- USD/CAD rises towards 1.2600 area as the Greenback demand surges.

- The US 10-year bonds yields rise, supporting the US dollar.

- Technically, the USD/CAD pair may aim for 1.2635-40 area.

The analysis for the USD/CAD pair shows a bullish case as the US dollar demand surges amid the rise in US Treasury yields. The USD/CAD pair rose to three-day highs as the New York session begins, climbing up to 1.2600 area.

The US dollar continues to benefit from positive price dynamics in US Treasury bonds. Despite that, the current downturn in crude oil prices has had a mildly positive impact on the USD/CAD pair.

–Are you interested to learn more about low spread forex brokers? Check our detailed guide-

On Tuesday, rising US Treasury yields helped the US dollar remain positive. Daily, the 10-year US Treasury yield is 1.366, the highest in more than 10 trading days. Moreover, the US dollar index holds steady at 92.30, with moderate daily gains.

There won’t be any high-level data in the US economic docket, and the pair is likely to continue to fluctuate with the yield on US Treasury securities.

Futures for US stock indices are trading unchanged on the day, which indicates that risk perception cannot be used as a guide for today’s trading.

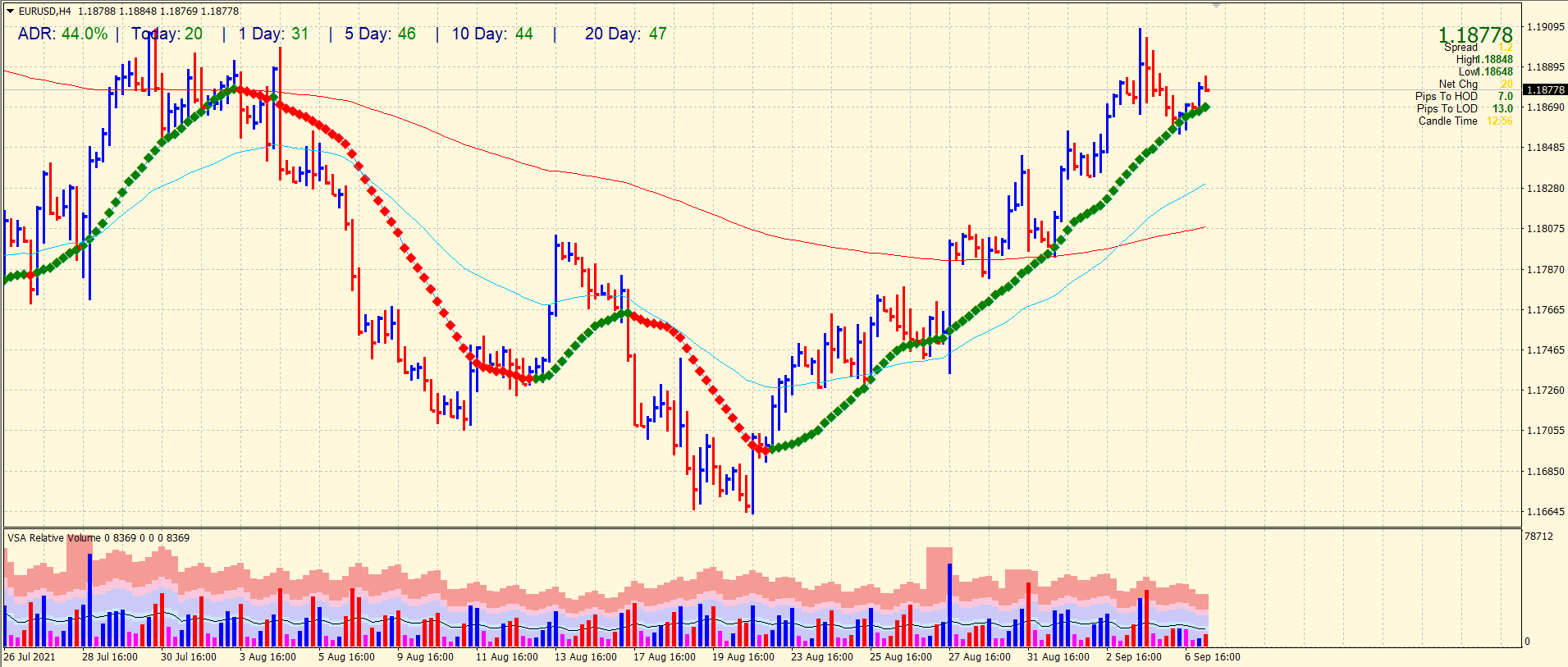

USD/CAD price technical analysis: Confluence barrier to act as a key

Bulls are now aiming to move above the confluence barrier, which consists of a 200-period SMA on the 4-hour chart and a short-term downtrend line. The 23.6% Fibonacci level follows the previous segment 1.2949-1.2494. Probably the recent correction began from YTD highs, which would point to further short-term appreciation. The USD/CAD could then aim for a breakout of the supply zone at 1.2635-40.

–Are you interested to learn more about forex signals? Check our detailed guide-

The immediate support, however, is near the horizontal 1.2555 level in front of the 1.2525-20 area and the psychological 1.2500 level. In the case of a convincing downside break, bearish traders will be triggered, leaving USD/CAD at risk. It could then dip towards challenging horizontal support near the 1.2430 level before finalizing at the round 1.2400 level.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.