Real results are beginning to flow in from Scotland and the No campaign can begin releasing a cautious smile: 2 areas that were expected to show a Yes victory went for No.

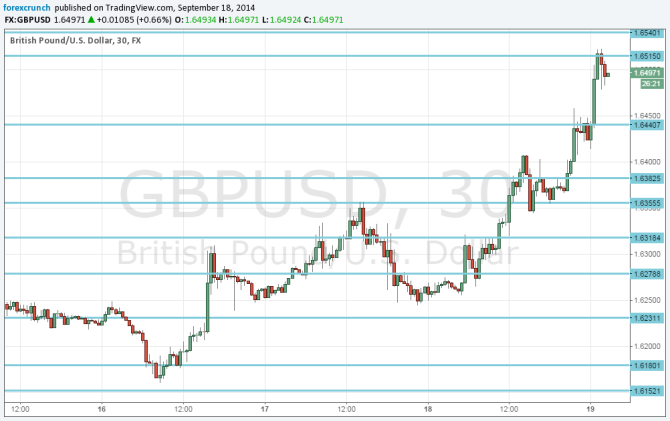

While these are very small regions, the markets are already reacting. GBP/USD has moved up to a higher range, breaking above 1.6440 and later above 1.65 before retreating.

It is currently in a higher range and there is room to doubt if there is much more on the upside

Big update: Networks call the elections: No to Scottish Independence

And that’s it: Scotland officially rejects independence – it’s all over

Update: No campaign on track for victory – is GBP/USD a “sell the fact”?

4 out of 32 areas have been declared.

- Orkney went to No as expected.

- Shetland went to No as expected.

- The Western Islands aslo went to no by 53.42% against 46.58%, and this was surprising.

- Clackmannanshire was the first region to declare and it also surprised with a win for the No campaign. This was taken nearly 54% to 46%.

Update: a 5th area has reported: Inverclyde, and the result is a very marginal victory for No: 50.1% against 49.9%.

In general, turnout has been very high, but in Dundee, which was expected to be a Yes stronghold, the turnout was not huge. This is Scotland’s fourth largest city.

Earlier, a YouGov after-the-vote opinion poll showed a 54% / 46% for the No campaign. This sent GBP/USD to the higher range.

Yet again, it’s important to note that the number of votes officially counted is small so far, and that it is hard for polling companies to get this correctly due to the special nature of the historic vote and the special rules applied.

So, here are the levels to watch for GBP/USD and here is the chart: