The second purchasing managers’ index for the UK comes out slightly better than markets had anticipated: 52.5 against 52.2 predicted. Yesterday’s manufacturing PMI disappointed but still stands at higher ground. The most important release awaits us tomorrow: the services PMI.

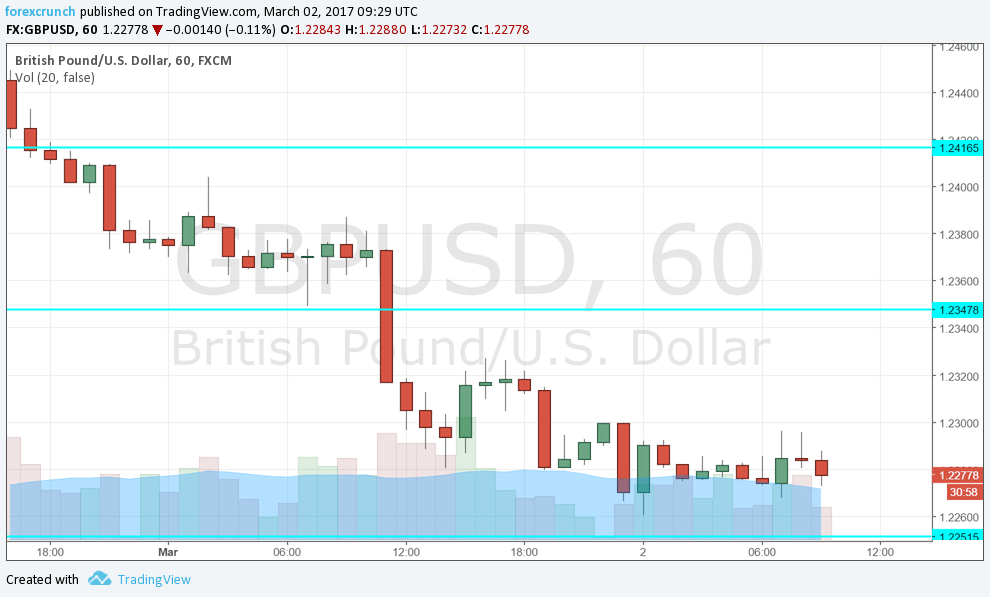

GBP/USD remains on the back foot trading at 1.2275. Support awaits at 1.2250 and 1.2120. Resistance is at 1.2350.

Markit’s construction PMI for the UK was expected to remain unchanged at 52.2 in February. The level represents relatively slow growth.

GBP/USD was trading lower ahead of the publication, around 1.2275. The strength of the greenback thanks to Fed hawkishness and worries about a messier Brexit weigh on cable.

The unelected House of Lords made amendments to the Brexit Bill that the House of Commons passed. The changes relate to the rights of EU nationals living in the UK. A political ping-pong could follow and cause more uncertainty. The government led by Theresa May wants to trigger Article 50 by the end of March. This is still feasible though.

Here is how the recent moves look on the 30-minute GBP/USD chart: