- Retail sales in the United States decreased more than forecasted in November.

- Initial claims for state unemployment benefits in the US decreased by 20,000.

- Oil prices fell by roughly 2% as traders fretted about the future of fuel demand.

Today’s USD/CAD price analysis is bullish as the dollar strengthens against the Canadian dollar. Retail sales in the United States decreased more than forecasted in November. Still, consumer spending was buoyed by a tight labor market last week, when the number of Americans applying for unemployment benefits dropped to its lowest level in five months.

-Are you looking for automated trading? Check our detailed guide-

After an unrevised 1.3% increase in October, retail sales dropped 0.6% last month, the worst since December 2021. Economists anticipated a 0.1% decline in sales. November saw a 6.5% annual increase in retail sales.

During the week ending December 10, initial claims for state unemployment benefits decreased by 20,000 to a seasonally adjusted 211,000.

Even though there has been a surge of layoffs in the technology industry, claims have remained below the 270,000 barrier, which economists warned would raise a warning sign for the labor market.

On Thursday, oil prices fell by roughly 2% as traders fretted about the future of fuel demand due to a stronger dollar and additional interest rate increases by international central banks. This hurt the Canadian dollar.

Even as the economy veers into a potential recession, Federal Reserve Chair Jerome Powell said on Wednesday that the US central bank would increase interest rates further next year. The Bank of England and the European Central Bank hiked interest rates on Thursday to combat inflation.

Oil costs more for people using other currencies when the US dollar is stronger.

USD/CAD key events today

There won’t be any key economic releases from the United States or Canada. The price might therefore consolidate.

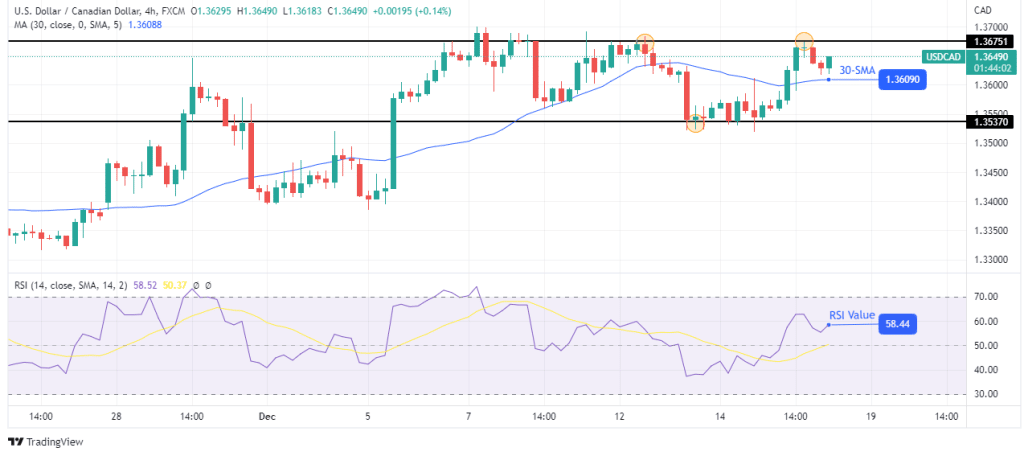

USD/CAD technical price analysis: Strong barrier for bulls at the 1.3675 level

The price currently trades above the 30-SMA after failing to break the 1.3675 resistance level. This has been a difficult level to break, and it has stopped bulls many times before.

-If you are interested in forex day trading then have a read of our guide to getting started-

The price is pulled back close to the 30-SMA and is now looking ready to bounce higher. A break below the SMA would show the price consolidating with the 1.3675 level as resistance and the 1.3537 level as support.

However, if the 30-SMA holds support, the price might retest and surpass the 1.3675 resistance.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.