The New Zealand dollar enjoyed a positive week, rising to new multi-year highs. The quarterly publication of retail sales stands out among other events that are set to shake the kiwi. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

NZD/USD enjoyed the general weakness of the greenback and shot higher to new multi-year highs, not waiting for the domestic employment data. Markets certainly sold off the greenback. However, this reversed on the explicit threat of intervention from RBNZ governor Wheeler, as well as the mixed jobs data. Unemployment in New Zealand remains at 6%, and wage inflation seems soft.

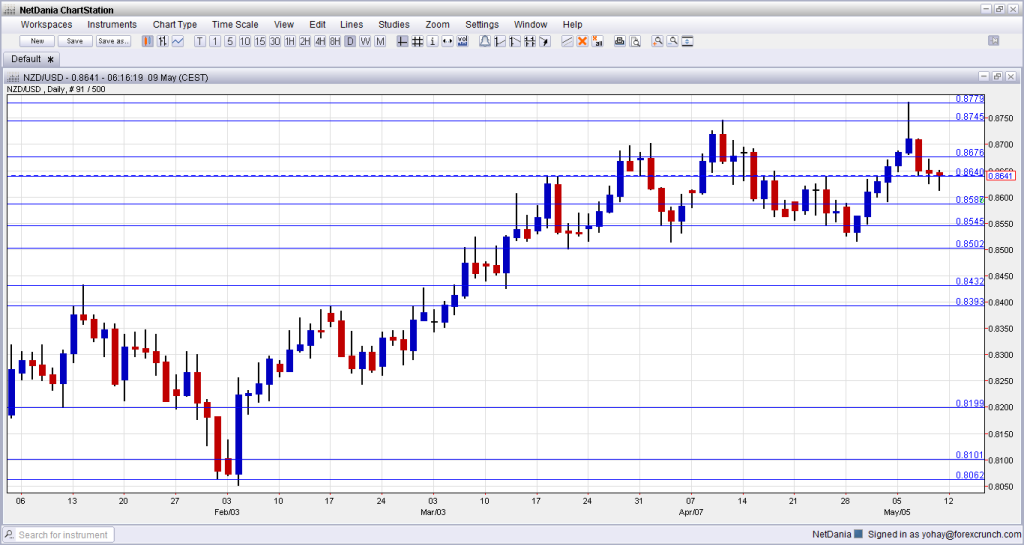

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily chart with support and resistance lines on it. Click to enlarge:

- FPI: Monday, 22:45. The announcement of changes in food prices affects the kiwi as New Zealand is an exporter of food, especially dairy products. After a drop of 0.3% in March, a small rise is likely for April.

- RBNZ Financial Stability Report: Tuesday, 21:00. This report by the RBNZ is published only twice per year, making it important. We get to see a long term outlook of the economy, inflation and even interest rates from Graeme Wheeler and his companions. Volatility usually accompanies the publication.

- Retail Sales: Tuesday, 22:45. As with other economic figures, New Zealand stands out by publishing the data only once per quarter. In Q4 2013, expectations were high and the eventual outcome disappointed: a rise of only 1.2%. A similar or slightly stronger rise in the volume of sales is expected. Core sales, which rose by 0.7% in Q4, are expected to rise at a stronger pace this time.

- Business NZ Manufacturing Index: Wednesday, 22:30. This business survey by Business New Zealand showed stronger growth in March, with the indicator standing at 58.4 points, reflecting strong growth. Any number above 50 represents growth. A small dip is expected for April.

- Annual Budget Release: Friday, 2:00. The New Zealand treasury gets its time in the sun, going to parliament and presenting the annual budget. While this isn’t usually the final version, the budget includes updated economic forecasts for the economy that have an impact on the currency.

* All times are GMT.

NZD/USD Technical Analysis

Kiwi/dollar began the week in the high range it ended the previous week and then made a clear break above the 0.8745 line mentioned last week. The new peak seen at 0.8780 eventually served as a swing high.

Technical lines, from top to bottom:

The multi year high of 0.8842 is not that far away. Below this level, the recent 2014 high of 0.8780 serves as minor resistance at the moment.

The previous 2014 peak of 0.8745 joins the chart and will be watched on any upside move. The 2013 peak of 0.8676 now switches to a pivotal line in the range.

The older swing high of 0.8640 is close by and is still of significance. It is followed by the stubborn May 2013 high of 0.8586 is another important line.

The new low of 0.8550 is the next stepping stone on the way down and now serves as important support. 0.85 is around number and could trigger comments by policymakers. A move above this line didn’t hold in early March 2014.

0.8435 was the peak in September and was retested in January. It was a strong double top. 0.8392 served as resistance was a recurring peak between November and February.

0.8335 capped a move higher in December and also had a role in the past. The pair fell short of this line in January 2014. Below, 0.8280 supported the pair in February 2014 and also in the past. 0.82, worked as support several times: in September, October and also in December. It is somewhat weaker now.

I am neutral on NZD/USD

The kiwi made an attempt to rise even higher and was rejected. While flows into the country and the general economic situation support a stronger currency, the will of the RBNZ to see a weaker currency and a stabilization in the US dollar could keep the pair more balanced for the time being.

Further reading:

- For a broad view of all the week’s major events worldwide, read the USD outlook.

- For EUR/USD, check out the Euro to Dollar forecast.

- For the Japanese yen, read the USD/JPY forecast.

- For GBP/USD (cable), look into the British Pound forecast.

- For the Australian dollar (Aussie), check out the AUD to USD forecast.

- For USD/CAD (loonie), check out the Canadian dollar forecast.