After a very long preparation, which also included assistance from the government, the Reserve Bank of New Zealand raised the interest rate from 2.50% to 2.75%. This was no surprise, and some market analysts suspected that NZD/USD would fall in a “buy the rumor, sell the fact” reaction.

However, as the RBNZ hinted more rate hikes than expected, the kiwi rallied to levels last seen nearly one year ago. Is this just the beginning of a bigger rally?

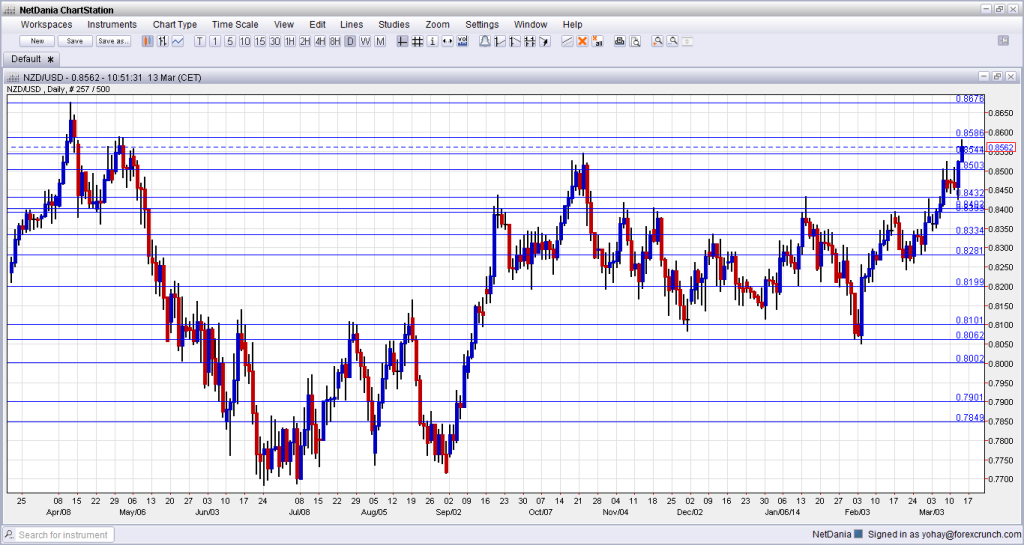

Here is the rally in the daily chart, which shows the extent of the move:

First, the statement included a clear intent of making more rate hikes by saying that it is “commencing” the adjustment. The speed and the extent will depend on incoming data, but more hikes are imminent.

In addition, the RBNZ released a forecast reaching up to 2017, and hinted about a peak rate of 5%, higher than 4.50% expected. The road is still long if we assume hikes of 0.25% each time, but it could come faster.

Coming back to 2014, analysts in New Zealand upgraded their forecasts for hikes during the current year. An interest rate of 3.75% by year end would come as no surprise now, but the shift in expectations certainly surprised markets.

Here are key quotes from the announcement:

New Zealand’s economic expansion has considerable momentum, and growth is becoming more broad-based. GDP is estimated to have grown by 3.3 percent in the year to March.

…

While headline inflation has been moderate, inflationary pressures are increasing and are expected to continue doing so over the next two years. In this environment it is important that inflation expectations remain contained. To achieve this it is necessary to raise interest rates towards a level at which they are no longer adding to demand. The Bank is commencing this adjustment today. The speed and extent to which the OCR will be raised will depend on economic data and our continuing assessment of emerging inflationary pressures

NZD/USD

The kiwi made a decisive move above 0.85, which was a battle line recently, but didn’t stop there. After settling around 0.8520, it extended the move in the Tokyo session up to the vicinity of 0.8560. When European traders joined, a new peak of 0.8578 was hit.

NZD/USD is now above the October 2013 high of 0.8544 and practically met resistance at the minor line of 0.8586, which capped the pair in April 2013. The 2013 peak of 0.8676 is already stronger resistance.

A consolidation of the move could send the pair to support at 0.8544, followed by the round 0.85 level. For more lines, events and analysis, see the NZDUSD forecast.