- The US dollar remained steady, having reached a two-week low of C$1.3408 on Friday.

- Saudi Arabia plans to substantially reduce output in July.

- The US dollar strengthened against major counterparts following a robust US jobs report.

Today’s USD/CAD forecast is bearish. The Canadian dollar maintained its strength against the US dollar amid Saudi Arabia’s significant production cut announcement. This caused a more than 1% increase in crude prices. Similarly, the US dollar remained steady, having reached a two-week low of C$1.3408 on Friday.

–Are you interested in learning more about copy trading platforms? Check our detailed guide-

In July, Saudi Arabia plans to reduce output substantially. Consequently, supplementing the broader OPEC+ agreement aimed to limit supply until 2024 and boost oil prices.

Furthermore, the energy ministry of Saudi Arabia stated that its output would decrease from around 10 million barrels per day (bpd) in May to 9 million bpd in July. This marks the largest reduction in years.

Notably, OPEC+ accounts for approximately 40% of global crude production, which means their policy decisions can have significant implications for oil prices.

In April, a surprise supply cut briefly pushed the international benchmark Brent crude price up by approximately $9. However, concerns about the global economy’s weakness and its impact on demand subsequently led to a price retreat.

Meanwhile, the US dollar strengthened against major counterparts following a robust US jobs report. This led traders to anticipate higher interest rates in the long term. The US dollar gained support from increased Treasury yields, driven by data showing a May increase of 339,000 in public and private sector payrolls. This figure significantly exceeded the average forecast of 190,000 by economists polled by Reuters.

USD/CAD key events today

Investors expect PMI data from the US that will show the level of business activity in the services and non/manufacturing sectors.

USD/CAD technical forecast: Bears take a breather after impulsive leg.

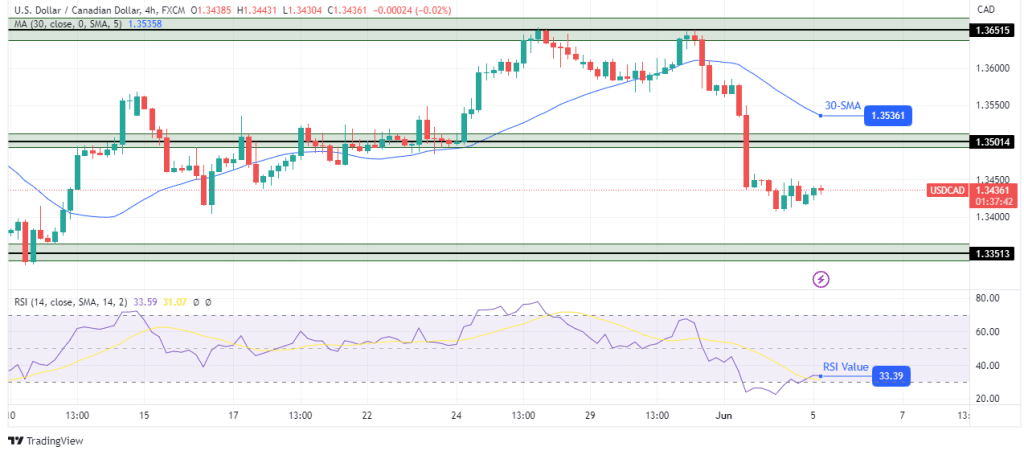

The bias for USD/CAD on the 4-hour chart is bearish. Bulls could not make a new high above the 1.3651 resistance, allowing bears to take over by pushing below the 30-SMA. Notably, the bearish bias got stronger when the price broke below the 1.3501 support level.

–Are you interested in learning more about scalping forex brokers? Check our detailed guide-

Currently, the price is consolidating after the big bearish move. However, the price will likely soon resume the downtrend and fall to retest the 1.3351 support level. This downtrend will continue lower if the price stays below the 30-SMA.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money