The Conference Board’s measure of consumer confidence beat expectations for February and reached a high of 114.8 points. This is a leap of 3 points from an upwards revised 111.8 number in January. The underlying components regarding the current conditions (133.4 points), as well as expectations (102.4), are also up.

Nevertheless, the US dollar does not count it as a reason to be cheerful. Earlier on, the US released a revision of GDP and it remained unchanged at 1.9%, a mediocre growth rate and below 2.1% expected.

There are bigger forces at play. President Donald Trump will deliver a highly anticipated speech at 2:00 GMT, during the Asian session. His address is expected to consist of economic plans, but early indications do not provide reasons for optimism. The President prioritizes defense and healthcare over infrastructure and taxes.

Another force is the growing expectations for a rate hike in March. These should have supported the greenback, but the GDP release somewhat dampens the picture. The most critical publication is probably the average hourly earnings component of the Non-Farm Payrolls report due only on March 10th, five days before the Fed decision.

USD down

The US dollar is trading lower across the board

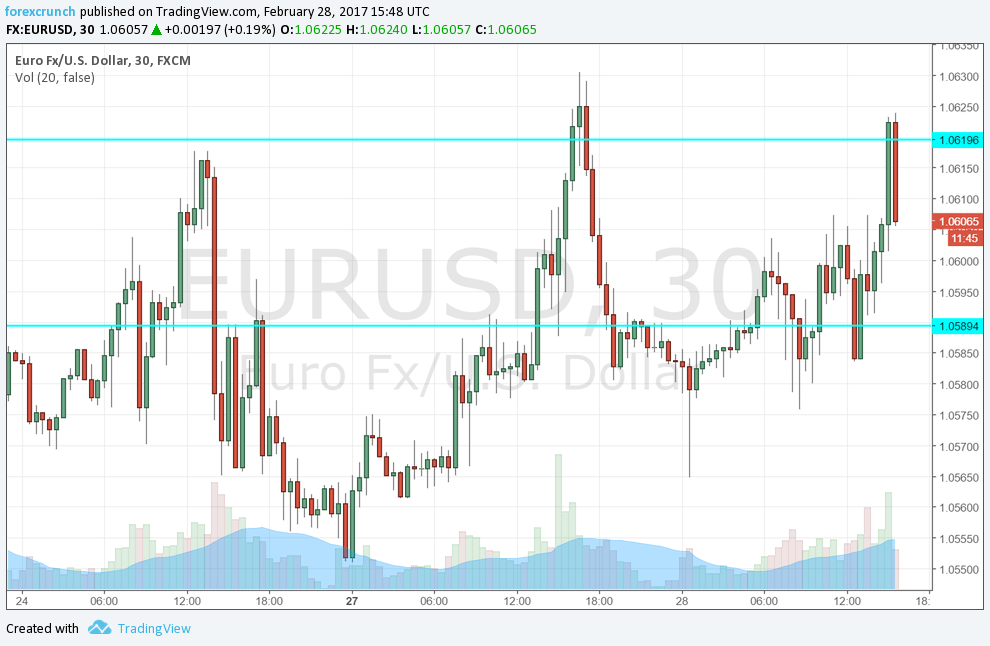

- EUR/USD is around 1.0620 as we await European inflation data.

- GBP/USD is recovering from Brexit worries and edges closer to 1.2450.

- USD/JPY dips under the 112 level. Support awaits at 111.40.

- USD/CAD stands out in weakness, falling due to the slide in oil prices, from the highs.

- AUD/USD makes another attempt at the 0.77 level.

- NZD/USD extends its recovery and tackles resistance at 0.7230.

More: USD: Trump does not provide boost on Fox but Fed hike odds rise – dollar looks down

Here is how it looks on the EUR/USD chart: