The number of sales of existing homes dropped by 3.7% in February to an annualized level of 5.48 million, a bit under expectations.

The US dollar is slightly weaker against the yen but the moves are limited. This is a second-tier figure and the miss is not a disaster. Most transactions in the housing sector are of existing homes. However, these create less economic activity than sales of new homes.

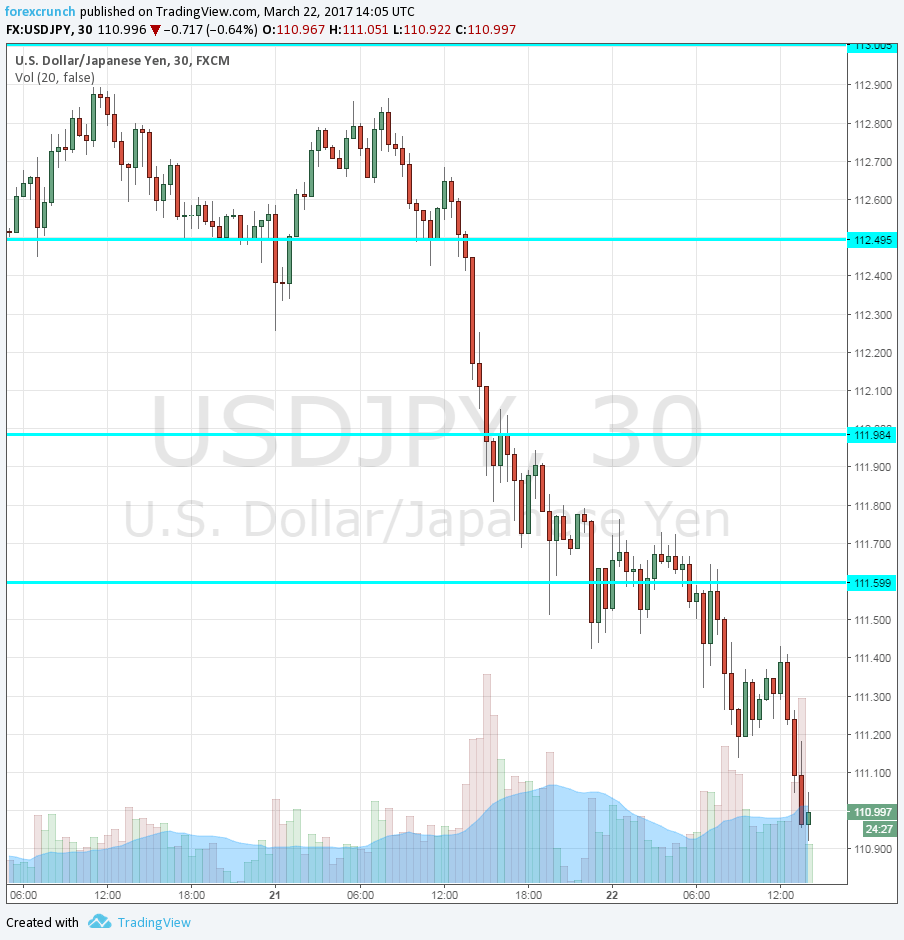

USD/JPY is hugging the 111 level. After a struggle, the pair broke under the triple-bottom of 111.60 and from there it extended its falls. The US dollar continued losing ground against the yen even as it stabilized and even recovered against other currencies.

The yen is also enjoying safe haven flows. A significant drop in stocks seen yesterday sent traders to the safety of the Japanse yen.

EUR/USD is more stable around 1.08 while the pound is wary of the looming Brexit and has receded from the 1.25 level it captured temporarily early in the day.

US existing home sales were expected to slide to 5.57 million (annualized) from 5.69 million in January, a drop of 2%.

The dollar was making small attempts to recover, but these were quite limited. The greenback extended its losses against the yen.