The New Zealand dollar had an excellent week, riding higher alongside jobs. Apart from the US elections, the RBNZ rate decision stands out, with a potential for a rate cut. Here is an analysis of fundamentals and an updated technical analysis for NZD/USD.

New Zealand reported a jump of 1.4% in employment in Q3, with a drop of the unemployment rate to 4.9%. Together with a leap in milk prices worth 11.4%, and worries about the US elections, the kiwi surged. Stable inflation expectations and a positive change of mood towards the elections cooled it down just a bit.

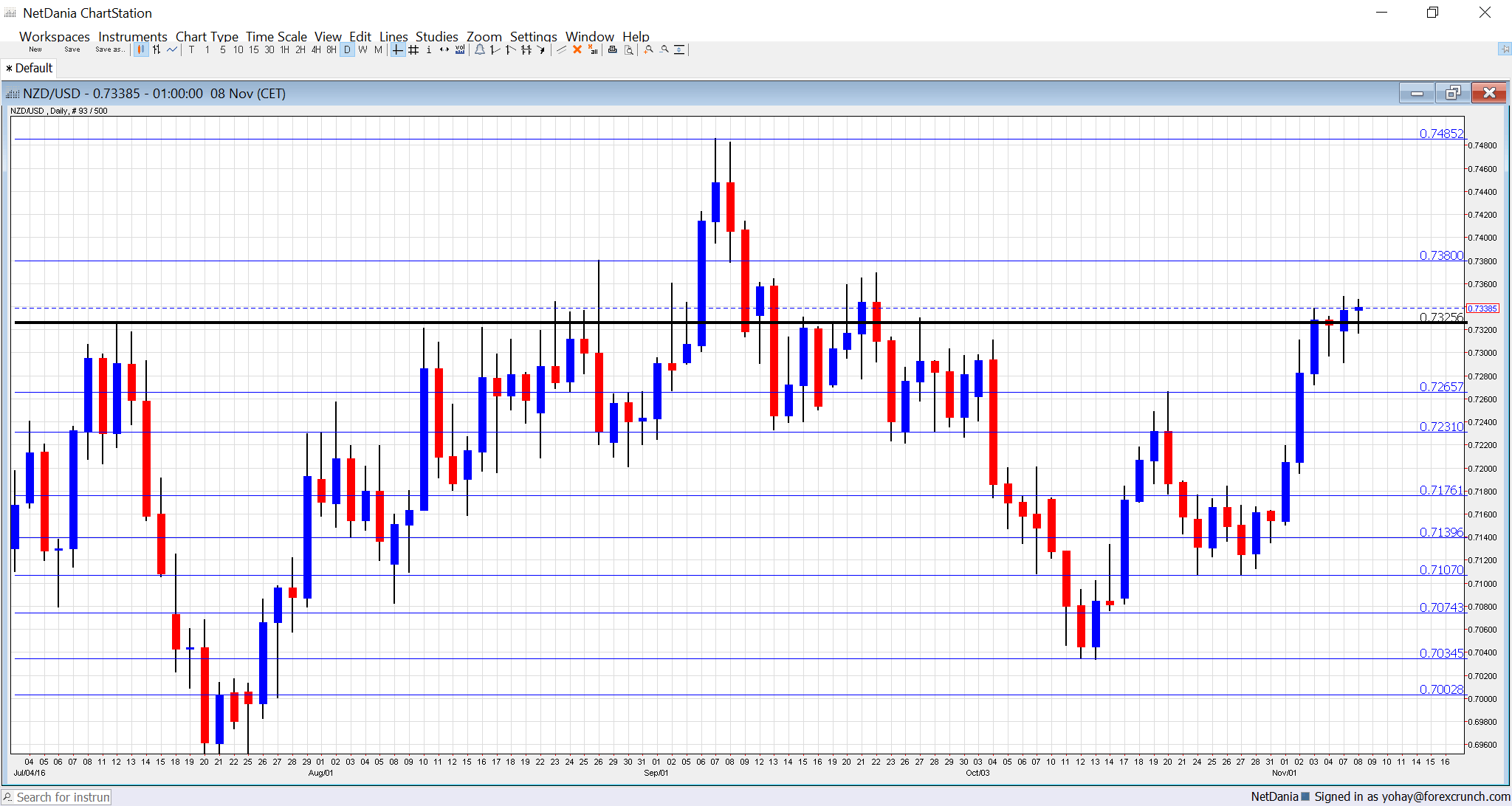

[do action=”autoupdate” tag=”NZDUSDUpdate”/]NZD/USD daily graph with support and resistance lines on it. Click to enlarge:

- Rate decision: Wednesday, 20:00, with the press conference at 21:00. The Reserve Bank of New Zealand is in the middle of rate cutting cycle, but is moving cautiously. The last move in August with a pause in September. Lower inflation and a desire to weaken the currency fueled the cuts. Also now, consensus stands on a cut from 2% to 1.75%, but nothing is certain. The excellent jobs report could give Governor Graeme Wheeler and his colleagues a reason to pause. However, if Clinton wins and a risk-on atmosphere pushes the kiwi higher, maybe that could have a last minute influence. All in all, a non-cut would push the kiwi higher, would be a surprise and we certainly cannot rule it out.

- Business NZ Manufacturing Index: Thursday, 21:30. This PMI-like survey has been upbeat for a long time, reaching 57.7 points last time. A similar score is likely now.

- FPI: Thursday, 21:45. The Food Price Index has been playing second fiddle to the GDT Price Index, but till matters. After a slide of 0.9%, a small rise is expected.

NZD/USD Technical Analysis

Kiwi/dollar was on the move, eventually moving above the 0.7330 level mentioned last week.

Technical lines, from top to bottom:

The round number of 0.74 served as resistance and support back in 2015. 0.7330 was an initial high in 2016.

0.7265 was a swing high in October 2016 and works as resistance. 0.7230 served as support in September 2016.

0.7160 is a pivotal line within the range. 0.7140 worked in both directions in the past months.

0.71, a round number, was a double bottom in October. 0.7075 was a swing low in August and had a role afterwards as well. It is followed by 0.7035, the low seen in October 2016.

The round level of 0.70 is still important because of its roundness but it isn’t really strong. The low of 0.6940 allowed for a temporary bounce.

I am bullish on NZD/USD

The RBNZ could pause after the superb jobs report. In addition, a Clinton win could also create demand for risk assets, and the kiwi is a prime example.

More:

- How to trade the US elections with currencies

- US elections: updates on 21 brokers

- US elections and forex – all the updates in one place

And the video:

Our latest podcast is titled Bold in oil and talking up the currency

Follow us on Sticher or iTunes

Safe trading!