A big miss: 49.4 points in the ISM Manufacturing PMI, showing contraction in the sector. The employment component is also down with 48.3 points. It implies a job loss. The US economy mostly consists of the services sector, not manufacturing. Nevertheless, it does not bode well for the wider economy. The services gauge is published only on Monday, after the NFP. In a separate release, construction spending came out flat instead of a rise of 0.3% projected.

The US dollar falls across the board. Does this signal a weak NFP? An end to the expectations for a rate hike in September? The odds are lower, that’s certain.

Currency reaction to contraction

- EUR/USD jumps to 1.1165 up from 1.1140.

- GBP/USD jumps above 1.33 to 1.3315. The momentum continues after a strong UK PMI.

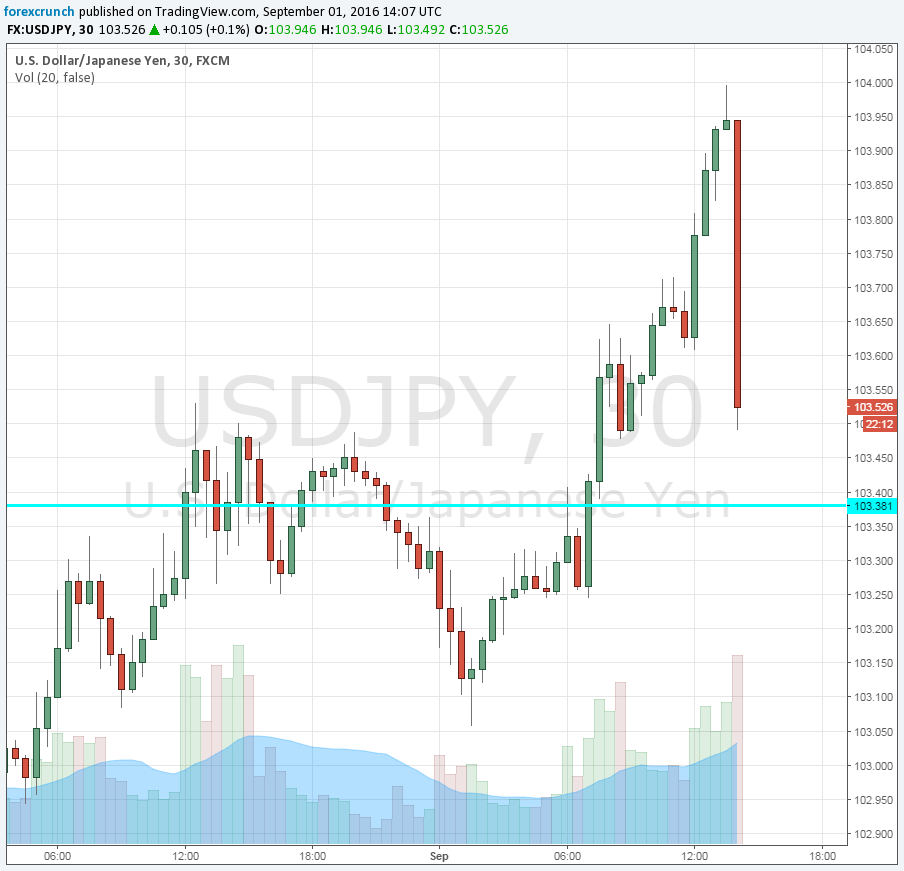

- USD/JPY is down to 103.60.The rally comes to a halt.

- USD/CAD is trading at 1.31.

- AUD/USD is at 0.7540, still struggling to gain new ground.

- NZD/USD is at 0.7270, recovering from the lows.

Here is the chart of USD/JPY in reaction to this release:

The US ISM Manufacturing PMI was expected to tick down to 52 points in August from 52.6 in July. This forward-looking measure serves as a hint towards tomorrow’s all-important Non-Farm Payrolls. The employment component is of higher importance here.

The dollar has been retreating just a bit from the highs it obtained following last week’s Jackson Hole Symposium. A relatively upbeat speech by Yellen, accompanied by talk of a hike in her September from Vice Chair Fischer raised the stakes for the monthly jobs report.

Nevertheless, with the elections looming and the Fed’s natural dovishness, only a blockbuster NFP will make September a real option for skeptical markets.

See how to trade the NFP with EURUSD

Markit’s parallel manufacturing PMI was marginally revised down from 52.1 to 52 points in the final read.

Earlier, US jobless claims came out at 263K, within expectations of 265K and just above 261K reported last week. Labor costs were revised higher to 4.3% while productivity was downgraded to -0.6%.

It is the first day of the month and purchasing managers’ indices are published worldwide. China’s figures were mixed, hugging the 50 point threshold that separates expansion from contraction. Euro-zone PMIs mostly came in line with early estimations, with only Italy causing worries.

The big surprise came from the UK: the indicator jumped no less than 5 points, reflecting a much better mood towards Brexit. The pound stood out with significant gains, leaping 100 pips and continuing northbound. GBP/USD traded at 1.3265 just before the ISM data was published.