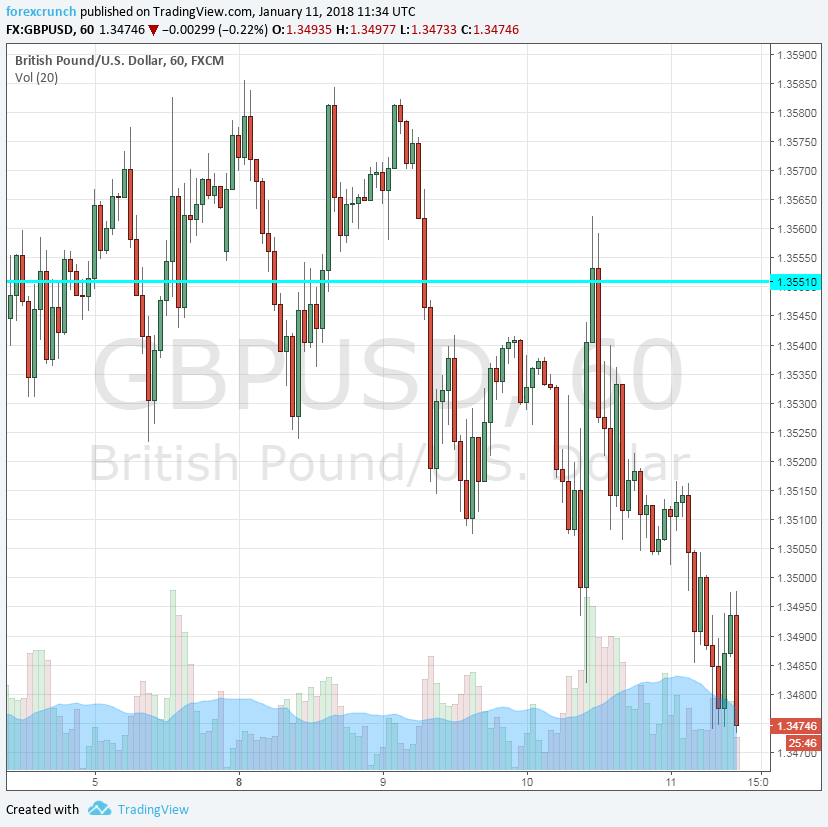

The British pound slipped under 1.35 once again. The previous fall was related to mediocre data such as the trade balance, and this drop is also related to worrying signs for the British economy.

In between, GBP/USD made a rapid move above 1.35 thanks to the weakness of the dollar. Reports coming out of China said that the world’s second-largest economy would slow or halt buying US bonds. Since then, authorities in Beijing cooled down the reports, allowing the dollar to recover.

However, if we look out at pound crosses, we can observe a rise in EUR/GBP and a fall in GBP/JPY, indicating that the problem is the pound.

So, what are the worrying figures?:

- Lenders expecting a squeeze: According to the credit conditions survey by the Bank of England, lenders are expecting a significant squeeze on unsecured debt to households in 2018. Another research by the BOE shows that borrowers tend to remain indebted for a longer period of time than regulators had previously anticipated.

- Tesco and Mark&Spencer, two huge retailers in the UK, reported underwhelming sales in the holiday season. This is a result of consumers. For Tesco, a supermarket chain, the rise was lower than expected. For Marks&Spencer, that mostly does not focus on essentials such as food, sales dropped.

- Financial job vacancies fall: A survey by Morgan McKinley, a recruiting firm, reported a 30% y/y drop in the number of people looking for a financial sector position in December. The m/m drop is 37%. Brexit is biting also in the high-earning sectors.

All in all, Brexit is causing prices to rise and high-paying jobs to move away. Will the pound continue falling?

GBP/USD currently trades at 1.3470. Support is close at 1.3460, followed only by 1.3340. Resistance is at 1.3560 and then 1.3615.