The New Zealand dollar held up on high ground and eventually broke to levels last seen in 2011. Can it continue the positive trend? The upcoming week already features more events with business confidence standing out. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

A combination of a bigger than expected trade surplus and a hawkish comment from an RBNZ member were the one-two punch the kiwi sent on its way up, challenging the 0.87 line. Some positive data from the US was far from enough to stop the New Zealand dollar.

[do action=”autoupdate” tag=”NZDUSDUpdate”/]

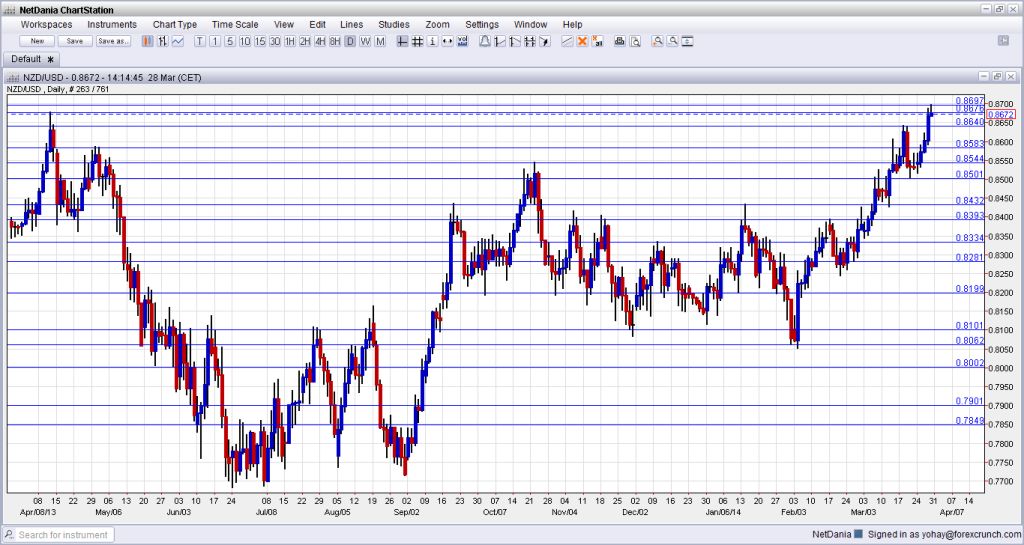

NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Building Consents: Sunday, 21:45. This volatile monthly indicator turned negative in January with a plunge of 8.3% after a rise of 7.1% beforehand. The see-saw is likely to continue with a strong leap this time.

- ANZ Business Confidence: Monday, 00:00. The 1500 business survey reached a level of 70.8 points back in February, reflecting the strongest level of optimism since the 1990s. The level of confidence is expected to remain high, but maintaining these extremely high level might be a difficult task. Any score above 0 reflects optimism.

- ANZ Commodity Prices: Wednesday, 00:00. New Zealand’s food exports enjoyed three consecutive rises in commodity prices, with a 0.9% advance recorded in February. A smaller rise is likely now.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar began the week in the lower 0.85 to 0.8544 range (mentioned last week) before climbing to the higher levels below 0.8586. The aforementioned boost sent it beyond the 0.8676 line, and high ground was nicely maintained, with the pair even edging even higher.

Technical lines, from top to bottom:

The multi year high of 0.8832 is not that far away. Below this level, we can mark the round number of 0.88 as minor resistance. Another minor line is the round 0.87 level.

The 2013 peak of 0.8676 is a strong line in the distance. The 2014 peak of 0.8640 is close by, and it is key to any upside moves.

It is followed by the stubborn May 2013 high of 0.8586 is another important line. The October peak of 0.8544 is an important resistance line.

0.85 is around number and could trigger comments by policymakers. A move above this line didn’t hold in early March 2014. 0.8435 was the peak in September and was retested in January. It is a strong double top.

0.8392 served as resistance was a recurring peak between November and February. 0.8335 capped a move higher in December and also had a role in the past. The pair fell short of this line in January 2014.

Below, 0.8280 supported the pair in February 2014 and also in the past. 0.82, worked as support several times: in September, October and also in December. It is somewhat weaker now.

I remain bullish on NZD/USD

While the US is getting closer to its own real tightening, New Zealand is already there after the rate hike and especially the hawkish tone surrounding it. Another upbeat business confidence figure from ANZ could not only keep the kiwi ahead of its commodity currency peers, but may also help it stay above the greenback also in case of a positive NFP.

The kiwi is among the 5 most predictable currency pairs

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.