- The Bank of Canada will release minutes from its policy-setting meeting this week.

- Data released Friday revealed that Canadian retail sales dipped by 0.1% in November.

- Canada’s sales probably increased by 0.5% in December.

Today’s USD/CAD outlook is bearish as the Canadian dollar strengthens. The Bank of Canada will release minutes from its policy-setting meeting this week, the first in its history. According to some analysts, this will help regain the trust lost due to last year’s high inflation and promote creative thinking.

–Are you interested to learn more about Forex apps? Check our detailed guide-

The Bank of Canada’s 2% objective was exceeded in June as annual inflation soared to 8.1%, the highest level in 39 years. Inflation dropped to 6.3% in December.

Most analysts anticipate another quarter-point rate hike to 4.5% when the six-member governor council gathers on Wednesday. The BoC started raising rates in March when its benchmark interest rate was 0.25%.

The meeting’s so-called “summary deliberations” will be released on February 8. The BoC announced in September that it would release minutes to increase transparency, as the International Monetary Fund advised.

In addition to other recent data on jobs and prices that point to another interest rate next week, data released on Friday revealed that Canadian retail sales dipped 0.1% in November from the prior month before rebounding in December.

The monthly sales decline for November was lower than the 0.5% decline predicted by analysts. Sales probably increased by 0.5% in December, according to Statscan’s flash estimate.

According to Shelly Kaushik, an economist at BMO Capital Markets, the optimistic estimate for December “suggests sales recovered… as Canadian consumers continue to be resilient in the face of harsh rate hikes.”

USD/CAD key events today

There won’t be any key economic releases from the US or Canada today. Therefore, the price will likely consolidate.

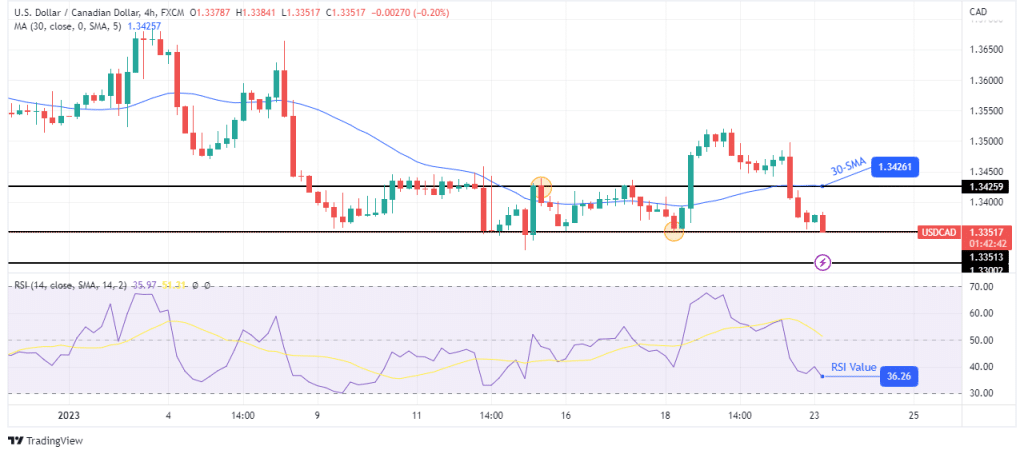

USD/CAD technical outlook: Bears are up against the 1.3351 support

The 4-hour chart shows the price trading below the 30-SMA after breaking below the 1.3425 support. The RSI also broke below the 50 mark, suggesting momentum favors bears. The price is currently at the 1.3351 support.

–Are you interested to learn more about STP brokers? Check our detailed guide-

If bears can break below this support level, we might see the price falling to the next support at 1.3300. However, if the support at 1.3351 holds strong, we might see bulls return to retest the 30-SMA before the downtrend continues.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.