EUR/USD made an upwards move on the heels of the Fed decision but eventually returned down to the drawing board.

What’s next? The team at Goldman Sachs sees a downturn worth 600-1000 pips:

Here is their view, courtesy of eFXnews:

In a note to clients today, Goldman Sachs discusses the outlook for EUR/USD, where GS economists now expect a continuation of QE into mid-2017, well beyond the original end date of September next year. The following are the key points in GS’ note along with its latest EUR/USD forecasts.

“1- Our European economics team expects QE to run through end-2016 at its present run-rate of EUR 60bn per month, with purchases ending mid-2017 after tapering in the first half of the year. This represents a material up-sizing of the original program and should weigh on the single currency.

2- Last year, in the run-up to ECB QE, we spent lots of time mapping ECB balance sheet expansion into EUR/$. The various approaches we tried converged on EUR 1 tn mapping roughly into 10 big figures in EUR/$ downside,” GS argues.

Against that backdrop, how does GS see the outlook from here?

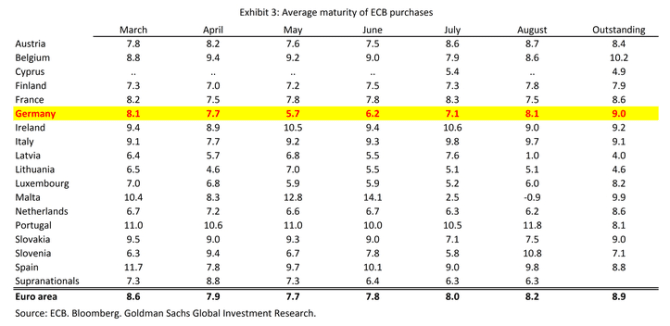

3- “Our models say that 4 big figures in the recent rise in EUR/$ are due to mounting risk aversion on China fears. A program extension of the size envisaged by our economists could mean another 4 big figures, but we see this as a lower bound. That is because there is scope to better anchor Bund yields, after the Bundesbank reduced the maturity of its purchases earlier this year (Exhibit 3).

4- In our view, a core aspect of any QE program needs to be to crowd investors out of the safe haven asset, which means keeping Bund yields low and stable (much as the BoJ did after the initial bout of volatility in May/June of 2013). We think this provides some additional downside for the Euro, since our balance sheet analysis does not factor in duration,” GS adds.

5- “Depending on how credible an upsizing to ECB QE is, we therefore see scope for EUR/$ to fall between 6 and 10 big figures, including positive effects on risk appetite,” GS projects.

GS maintains its 12-month forecast for EUR/$ to 0.95.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.