UK inflation slips back down: prices rise only 0.3% y/y and 0.1% m/m in the month of April. Core inflation is up only 1.2% against 1.4% expected.

While the change in the Easter holiday can be blamed as well as air fares, this isn’t good news for the BOE. GBP/USD loses some of its upside momentum and dips under 1.45.

Will this significant miss have a significant impact or will we return to the Brexit based movements in no-time?

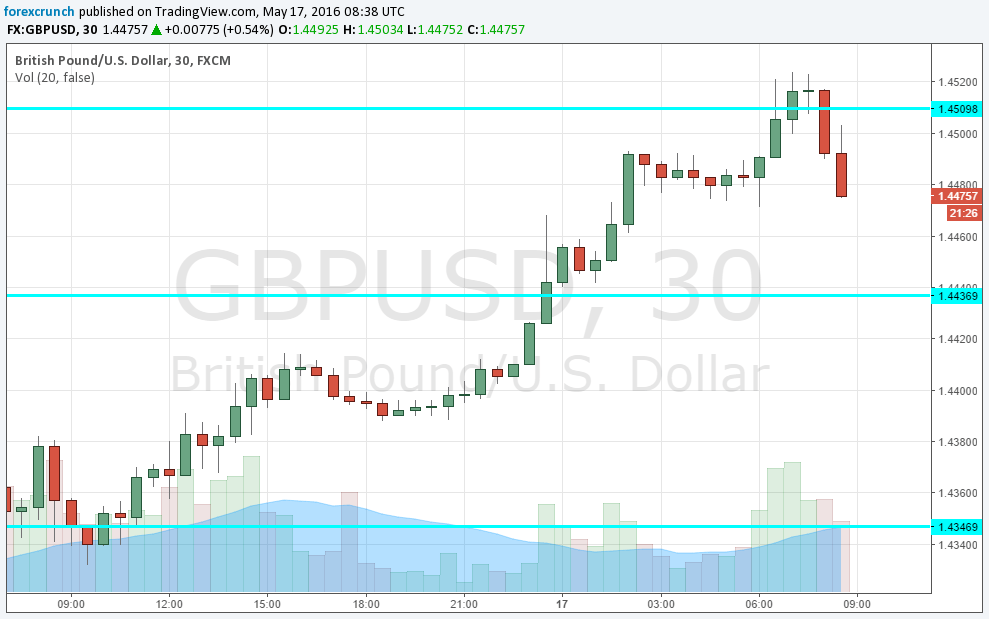

Here is how it looks on the charts. As it happens many times with UK releases, the move to the downside began before the actual publication. Support awaits at 1.4440 followed by 1.4350. Resistance remains at 1.4510.

The UK was expected to report an annual rise of 0.5% in the Consumer Price Index (CPI) in April, the same as in March. Core CPI carried expectations for a rise of 1.4% instead of 1.5% seen last time. Month over month, prices were predicted to advance 0.3% after 0.4% beforehand.

Easter was celebrated earlier this year, in March instead of in April. This could have affected year over year CPI in both months.

GBP/USD was moving higher ahead of the publication, topping 1.45 on opinion polls showing a greater chance of the UK staying in the EU. Inflation is a top tier economic release, critical for the Bank of England’s next move. However, the focus of the markets is on the June 23rd EU referendum. So, this release is only a temporary diversion of attention from the main thing.