Some good news from the biggest sector in the UK: the situation is more upbeat than expected with 53.5 points in services, despite the upcoming EU Referendum.

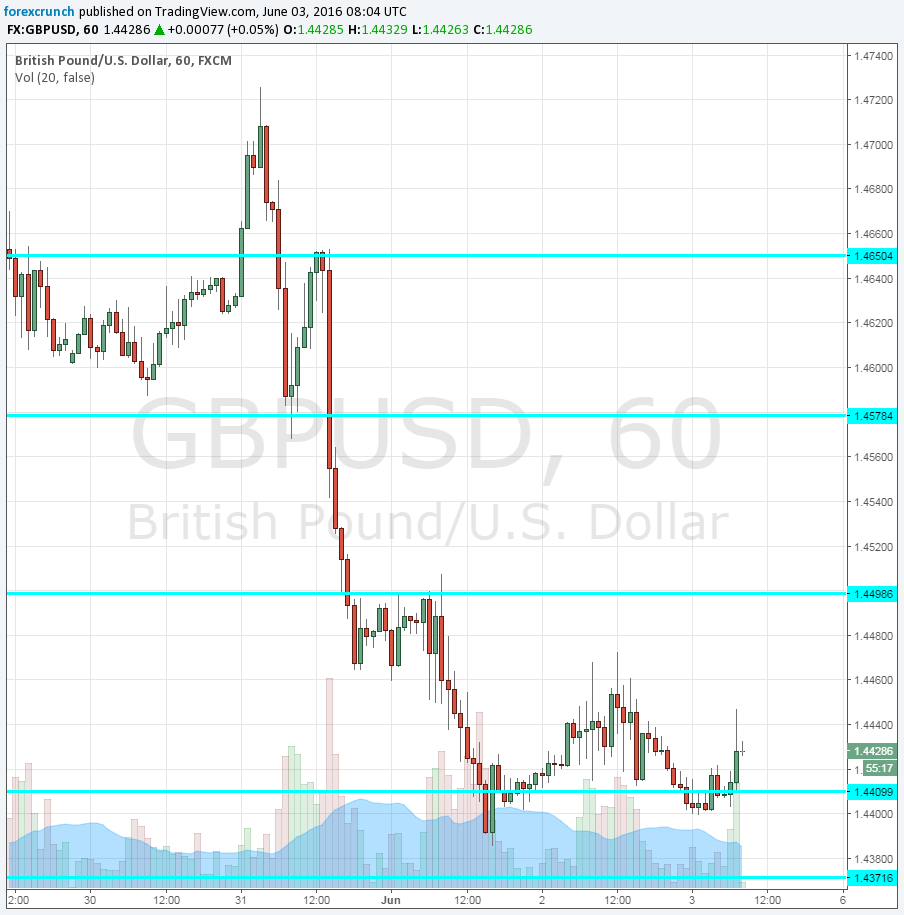

GBP/USD was already moving a bit higher ahead of the release and the reaction is quite shallow. There is also tension towards the NFP.

Markit’s purchasing managers’ index for the services sector was expected to tick down up from 52.3 points in April to 52.5 in May, reflecting modest growth in the UK’s largest sector. This is the last and most important of PMIs.

GBP/USD traded around 1.4430 ahead of the publication.

Earlier this week, the manufacturing PMI beat expectations while construction missed. Both of them showed very modest growth. The tension towards the EU referendum may already be taking its toll on business confidence.

The pound has been pound this week on polls suggesting a momentum for the Brexit campaign. This has changed the mood which has already looked more positive for the Bremain camp.

Today’s big event is the US Non-Farm Payrolls. See how to trade the NFP with EUR/USD.