- DXY adds small gains and reaches new YTD peaks.

- US inflation remains high at multidecade high levels.

- On Thursday, the bond market will be closed.

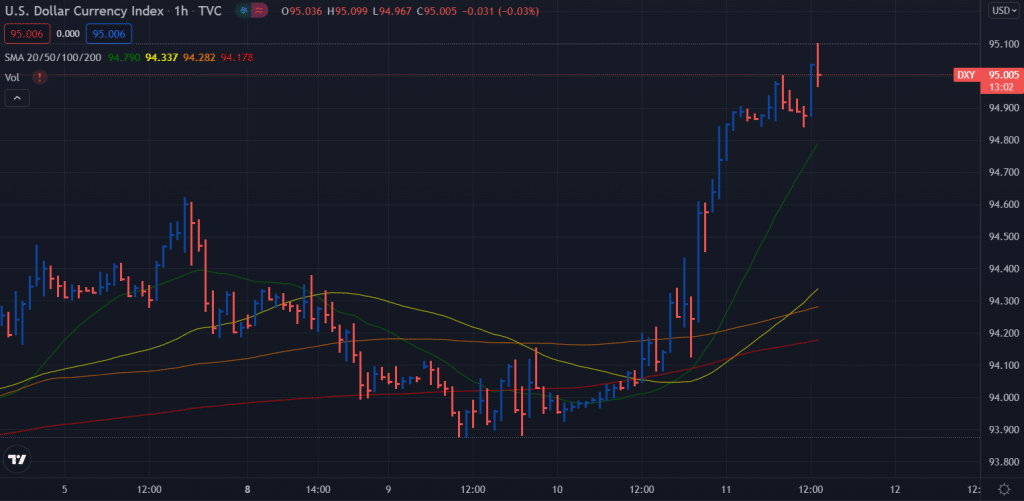

US Dollar Index (DXY) price analysis suggests a bullish picture as the price marks fresh yearly highs above the 95.00 handle on the day. As measured by the US Dollar Index (DXY), the US dollar has made recent gains and reached new cycle highs at 95:00 on Thursday.

-Are you looking for CFD brokers? Take a look at our detailed guideline to get started-

In the wake of Wednesday’s sharp rise, the index is on course for new highs in the 95 area, where initial resistance has surfaced.

After the CPI report, the dollar jumped on a rebound in US yields along the curve and a moderate correction in TIPS prices. According to the Bureau of Labor Statistics (BLS), US consumer prices rose 6.2 percent from October 2020, while consumer prices excluding food and energy (core consumer price index) rose 4.6 percent.

In any case, speculation about the Federal Reserve System changing interest rates earlier than expected has already contributed to dollar growth.

As well as the US debt market being closed for Veterans Day, no data has been released in the US data room.

The index rose 95.00 to new cyclical highs, the level last touched by the Coronavirus pandemic this summer. A sudden shift in dollar sentiment is fueled by rising yields and the perception that inflation will persist for longer than anticipated, which is reflected in mounting speculation about a rate hike as early as 2022.

US Dollar Index price technical analysis: Bulls regaining around 95.00

The US dollar index remains quite strong beyond the 95.00 mark. The previous 4-hour bar closed at highs with a very wide spread. The bar had broken out of the previous consolidation resulting in the formation of new highs. However, the recent 4-hour bar has formed a high but reversed back to the open price, indicating a corrective mode in the market. This is quite possible to see a mild correction of 23.6% after such a huge bull run. Technically, the price remains supported by several key levels. The important moving averages on the 4-hour chart are all lying one above another, posing a bullish scenario.

-If you are interested in knowing about scalping forex brokers, then read our guidelines to get started-

Any downside correction may find immediate support around 94.80 ahead of 94.30 and then 93.90. On the upside, 95.25 will be the key hurdle to overcome for now, ahead of 96.00. However, sustaining above 95.00 will add much to the probability of achieving 96.00.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.