The New Zealand dollar surrendered to the comeback of the US dollar despite enjoying some positive data. Two events are listed for the upcoming week. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

The kiwi dollar enjoyed a very positive trade balance surplus at 339 million, including a nice rise in exports. Nevertheless, the hawkish tone heard from the Fed was overwhelming for NZD.

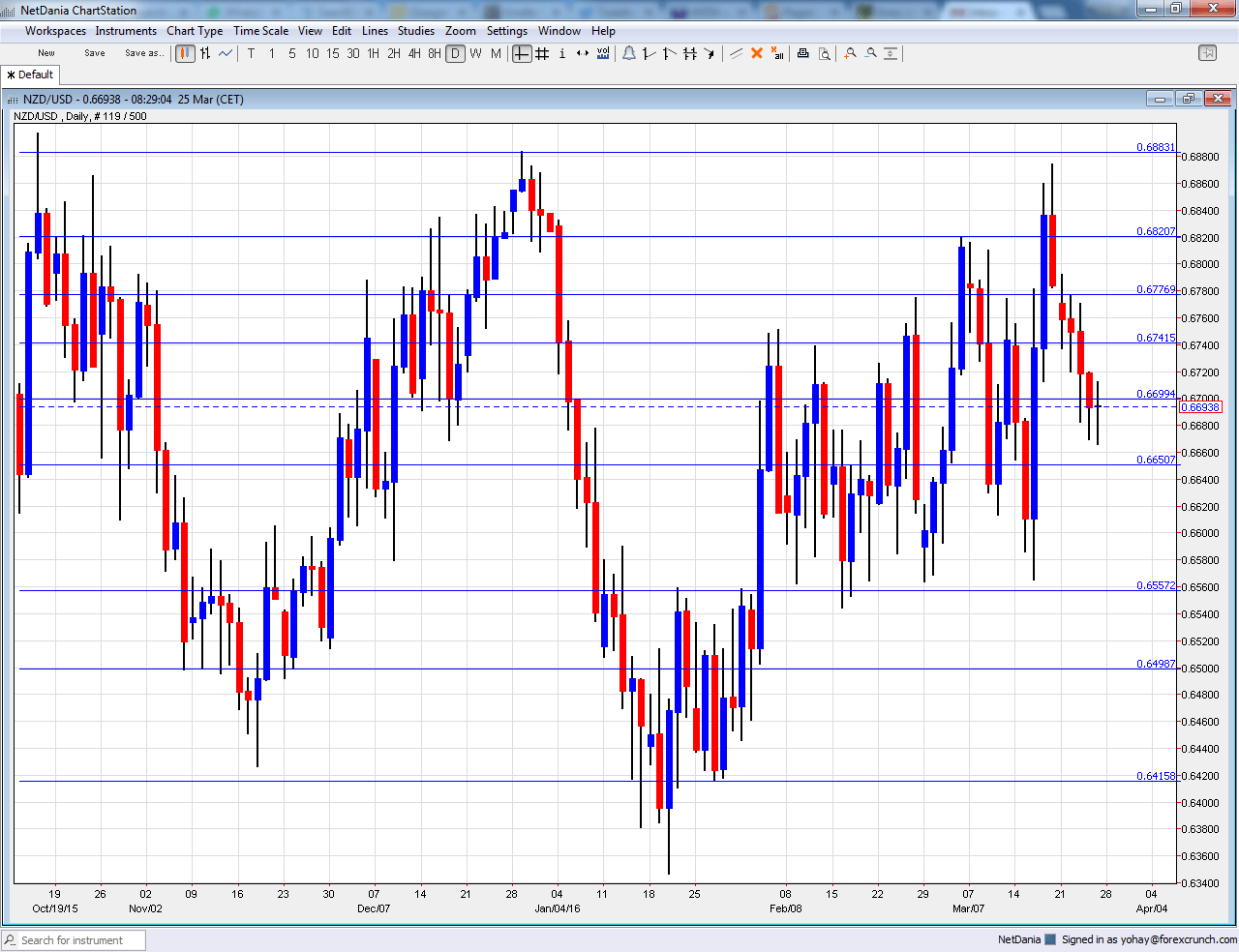

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Consents: Tuesday, 21:45. This indicator is somewhat volatile, but still provides a view on the housing sector. Permits fell by 8.2%. This sharp fall might be followed by a bounce now.

- ANZ Business Confidence: Thursday, 00:00. This survey of 1500 businesses fell quite badly to 7.1 points in February. We could see slightly higher levels now.

NZD/USD Technical Analysis

Kiwi/dollar had a gradual fall from the highs, struggling with the 0.67 level mentioned last week..

Technical lines, from top to bottom:

The round level of 0.70 is already in sight. The low of 0.6940 allowed for a temporary bounce.

The round 0.69 level has switched positions to resistance. 0.6860 was a low point as the pair dropped in June 2015. 0.6820 is worth noting after it capped the pair in March 2016.

It is followed by 0.6780 that capped the pair in recent months. The round level of 0.67 that works nicely as support. Another line worth noting is 0.6640, which capped the pair in November.

The post crisis low of 0.6560 is still of importance. Below, the round 0.65 level is of high importance now, serving as support.

Below, we find 0.6415, which cushioned the pair in January, as support. 0.6350 provided support in January 2016.

I am bearish on NZD/USD

The US dollar seems to be in control and at the moment, there is saving for the kiwi. Things could change later on, but not now.

In our latest podcast we crunch some commodities