- Investors are awaiting the Fed rate decision.

- Markets are pricing in an 86% chance of a 25bps rate hike.

- Canada’s annual inflation rate decreased more than anticipated to 5.2% in February.

Today’s USD/CAD price analysis is slightly bullish. The dollar was trapped near five-week lows as investors awaited information on the Federal Reserve’s direction in the wake of the turbulence in the global banking system.

-If you are interested in forex day trading then have a read of our guide to getting started-

Investors focus on whether the Fed will stick to its hawkish course to combat sticky inflation or pause interest rate hikes in light of recent bank problems.

According to the CME FedWatch tool, markets are currently pricing in a 14% likelihood of the Fed not raising rates and an 86% chance of a 25-bps boost. Investor sentiment remained fragile, with concerns over the banking sector’s future beginning to lessen following recent market volatility.

On Tuesday, the Canadian currency fell versus the US dollar, retreating from a two-week high. Domestic inflation data confirmed the Bank of Canada’s recent decision to halt its interest rate hike program.

In February, Canada’s annual inflation rate decreased more than anticipated to 5.2%, its lowest level in 13 months, compared to last year’s significant price increase.

This month, the Bank of Canada (BoC) became the first significant central bank to hold its key interest rate at 4.50%.

Since then, financial instability has increased pressure on other central banks to ease off on tightening. Later today, the Federal Reserve is scheduled to decide on interest rates.

USD/CAD key events today

Investors are awaiting the conclusion of the FOMC meeting, which might result in a rate hike. This will likely cause a lot of volatility in the pair.

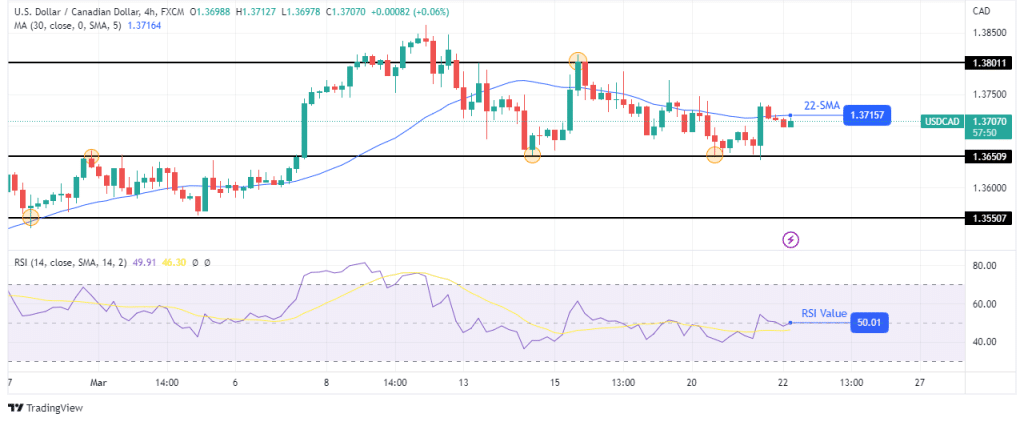

USD/CAD technical price analysis: A battle for control at the 30-SMA

After a big bullish candle, the 4-hour chart shows USD/CAD trading near the 30-SMA. The bulls attempted a break above the 30-SMA, but the bears also fought for control. The RSI is trading slightly above the 50-mark, showing bulls are currently a bit stronger.

-Are you looking for automated trading? Check our detailed guide-

Therefore, if bulls win this battle, the price will likely rise to 1.3801 resistance. Therefore, if bulls win this battle, the price will likely rise to 1.3801 resistance. On the other hand, if the bears win, the price will retest the 1.3650 support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.