The British pound suffered from Carney’s comprehensive plan based on soft data. It now faces hard data. Will it continue to the downside? The yen faces a different fate. Here is the view from Morgan Stanley:

Here is their view, courtesy of eFXnews:

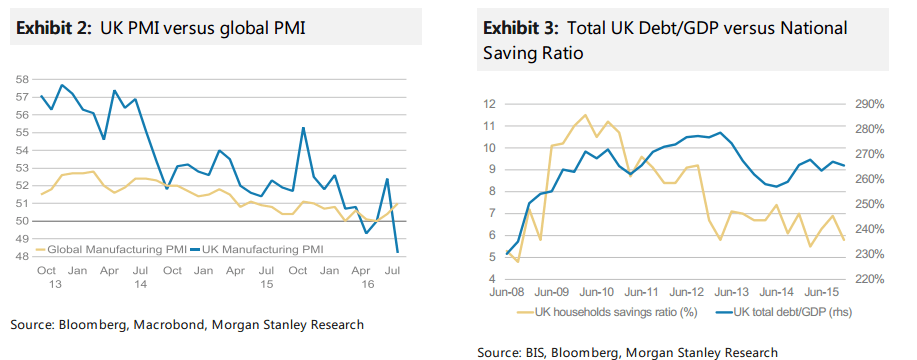

Textbook-like GBP weakness. The easing measures announced by the BoE last week read like textbook tools to weaken sterling. Cutting interest rates by 25bps, indicating future cuts are likely and increasing the BoE’s balance sheet by another GBP70trn via debt purchases (including GBP10trn corporate bonds) should drive GBP down. Unlike the BoJ or ECB, which have lost control over their real rates and yields, the BoE still has the capability to set real rates and yields near levels it regards as appropriate. The GBP yield curve offers room to manoeuvre as its rates are not at zero yet.

ools to weaken sterling. Cutting interest rates by 25bps, indicating future cuts are likely and increasing the BoE’s balance sheet by another GBP70trn via debt purchases (including GBP10trn corporate bonds) should drive GBP down. Unlike the BoJ or ECB, which have lost control over their real rates and yields, the BoE still has the capability to set real rates and yields near levels it regards as appropriate. The GBP yield curve offers room to manoeuvre as its rates are not at zero yet.

GBP depreciation best route to go. For July, the Pension Protection Fund reported a GBP408bn deficit for corporates included in the FTSE 350.Within two months, the pension fund deficit increased by GBP 314.8bn to GBP408bn, mainly driven by falling yields. In the absence of a quick rebound of gilt yields, the sharp rise of the deficit suggests the corporate sector would have to increase contributions or reduce its pension obligations.

Hence, a weak GBP does not only offer supply-side support but may also help boost UK inflation expectations, allowing nominal yields to increase while simultaneously allowing real yields to stay low. Front-loaded GBP weakness may help the UK minimize still substantial Brexit costs. We reiterate our GBPUSD 1.24 and EURGBP 0.94 target.*

=====

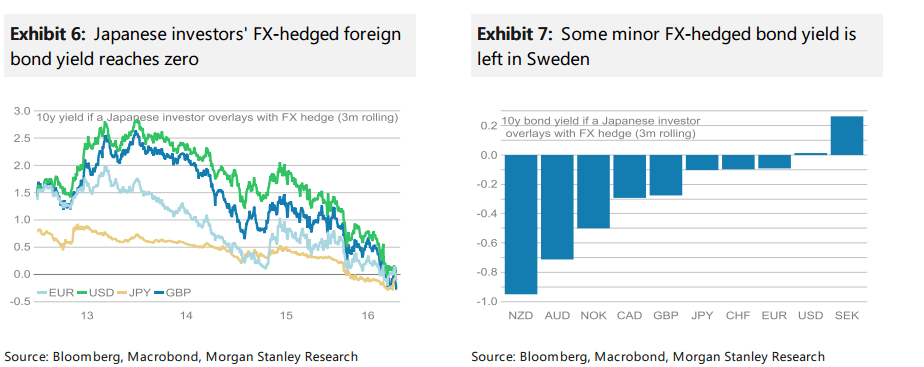

..JPY bid has remained in place. Exhibit 6 shows 10-year bond returns held by a Japanese investor on an FX hedged basis in EUR, USD and GBP compared with the 10-year JGB yield. On a currency-hedged basis, there is nothing to gain anymore. When ‘Abenomics’ was introduced in 2013, Japan’s financial institutions did not only increase their foreign asset holdings but also decreased their hedging ratios.

On hindsight, it looks ambitious to decrease currency hedging when the hedged return of foreign bond holdings exceeded the equivalent JGB yield by up to 200bps. It was this aggressive risk-taking approach that got pension funds into trouble when the JPY started to rally in December 2015. Pension funds reported record losses and since their main target is capital preservation, recent FX volatility hitting its balance sheets may have reduced future capacity for risk-taking. Should this observation prove correct, Japan’s pension funds may not take more risk on their balance sheets. Accordingly, we remain USDJPY bearish.

*In its strategic portfolio, Morgan Stanley maintains a short GBP/USD and a long EUR/GBP positions.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.