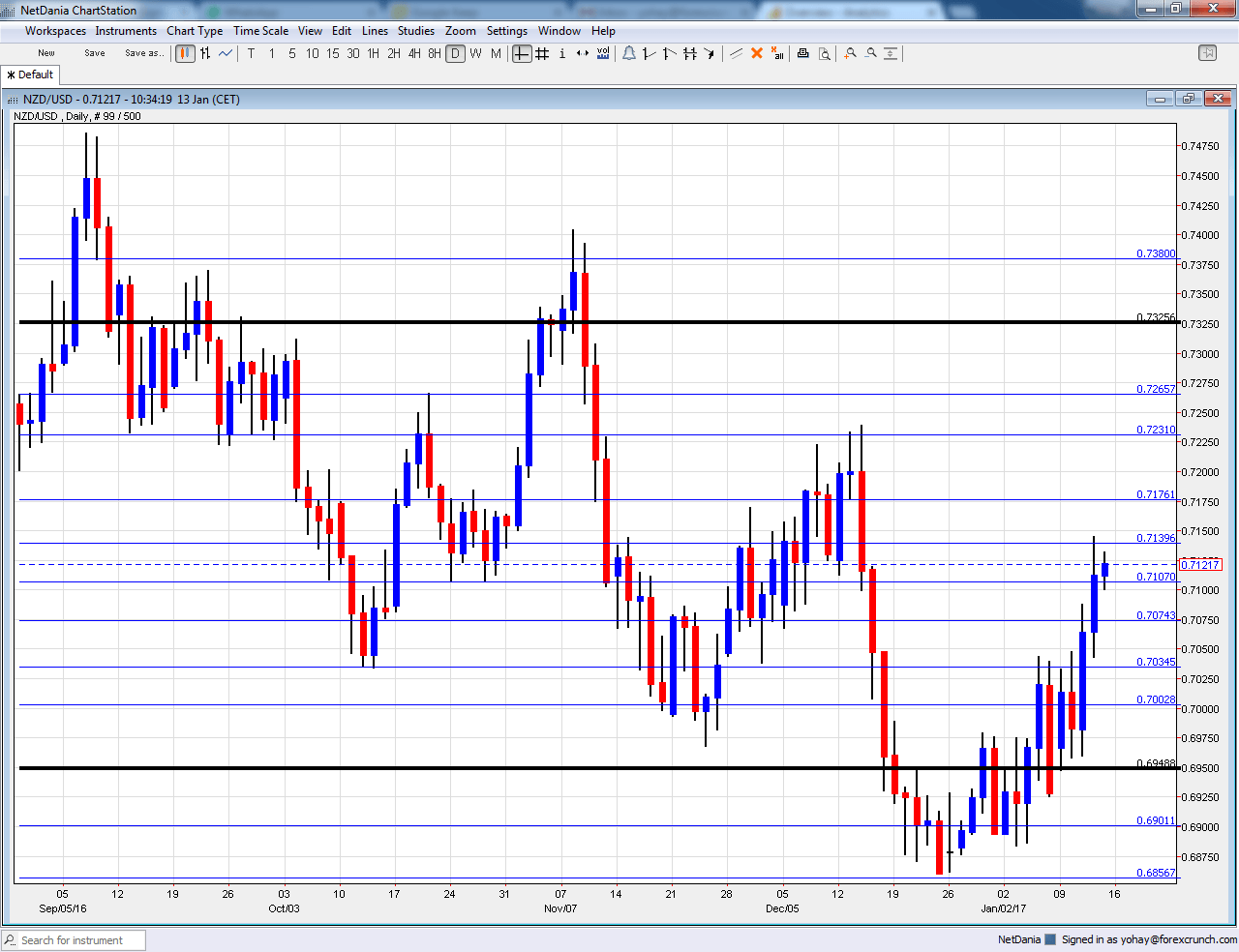

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- FPI: Sunday, 21:45. The Food Price Index has an impact on the kiwi, as the nation exports food, especially dairy products. The FPI dropped in the past three releases, last time by 0.1%.

- NZIER Business Confidence: Monday, 21:00. The survey of around 2500 businesses has been on the up and up in the past two reads, hitting a high of 26 points in Q3. We now get the measure for Q4, which is also likely to be a positive number, reflecting optimism.

- GDT Price Index: Tuesday, during the European afternoon. The Global Dairy Trade has the biggest impact on the kiwi among all commodity-related measures. After a series of big jumps, the indicator slipped in the last two auctions, dipping 3.9% last time.

- Business NZ Manufacturing Index: Wednesday, 21:30. The PMI-like survey has been relatively stable, well within growth territory, above 50 points. However, it did edge lower in the past two months, standing at 54.4 in December. We now get the first measure for 2017.

- Building Consents: Wednesday, 21:45. This index of the housing sector tends to be volatile. Nevertheless, it provides an insight of this bustling part of the economy. Back in November, building approvals rose by 2.6%, after three months of declines.

NZD/USD Technical Analysis

Kiwi/dollar found it hard to recapture the 0.70 level (mentioned last week) but when it succeeded, it surged to resistance at 0.7140.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterward as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am bearish on NZD/USD

The US dollar is likely to rise ahead of Trump’s inauguration, and even the solid kiwi will probably succumb to the pressure.

Our latest podcast is titled Trump Train or Donald Derailed?

Follow us on Sticher or iTunes

Safe trading!